A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Chinese Corn Demand– Some See More Purchases as a Possibility

Bloomberg News reported on Wednesday that, “China, the biggest corn consumer after the U.S., is still short of the feed grain, and more overseas purchases are likely.

“Asia’s top economy has to nourish the world’s largest hog herds and supply a growing local refining industry, which produces everything from sweeteners to starches and alcohol. The increased demand this year and in future years comes as the country grapples with limited amounts of productive farmland.

“The U.S. reported sales of more than 1 million tons of corn to China on Tuesday, a day after the government said weekly export inspections climbed to the highest level in at least 26 years. The announcement of the latest sales coincides with an in-person meeting of top U.S. and Chinese envoys this week in Alaska, the first since President Joe Biden took office in January.

Private exporters report sales of 1,156,000 MT of corn for delivery to China during MY 2020/2021. https://t.co/YLt4xjGasy

— Foreign Ag Service (@USDAForeignAg) March 16, 2021

“More large purchases are possible soon because of strong demand from the refining industry as well as from feed mills, said Meng Jinhui, a senior analyst with Shengda Futures in Beijing. While feed mills can use cheap state wheat or imported sorghum to replace corn, refiners’ only option is corn, Meng said.”

The Bloomberg article stated that,

China’s corn imports could eventually climb as high as 40 million tons this calendar year from 11 million tons in 2020, according to Meng.

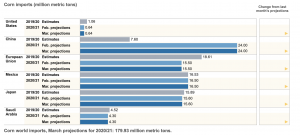

“The latest estimate from the U.S. Department of Agriculture puts purchases at 24 million tons in the 2020-21 marketing year, more than triple a year earlier.”

And on Wednesday, USDA announced an additional sale of 1,224,000 metric tons of corn for delivery to China during the 2020/2021 marketing year.

Private exporters report sales of 1,224,000 MT of corn for delivery to China during MY 2020/2021. https://t.co/RlLLAesFXz

— Foreign Ag Service (@USDAForeignAg) March 17, 2021

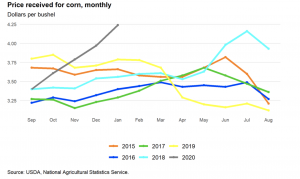

In its monthly Feed Outlook report last week, the USDA’s Economic Research Service (ERS) indicated that, “[U.S.] corn exports are projected to total 2,600 million bushels for 2020/21—unchanged from the previous month and still a record, if realized. The export market is providing strong support for corn prices, as reflected by the increasing Gulf-spot price. According to the Census Bureau, through the first 5 months of the marketing year, U.S. corn exports have totaled 857 million bushels. The current total is substantially higher than 2019/20, but it is not a record pace.

The Outlook report explained that, “Distinct from previous years, however, a much larger portion of U.S. shipments have been destined for China. The Foreign Agricultural Service’s (FAS) Export Sales Report system shows record amounts of total commitments and outstanding sales for U.S. corn—mostly driven by large purchases for China’s market. In order to meet these outstanding sales, the U. S. export program would have to operate at a very high pace, consistently, for the remainder of the marketing year. Inspections data indicate a high export level for February—potentially a February export record—with strong demand to China, Mexico, and Japan. While the strong pace may be logistically feasible, the United States is also likely to face increased competition from Southern Hemisphere corn exporters in the second half of the marketing year.”

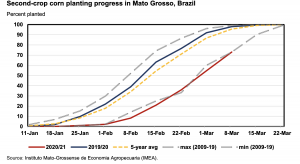

Last week’s update added that, “Corn production in Brazil is unchanged this month at 109.0 million, despite planting delays of the second crop corn, which constitutes almost 80 percent of Brazilian output.”

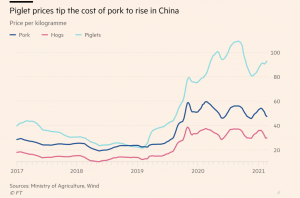

Meanwhile, Financial Times writers Hudson Lockett and Emiko Terazono reported on Tuesday that, “Hog futures and piglet prices in China have jumped as authorities struggled to control outbreaks of African swine fever, with virus strains and illegal vaccines prompting supply fears in the world’s biggest pork market.

“Scientists said the new variants, which have left commodities traders scrambling for information, were spreading more easily than the dominant variety of the pathogen. They have also raised the risk of a more protracted disruption to supply for the largest producer and consumer of the meat.”

The FT article stated that, “ASF, which does not affect humans, has hit China’s pork production since it began spreading in 2018. Beijing has predicted a steady recovery in supplies this year after falling to a two-decade low in 2020, but analysts said the virus strains could threaten those forecasts.”

“Justin Sherrard, an analyst at investment bank Rabobank, downgraded his forecast for growth in China’s pork production to 8 to 10 per cent this year, from a previous forecast of 10 to 15 per cent, due to the strains,” the FT article said.

A delayed recover in the Chinese hog herd could have an adverse impact on feed demand, as the interdependency of the relationship between Chinese pigs and American crops has increased.