As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

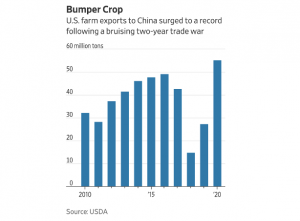

Farm Exports to China Surge as Logistical Concerns Over Shipping Containers Emerge

Wall Street Journal writer Jesse Newman reported on Wednesday that, “China is once again the U.S.’s chief customer for agricultural goods, three years after the start of a bruising trade war that prompted American farmers to try to wean themselves off their biggest market.

“Following a cease-fire between the world’s two largest economies last year, U.S. farmers are shipping record volumes of crops and meat across the Pacific. The surging agricultural exports are helping power a turnaround in the U.S. farm economy, lifting commodity prices and profits for agribusinesses, and fueling expectations that farmers will devote more land than ever for some crops.

U.S. agricultural exports to China in 2020 rose to 55.5 million tons and comprised one-quarter of all farm shipments, according to U.S. Agriculture Department data. China is now buying more farm goods than it did before the trade war, and U.S. agricultural officials expect Chinese demand to grow further.

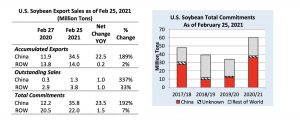

The Journal article pointed out that, “China’s race to fatten its hogs helped drive a 53% jump in U.S. soybean exports to the country last year compared with 2019, representing the second-highest volume on record and more than half of all soybean shipments, according to USDA. Corn exports soared more than 20-fold to a new high.”

Top 10 U.S. export markets for #corn, by volume https://t.co/nwZBJ79MyC @USDA_ERS

— Farm Policy (@FarmPolicy) March 8, 2021

* #China pic.twitter.com/GrLQjrwz7Q

Top 10 U.S. export markets for #soybeans, by volume https://t.co/nwZBJ79MyC @USDA_ERS

— Farm Policy (@FarmPolicy) March 8, 2021

* #China pic.twitter.com/M6BD9d2iwK

Top 10 U.S. export markets for #wheat, by volume https://t.co/nwZBJ79MyC @USDA_ERS

— Farm Policy (@FarmPolicy) March 8, 2021

* #China pic.twitter.com/Eeb5aNDR9y

“Grain-trading giants that are pumping out feed ingredients for Chinese hog farmers say they expect the strong demand to continue. Chinese purchases are helping draw down U.S. corn and soybean stockpiles, prompting domestic processors to rush to lock in supplies and boosting some food prices for consumers,” the Journal article said.

This month’s Oilseeds: World Markets and Trade report, from the USDA’s Foreign Agricultural Service (FAS), noted that, “As of February 25, 2021, cumulative global U.S. soybean shipments reached 52.7 million tons, with China accounting for 65 percent (34.5 million tons). This pace for exports to China is nearly triple from the same period in 2019/20. Outstanding sales to all destinations reached 7.5 million tons, up nearly 70 percent from last year. These are led by outstanding sales to China of just over 1.0 million tons, which are more than triple last year. Due to growth in sales and exports to China, total export sales commitments reached a record 60.0 million tons, up 70 percent (26.0 million tons) from last year.”

Also, FAS stated in its monthly Grain: World Markets and Trade report this week that, “At the end of February, U.S. sorghum outstanding sales for delivery by August 2021 stand at 2.8 million tons, the second-largest volume in history. Almost three-quarters of these sales are slated to go to China, while the rest is mostly reported for unknown destinations.”

Meanwhile, Peter S. Goodman, Alexandra Stevenson, Niraj Chokshi and Michael CorkeryOff the coast of Los Angeles, more than two dozen container ships filled with exercise bikes, electronics and other highly sought imports have been idling for as long as two weeks.

“In Kansas City, farmers are struggling to ship soybeans to buyers in Asia. In China, furniture destined for North America piles up on factory floors.

Around the planet, the pandemic has disrupted trade to an extraordinary degree, driving up the cost of shipping goods and adding a fresh challenge to the global economic recovery. The virus has thrown off the choreography of moving cargo from one continent to another.

