As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve Ag Credit Surveys- 2020 Fourth Quarter Farm Economy Conditions

Last week, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the fourth quarter of 2020.

Federal Reserve Bank of Chicago

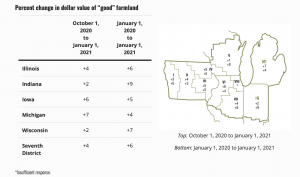

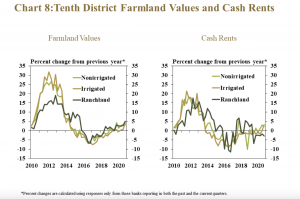

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “For 2020, the District saw a steep annual increase of 6 percent in its farmland values (see table and map below). In the fourth quarter of 2020, Indiana and Wisconsin experienced even larger year-over-year increases in their agricultural land values than the District did overall, whereas Iowa and Michigan experienced slightly smaller increases. (Illinois’s year-over-year gain in farmland values was on par with the District’s.) The District’s farmland values rose 4 percent in the fourth quarter of 2020 relative to the third quarter.”

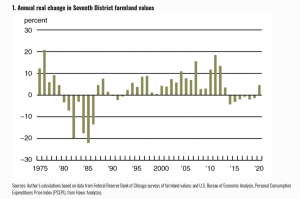

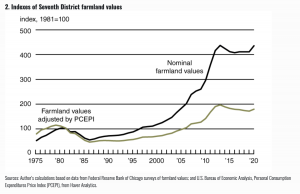

The AgLetter stated that, “Even with inflation taken into account, District farmland values had an annual increase of almost 5 percent in 2020; this increase in real terms was the first one since 2013.

“In both real and nominal terms, District farmland values peaked in 2013. At the end of 2020, District farmland values were still down 9 percent from their peak in real terms, yet they were nearly back to it in nominal terms.”

Mr. Oppedahl added that, “In addition to the impetus from lower interest rates, farmland values were boosted by 2020’s rebound in total revenues from corn and soybean production in the five District states. All but one of the states had higher levels of both corn and soybean output in 2020 than in 2019.”

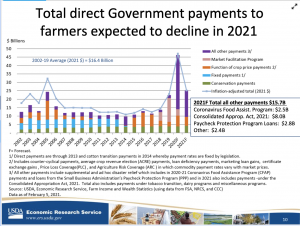

Given even higher levels of government support and higher prices for some farm products, including corn and soybeans, the USDA forecasted an increase of $38 billion in net farm income for the country in 2020.

The Chicago Fed indicated that, “The District also experienced positive changes in its agricultural credit conditions during the fourth quarter of 2020. In the final quarter of 2020, repayment rates for non-real-estate farm loans were higher than a year ago, and loan renewals and extensions were lower than a year earlier. Neither of these farm credit indicators had recorded year-over-year improvements since the third quarter of 2013. Meanwhile, non-real-estate farm loan demand relative to a year ago was lower for the second quarter in a row.”

Senior Business Economist David Oppedahl reports #Midwest farmland values surged in 2020 and offers takeaways from our latest #AgLetter. Find the full video and report here: https://t.co/iGpPo0EHwi #farmlandvalues #agindustry #agriculture pic.twitter.com/LZMjnVe0Gn

— ChicagoFed (@ChicagoFed) February 12, 2021

Federal Reserve Bank of Kansas City

and

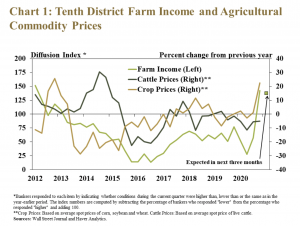

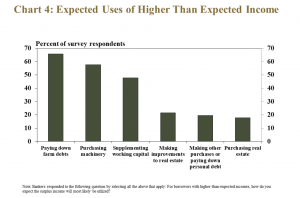

Thursday’s update stated that, “Agricultural lenders expected farmers to strengthen their balance sheets and make capital purchases with incomes larger than initially expected. About 60% of respondents listed paying down farm debts or machinery purchases as likely uses of extra income.”

Kauffman and

In summary, the Kansas City Fed stated that, “Increases in commodity prices at the end of 2020 and robust support from government payments boosted economic conditions in the agricultural sector in the fourth quarter. A majority of bankers in the District indicated that farm income was higher than a year ago for the first time in eight years, boosting liquidity and loan repayment capacity, and providing renewed support for farm real estate. Overall, agricultural conditions in the first quarter of 2021 in the Kansas City Fed region were poised to remain strong for the first time since 2013.”

Federal Reserve Bank of Minneapolis

In an article last week, “A surprisingly good end to 2020 for farmers,” Joe Mahon pointed out that, “Farm incomes and capital spending increased at the end of 2020, according to lenders responding to the Minneapolis Fed’s fourth-quarter (January) agricultural credit conditions survey. The bump in incomes also led to increased loan repayment rates, while loan demand, renewals, and extensions decreased. Farmland values increased on average from a year earlier, and cash rents ticked up as well. The outlook for the beginning of 2021 is positive, with survey respondents predicting further growth in farm incomes and spending.”

Mr. Mahon explained that, “Given the role of recent commodity price spikes in bolstering farm incomes, some lenders expressed concerns about whether that trend would continue. Price swings were by far the biggest worry for the year ahead, according to results of a special question on the survey. Two in five lenders cited prices as their top concern for 2021, followed by 24 percent citing growing problems (severe weather or declining yields). Trade conflict and declining government support were also widely cited as paramount concerns by 13 percent and 11 percent of respondents, respectively.”