Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

FAO Food Price Index Climbs on Strength of Grain Prices, as Chinese Demand Persists

Financial Times writer Emiko Terazono reported last week that, “Global food prices have reached their highest in almost seven years, further raising the spectre of food inflation and hunger at a time when the Covid-19 pandemic continues to hit economies around the world.

“The UN Food and Agriculture Organization’s food price index for January rose by a tenth from a year ago to its highest level since July 2014, led by a sharp increase in grain prices. Substantial buying of corn by China and lower-than-expected production in the US helped send the gauge — which tracks a basket of food commodities against their 2014-16 prices — to its eighth consecutive monthly increase, the longest rising streak in a decade.”

The FT article explained that, “China is seeking to restore its grain reserves, as well as keeping a lid on domestic prices while it rebuilds a hog herd that was decimated by African swine fever.”

Ms. Terazono added that, “Corn prices are up 45 per cent from a year ago to $5.55 a bushel and soyabeans have jumped 56 per cent to $13.71. Wheat is up 16 per cent while rice is 27 per cent higher.”

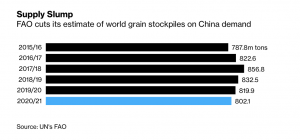

Also last week, Bloomberg writers Megan Durisin and Agnieszka de Sousa reported that, “China’s ravenous appetite for crops is further tightening global grain supplies and setting the stage for a prolonged rally in food costs.”

Meanwhile, the AMIS Market Monitor indicated last week that, “[Corn] trade forecast for 2020/21 (July/June) [is] scaled up sharply, primarily on exceptionally bigger purchases by China in recent weeks, which could push up the country’s imports for the season to a record 20 million tonnes.”

With respect to U.S. exports to China, last week’s Grain Transportation Report, from the USDA’s Agricultural Marketing Service, stated that, “[By] the week ending January 21, total commitments of U.S. corn to China for MY 2020/21 were 11.8 mmt, versus just 0.061 mmt by the same time last year for MY 2019/20.”

Looking ahead, Bloomberg’s Isis Almeida reported last week that,

The world’s largest agricultural commodities trader says China’s record buying spree isn’t over.

“Purchases by the Asian nation have ‘at least another couple of quarters to go‘ before the top soybean and corn importer has enough supplies, said Cargill Inc.’s Chief Executive Officer Dave MacLennan. Crop prices, which have rallied more than 50% since a low in August, need to rise further to curb consumption, he said.”

In a broader look at aggregate U.S. ag exports to China, Reuters News reported late last week that, “The United States exported $28.75 billion of agricultural goods and related products to China in 2020, data from the U.S. Department of Agriculture showed on Friday, missing the $36.5 billion targeted under the Phase 1 trade deal.”

“The missed target was widely anticipated despite a recent uptick in sales of corn and soybeans to China. U.S. President Joe Biden’s administration has said the deal is under review.”

🔥🔥U.S. #agricultural & related product exports during 2020 total $161 Billion +4%, highest since 2014 🌱#1 @FarmBureau pic.twitter.com/4XIDXfzGI3

— John Newton (@New10_AgEcon) February 5, 2021

In other news, Reuters writer Dominique Patton reported last week that, “A surge in hog disease outbreaks this winter in China, the world’s biggest pork producer, will slow the industry’s rapid recovery since the African swine fever contagion three years ago, according to industry participants and analysts.

“China’s pig herd rose 31% in 2020, according to official data, as the industry rebuilt. But more frequent outbreaks of swine fever are occurring in northeast and northern provinces along with a worse-than-usual rise in Porcine epidemic diarrhoea (PED), said a manager at a pig farm supply company.”

And a separate Reuters article last week, also by Dominique Patton, stated that, “Chinese scientists have found a natural mutation in the African swine fever virus they say could be less deadly than the strain that ravaged the world’s largest pig herd in 2018 and 2019.”

Also regarding corn demand, a Reuters article reported recently that, “Mexico’s corn imports could fall by about 9% this year, as the government seeks to discourage the use of genetically modified grains and boost its local crop, the agriculture ministry said on Tuesday.”

“The bulk of Mexico’s corn imports come from the United States, its top trade partner. In the year through November, Mexico had imported 13 million tonnes from the United States,” the Reuters article said.

On the supply side of the corn equation, the USDA’s Foreign Agricultural Service stated in a recent report (“Brazil: Grain and Feed Update“) that, “Post decreases its corn production forecast for MY 2020/21 (March 2021–February 2022) to 105 MMT, in response to reduced yields for first-crop corn, as well as the likelihood of delayed planting for large portions of second-crop ‘safrinha’ corn.”