“At the center of the storm is the shipping container, the workhorse of globalization.”

The Times article indicated that, “Americans stuck in their homes have set off a surge of orders from factories in China, much of it carried across the Pacific in containers — the metal boxes that move goods in towering stacks atop enormous vessels. As households in the United States have filled bedrooms with office furniture and basements with treadmills, the demand for shipping has outstripped the availability of containers in Asia, yielding shortages there just as the boxes pile up at American ports.”

More narrowly, the Times article stated that, “The dysfunction on the American West Coast has caused problems thousands of miles away.

“Scoular, one of the largest agricultural exporters in the United States, loads grain and soybeans into containers at terminals like Chicago and Kansas City, and then sends them by rail to Pacific ports en route to Asia.

“Given the prices fetched by containers in Asia, shipping carriers are increasingly unloading in California and then immediately putting empty boxes back on ships for the return leg to Asia, without waiting to load grain or other American exports. That has left companies like Scoular scrambling to secure passage.”

A news release on Tuesday from Rep. Jim Costa (D., Calif.), a senior member of the House Ag Committee, stated that, “[Rep. Costa] and Adrian Smith (R-NE), along with Representatives Rodney Davis (R-IL), John Garamendi (D-CA), Dusty Johnson (R-SD), Troy Nehls (R-TX), Jimmy Panetta (D-CA), and Mike Thompson (D-CA), led a bipartisan group of colleagues in a letter to Michael A. Khouri, Chair of the Federal Maritime Commission, voicing concern over reports that certain vessel-operating common carriers (VOCCs) are declining to ship U.S. agricultural commodity exports from U.S. ports.”

The release added that, “Over the past year, American producers, exporters, and entire economic sectors have grappled with widespread delays, bottlenecks, and increasing fees at our ports. These challenges are exacerbated by reports that VOCCs are delivering shipments to U.S. ports and then electing to leave without refilling empty containers with American goods for export. Such activity constricts entire supply chains and propels trade to move only in an inbound direction.”

I led more than 100 members in calling on FMC to address shipping companies that won't load US ag products at US ports. #NE03 ag producers rely on these ships to get products to market, and these reports must be investigated. Learn more here: https://t.co/R8bCB3gY7W

— Rep. Adrian Smith (@RepAdrianSmith) March 10, 2021

China is participating in unfair trade practices, prioritizing empty shipping containers over U.S. ag products. America’s farmers work hard to produce a high-quality product & we can’t allow China to shut them out of the market. https://t.co/DkcfB1nBai

— Rep. Dusty Johnson (@RepDustyJohnson) March 10, 2021

And Seattle Times writer Paul Roberts reported earlier this week that, “In Wenatchee, tens of thousands of boxes of apples that should be on their way to the Middle East and Asia are piling up instead in warehouses.

“In Ellensburg, it’s a similar story for mountains of hay bales that would otherwise be on container ships bound for Japan and South Korea.

The problem isn’t a lack of demand: Foreign buyers are eager for farm goods from Washington and other states. But thanks to the strange effects of COVID-19 on global shipping, U.S. farm exports are barely moving.

Mr. Roberts explained that, “The cargo-space crunch is the latest symptom of a global trade system that was unbalanced even before the pandemic, but is now so lopsided that entire sectors are at a virtual standstill.”

The Seattle Times article noted that, “But the surge in Asian imports has had another effect on Northwest farmers. Because U.S. demand for Asian products is so high, shipping companies can now make far more money sending empty containers back to China as soon as possible, rather than take the time to refill them with American farm products.

“It’s simple economics: Because a container of Chinese electronics, apparel and other exports is generally worth more than one filled with American farm products, shippers can charge more per eastbound container load, says Peter Friedmann with the Agriculture Transportation Coalition in Washington, D.C. For that reason, it’s more profitable for carriers to speed that container back to Asia for another high-value load than it is to wait for several days while a U.S. exporter fills the container with hay or apples or some other low-value product. Pound for pound, the value of American apples or potatoes or ‘is a mere fraction of the value of a container load of, say, Adidas running shoes,’ Friedmann says.”