As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

FAO Food Price Index Climbs, While Some See Continued Strong Chinese Demand for Agricultural Commodities

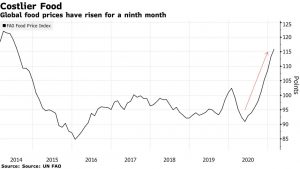

Late last week, Bloomberg writers Megan Durisin and Agnieszka de Sousa reported that, “The surge in food prices that’s eating into consumer budgets and hitting some of the poorest nations shows few signs of abating.

“A United Nations gauge of global costs rose for a ninth straight month in February, the longest run since 2008, when the world faced the first of two food crises within several years. Prices of everything from sugar to vegetable oils rose last month, sending the overall measure to a fresh six-year high.”

Prices are up again! https://t.co/1czPgYMxIR

— Abdolreza Abbassian (@Abbassian_A) March 4, 2021

The Bloomberg writers noted that, “Global food prices are still well below a 2011 peak and there are signs that increases in grains prices are slowing, with grains costs rising 1.2% last month, the least since July. Supply issues are poised to ease as wheat output is forecast to reach a record 780 million tons next season, while corn production in Latin America is seen above average, the FAO said.”

Reuters News reported on Thursday that, “FAO raised its forecast for the 2020 cereal season to 2.761 billion tonnes from an estimate of 2.744 billion made last month pointing to a 1.9% increase year on year.

“That revision reflected a 7.5 million tonne increase in the world wheat production estimate, driven by recently released official data from Australia, the European Union, Kazakhstan and Russia.”

Meanwhile, the March edition of the AMIS Market Monitor indicated that, “According to the latest five-year projection of the International Grains Council, there should be no complacency about global food production and trade.”

“While the rate of stock depletion for maize (corn) is projected to slow compared with the recent seasons, the outlook for world maize supply and demand remains tight. In comparison, world balance sheets for other grains remain relatively comfortable, with further wheat stock accumulation projected to new peaks, and only minor changes over the baseline for other grains.”

The Market Monitor added that, “International grain trade is seen expanding by an average rate of 2 percent annually, led by higher shipments of wheat and maize.

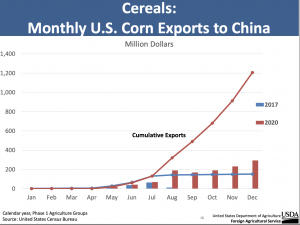

While annual increases are expected to be slower than in recent years, rising feed needs will continue to drive growth in maize shipments, with China a regular buyer of sizeable volumes.

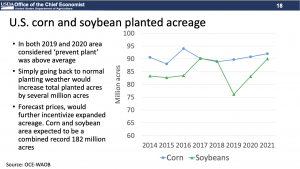

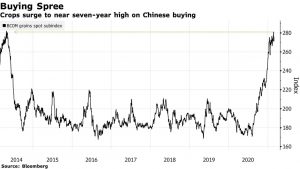

And Bloomberg writers Kim Chipman and Isis Almeida reported earlier this month that, “American farmers are set to plant the most corn and soybeans on record, but that won’t be enough to cool a China-driven price rally.

“That’s the view of Andersons Inc., one of the top five grain traders in the U.S. While growers will plant a combined 183 million acres this year, it will take more than one season to return the global market to surplus as China continues to scoop up everything from corn to soy to feed a hog herd that’s recovering from a deadly pig disease, said Chief Executive Officer Pat Bowe.”

The Bloomberg article indicated that, “‘One big corn crop is not going to cure the supply and demand, but everyone is going to be watching how U.S. plantings go,’ Bowe said in an interview Monday [March 1st]. ‘China demand will continue‘ and replenishing inventories ‘can’t happen with just one year.'”

New U.S. Agriculture Secretary Tom Vilsack says U.S. farmers should not rely on sales to China. He tells @DavidWestin that farmers must look for new markets https://t.co/a6nxZtk7hv pic.twitter.com/3rQxf0OoOl

— Bloomberg TV (@BloombergTV) March 4, 2021

Likewise, Bloomberg writers Michael Hirtzer and Isis Almeida reported last week that, “Strong Chinese crop demand will carry through the ‘medium term,’ reinforcing expectations for another record year of earnings and bolstering prospects past 2021, according to Archer-Daniels-Midland Co.’s chief financial officer.

“‘I am confident in the momentum from 2020 continuing, this year and beyond,’ Chief Financial Officer Ray Young said during Bank of America’s Global Agriculture & Materials Conference on Wednesday. ‘This is not a one-year phenomenon.'”

‘The main reason China is aggressively buying agricultural products from around the world is just fundamental demand,’ Young said. ‘And that’s the primary driver as to why China was aggressively importing last year and we expect them to be aggressively importing this year.’

Meanwhile, Reuters writers Hallie Gu and Dominique Patton reported last week that, “China’s government said on Friday it will raise its minimum purchase price for wheat and rice and expand corn planting areas this year, reiterating earlier plans to boost grain output after prices soared last year.

“The moves, outlined by Premier Li Keqiang and the state economic planning agency in annual reports to parliament, also come after the COVID-19 pandemic last year fuelled food security jitters in the world’s most populous country.”

The Reuters article added that, “Recognising the competition for land between soybeans and corn, the state planner prioritised higher corn acreage and said production of soybeans would be stable this year, changing prior years’ trends of large increases in output. It also said it would support production of grains on barren land.”

And Bloomberg News reported last week that, “China rolled out a roadmap to boost crop production in the world’s most populous nation, highlighting concerns over food security after the country imported record amounts of meat, corn and soybeans last year.

“Measures include creating agricultural belts devoted to large-scale farming and providing sufficient subsidies to motivate grain farmers, according to the latest five-year plan that sets out key economic and political goals through 2025.”

The Bloomberg article pointed out that, “Food security is moving to the top of the government’s agenda after the coronavirus pandemic and outbreaks of African swine fever raised concerns over whether China could guarantee food supplies for its 1.4 billion people. Imports of meat and grains surged last year, driving global prices higher and stoking worries over food inflation.”