Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Chinese Demand Undergirds Robust Soybean, Corn Prices

Reuters writers Hallie Gu and Dominique Patton reported last week that, “China’s soybean imports jumped 13% to an annual record in 2020, customs data showed on Thursday, after crushers ramped up purchases amid improved margins and healthy demand from the country’s rapidly recovering pig sector.

China, the world’s top soybean buyer, bought 100.33 million tonnes of the oilseed in 2020, up from 88.51 million tonnes in 2019, according to the General Administration of Customs.

The Reuters article noted that, “Crushers bought Brazilian soybeans early in 2020, and turned to U.S. cargoes in the fourth quarter when American beans hit the market, and as Beijing stepped up purchases of U.S. farm produce to meet the terms of China’s trade deal with the United States.

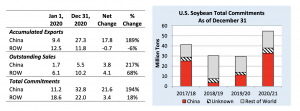

“China’s 2020 U.S. soybean imports were up 56.3% from a year earlier in yuan terms, the country’s customs spokesman said a press briefing on Thursday.”

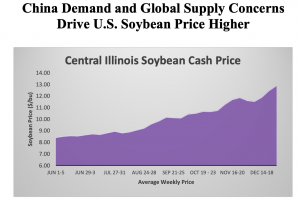

Meanwhile, in this month’s Oilseeds: World Markets and Trade report, the USDA’s Foreign Agricultural Service (FAS) stated that, “Since mid-August, U.S. cash soybean prices are up 50 percent on both strong China demand (rebounding pork feeding) and tightening U.S. supplies (smaller-than-anticipated production over the past 2 harvests).”

The FAS report explained that, “Due to the record pace of shipments and outstanding sales destined for China, total global commitments reached record highs at 54.8 million tons, up 6.8 million tons from the previous record in 2016/17.”

Also last week, Daniel Grant reported at FarmWeekNow Online that, “U.S. sales of ag products to China are on pace to set a new record for the past 12 months.”

The article stated that, “Wendong Zhang, an assistant professor/economist at Iowa State University who grew up in a rural county in northeast China, currently estimates yearly sales of U.S. ag products to China could total $31.15 billion.

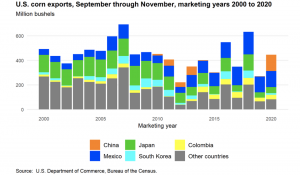

“‘If realized, this would be the highest ever,’ Zhang said during Purdue University’s annual Top Farmer Conference held virtually. ‘We’ve seen tremendous growth of advanced sales of soybeans and a record amount of feed grains, like corn.'”

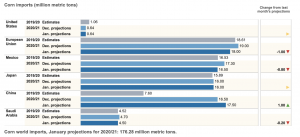

More narrowly with respect to corn, FAS pointed out in it’s January Grain: World Markets and Trade report that, “In December, China corn prices reached $394/ton, almost twice as high as U.S. corn. As China continues to rebuild its swine sector, demand for competitively priced feedstuffs is likely to remain strong. China corn imports for 2020/21 (October-September) are currently forecast at 17.5 million tons, the second largest after the European Union.”

And in its January Feed Outlook report, the USDA’s Economic Research Service (ERS) pointed out that, “Despite tighter domestic supplies, strong global demand for feed grains—particularly from China—paired with weather-affected summer crops in Eastern Europe and South America, have resulted in strong international demand for U.S. corn and feed grains.”

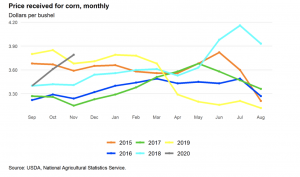

ERS also explained that, “Cash prices for corn have been steadily increasing since the summer, when the diminished production outlook for Ukraine and Russia was developing, and increasing demand from China materialized in the market.”

Meanwhile, Wall Street Journal writer Yuka Hayashi reported last week that, “The U.S.-China trade pact signed a year ago is being credited for improving business conditions for some American companies, even if a cornerstone of the deal—China’s commitment to greatly increase purchases of U.S. goods—has fallen short.”

Looking ahead, Reuters writer Andrea Shalal reported last week that, “The U.S. Chamber of Commerce sees ‘every indication‘ that a high-ranking delegation of Chinese officials will visit Washington early in the administration of President-elect Joe Biden, a top Chamber official said on Wednesday.

“Myron Brilliant, head of international affairs for the business group, told reporters such a visit could help lay the groundwork for improved U.S.-China relations and progress toward an expanded trade agreement.”