Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

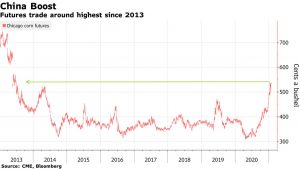

Unrelenting Chinese Demand Boosts Corn Prices

Bloomberg writers Kim Chipman and Nicholas Larkin reported this week that, “Corn prices in Chicago reached a seven-year high with China’s appetite for the grain stoking global supply concerns.

“The U.S. Department of Agriculture on Wednesday unveiled corn export sales to China of 680,000 tons, as well as 132,000 tons of soybeans. That’s on top of a 1.36-million-ton corn export sale to China reported Tuesday, marking the Asian country’s largest one-day purchase from the U.S. since July.”

The Bloomberg article noted that, “China is buying up record amounts of American corn to feed a hog herd recovering from African swine flu. The purchasing spree has rocketed the crop to multiyear highs, raising concerns about higher food prices. Money managers have been betting on a rally, with bullish wagers on corn near the highest in a decade.”

The Bloomberg article added that, “Soybean futures have been supported by China seeking more U.S. beans after top exporter Brazil suffered dry conditions that delayed planting and then downpours that slowed harvesting. Trucker protests over pay have also caused delays at a key export hub in Argentina, a key supplier of oilseed products.”

And on Thursday, USDA’s Foreign Agricultural Service announced, “Export sales of 1,700,000 metric tons of corn for delivery to China during the 2020/2021 marketing year.”

This is the sixth largest daily sales recorded for corn.

At this pace, China corn imports could exceed our (FAO-AMIS) latest 15mt forecast for 2020/21! Prices could rise much further... https://t.co/YkP7HEkCm0

— Abdolreza Abbassian (@Abbassian_A) January 28, 2021

And DTN Ag Policy Editor Chris Clayton reported this week that, “Looking at the next 18 months to two years of global grain and oilseed demand, Archer Daniels Midland Co. executives on Tuesday said they see an environment of heavy demand that will bring more acres into production.”

The DTN article stated that, “Responding to a question on longer-term demand for grains and oilseeds, [Juan Luciano, ADM’s CEO] said ADM sees ‘an environment of real demand, real effective demand’ going forward because customers do not have a lot of inventory and have been ‘hand-to-mouth’ with buys.

‘So, we see this is going to take 18 to 24 months for these supply-demand balances to be rebuilt,’ Luciano said. ‘We see these conditions subsisting for the next couple of years, even with farmers … trying to play more because I think the prices will bring more acres into production. But we need those extra acres right now.’

Meanwhile, Reuters writers Karl Plume and Hallie Gu reported this week that, “China has bought ‘roughly 200 million gallons’ of U.S. ethanol for the first half of 2021, matching its previous record for annual imports of the corn-based biofuel, Archer Daniels Midland Co Chief Financial Officer Ray Young said on Tuesday.”

The Reuters article indicated that, “Imports of 200 million gallons would eclipse China’s previous annual record of 198.1 million gallons in 2016, according to U.S. Census Bureau trade data.”

The price of corn is spiking as China returns to the U.S. corn market. Presented by @CMEGroup pic.twitter.com/ZWpHMo3xaO

— Bloomberg Quicktake (@Quicktake) January 26, 2021

“China has not traditionally been a large importer of ethanol, but tightening supplies of domestic corn used to make the biofuel coupled with a wide spread versus U.S. prices spurred the need for imports,” the Reuters article said.

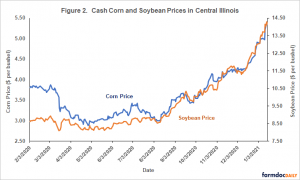

With respect to the potential impact of strong corn and soybean prices, University of Illinois agricultural economist Gary Schnitkey noted this week that, “Price increases and continued announcements of ad hoc Federal payments have led to higher estimates of revenues and returns in 2020. Incomes in 2020 could be well above average for many farms in Illinois.

“There also appears to be a reason for optimism for 2021 returns.”