As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

The 2021 Outlook for U.S. Agriculture From USDA’s Chief Economist

Speaking on Thursday at USDA’s virtual Agricultural Outlook Forum, USDA Chief Economist Seth Meyer provided a broad outlook for U.S. agriculture. Today’s update provides an overview of key aspects of Dr. Meyer’s presentation.

In his speech Thursday (transcript / slides), Dr. Meyer noted that, “Grain and oilseed markets are set to end the 2020/21 marketing year with tightening stocks in several key markets because of strong demand. World corn and soybean ending stocks are projected at multi-year lows as are U.S. ending stocks of corn, soybeans, and wheat. The 2020/21 U.S. season average prices for both corn and soybeans are projected at 7-year highs, and these strong prices have supported the entire grains and oilseeds sector.”

Dr. Meyer indicated that, “The commitment by China to greatly expand its purchases of U.S. agricultural products (and other goods) has coincided with its effort to rebuild its livestock sector after suffering the devastating effects of a widespread outbreak of African Swine Fever. Sales of agricultural commodities to China accelerated in the summer and fall, and by the end of the year the pace of corn and soybean sales to China was at or approaching new records.”

Dr. Meyer added that, “While exports to China were surging, U.S. agricultural sales to Mexico, Japan, Korea and other major trading partners worldwide also remained strong, providing further support to rising prices. Agricultural trade has proved resilient in the face of a global economic contraction and certainly much stronger than non-agricultural and further from what was experienced during the ‘great recession’ of just over a decade ago. This strength is reflected in USDA’s revised forecast for U.S. agricultural trade in FY 2021, with exports now forecast at a record $157.0 billion, or an increase of over $21 billion from FY 2020. Exports to China in FY 2021 are forecast at a record $31 billion, reflecting strong October-December shipments of U.S. soybeans, corn, wheat, cotton, and chicken paws.”

“This strength in agricultural exports over the past 12 months has helped to drive the price of many commodities from recent lows at the start of the pandemic to highs last seen more than 5 years ago.

We expect this export-led demand growth to continue through 2021, supporting prices and farm income, as the global economy continues to recover, and optimism grows for continued rebuilding of the U.S.-China trade relationship.

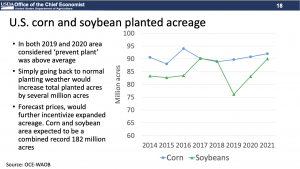

Turning to acreage prospects, Dr. Meyer explained that, “The three-crop total of corn, soybeans and wheat, could reach 227 million acres, the highest since 2016. Current new crop futures prices and contract bids for fall delivery signal strong acreage increases, particularly for soybeans for which acreage is expected to expand 6.9 million acres to 90 million.

“Corn area, also facing high prices, is expected to grow 1 million acres to 92 million. The combined two-crop acreage is projected to reach a record 182 million acres, compared to the previous record in 2017 of 180.3 million.”

#Corn balance sheet

— Farm Policy (@FarmPolicy) February 19, 2021

Grains and Oilseeds Outlook, #AgOutlook pic.twitter.com/bUHStTG3yA

And with respect to prices, Dr. Meyer noted that, “Given continued strong international demand and tight stocks, we project that soybean prices will remain elevated. The soybean price will also be supported by strong domestic demand and growth in U.S. renewable diesel capacity. In contrast, corn prices are expected to decline slightly with larger corn acres and an expected return to trend yields leading to slightly higher ending stocks with strong global demand moderating the price decline on what is expected to be a large crop under normal weather conditions.”

#soybean balance sheet

— Farm Policy (@FarmPolicy) February 19, 2021

Grains and Oilseeds Outlook, #AgOutlook pic.twitter.com/LuLpaRxZVQ

In remarks on farm income, Dr. Meyer pointed out that, “USDA currently expects net cash income to finish 2020 at $136.2 billion, but to fall to $128.3 billion in 2021. We expect net farm income, which includes the value of inventory changes, to decrease $9.8 billion (8.1 percent) to $111.4 billion in 2021. Despite this decline, 2021 net farm income would still be 21 percent above its 2000-19 average of $92.1 billion.”

“However, the decline in direct government farm payments from 2020 to 2021 is expected to more than offset the jump in cash receipts and drive most of the decline in both net income measures. Direct government farm payments are forecast at $25.3 billion in 2021, a decrease of $21 billion (45.3 percent) in nominal terms as smaller supplemental and ad hoc disaster assistance for COVID-19 relief is expected in 2021 relative to 2020.”