Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Kansas City Fed: “Pullback” in New Farm Loans Continues

A recent report from the Federal Reserve Bank of Kansas City (“Ag Lending Update: Fewer New Loans to Farmers,” by Ty Kreitman and Cortney Cowley) stated that, “Lending activity at commercial banks continued to slow in the fourth quarter, according to the National Survey of Terms of Lending to Farmers. The volume of total non-real estate farm loans declined by about 1% from a year ago, but remained slightly above the 10-year average in the fourth quarter.”

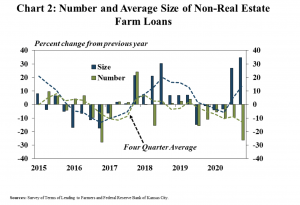

The report noted that, “Smaller loan volumes were driven by a lower number of new loans to farmers. While the number of loans continued to trend downward, the average size of farm loans grew for the second consecutive quarter.”

“While there were fewer loans for all purposes, operating loans continued to comprise the majority of non-real estate lending and accounted for over half of the overall decline,” the report said.

Dramatic improvement in ag economic conditions in our region @KansasCityFed according to survey of ag banks in December. pic.twitter.com/oeWEXrdxSr

— Nathan Kauffman (@N_Kauffman) January 29, 2021

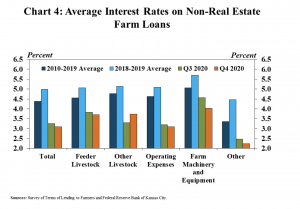

Kreitman and Cowley also pointed out that, “Interest rates on agricultural loans remained at historically low levels in the fourth quarter.”

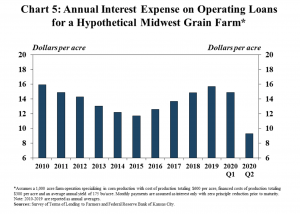

Correspondingly, the report stated that, “Alongside record low interest rates on farm loans, interest expenses for producers declined notably.”

The Kansas City Fed added that, “Agricultural lenders continued to report a slower pace of lending alongside improved financial conditions for farmers in the fourth quarter. Higher crop prices and continued support from government payments likely reduced the need for smaller loans, which drove the overall decline in lending activity.

Will we reverse the trend here? pic.twitter.com/VH3x2upKnP

— John Newton (@New10_AgEcon) January 27, 2021

“Moving forward, loan volumes may soften further if sharp increases in prices for key agricultural commodities, such as corn, soybeans, and wheat, continue to ease financing needs for farm borrowers.”