Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Recent CARD Paper Discusses China’s Hog Inventory, with Implications for Corn Demand

Writing recently in the CARD (Center for Agricultural and Rural Development) Agricultural Policy Review, from Iowa State University (“Is China’s Hog Rebuilding Complete? Reconciling Inventory and Price Data“), Dermot Hayes, Xi He, and Wendong Zhang stated that, “The African swine fever (ASF) outbreak that started in August 2018 wiped out 40% of China’s sow inventory. China has been making substantial efforts, including subsidizing large hog producers and encouraging industrialization and modernization of hog production, to rebuild and expand its pork production.

While China’s governmental inventory data as of December 2020 show sow and hog inventory were 92.1% and 93.1% of their respective 2017 levels, recent record-high piglet, sow, hog, and pork prices suggest a large persistent supply shortage.

“China’s record pork and live swine imports in 2020 suggest that China’s hog rebuilding might be fast but of low genetic quality. Specifically, it seems likely that the retention of low-quality commercial generation gilts helped rebuild the herd but set back the national breeding system by abandoning purebred grandparents and parent generation propagation.”

The CARD paper noted that, “Prices from the newly launched live hog futures market in January 2021 show that traders expect high prices into 2022. We predict that as of January 2022, China’s hog inventory will be 290 million head and monthly hog slaughter will be 14.5 million head based on estimated inventory-price elasticities and the relative change in live hog futures price for deliveries in January 2022 ($1.92/pound) compared to average hog prices in 2017 ($1.30/pound). Our predictions are lower than the average 350 million head hog inventory and 18 million head monthly hog slaughter in 2017, which indicates a weak recovery of hog inventory and slaughter into 2022.”

The Iowa State researchers added that, “China’s hog rebuilding has important implications for affordable pork consumption and feed grain and meat exporters. While inventory data show that hog and sow inventory has reached more than 90% of pre-ASF levels, high piglet, sow, hog, pork, and live hog futures prices indicate the reported recovery in inventory and slaughter recovery may not have translated into ample pork supplies. High futures prices into January 2022 indicate that we will likely see continued high pork prices and pork import demand into 2022.”

1. Recommended Reading for the Day: "Is China's Hog Rebuilding Complete? Reconciling Inventory and Price Data" New article by my colleagues at Iowa State. It could be the Rosetta Stone in figuring out why China is buying so much corn right now. https://t.co/nPf07I1jaH

— Scott Irwin (@ScottIrwinUI) March 22, 2021

8. This analysis convinces me that China's ASF hog losses were much larger than official numbers show and that the recovery is just really getting going. That means large demand for both corn and soybean meal as the herd recovers for real into 2022. pic.twitter.com/3zD9DCokdS

— Scott Irwin (@ScottIrwinUI) March 22, 2021

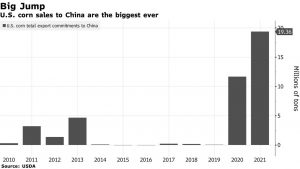

Meanwhile, Bloomberg writers Kim Chipman and Michael Hirtzer reported earlier this week that, “High-level talks between Beijing and Washington may have broken down into bickering, but American farmers are still selling boatloads of corn to Chinese importers.

“The U.S. Department of Agriculture announced almost 4 million metric tons of corn sales to China last week. That’s on top of 5 million tons sold in January and February, or more than five times the amount a year earlier.

It just goes to show what some farmers have long been hoping for: When China needs to make big purchases of crops like corn, the country will have little choice but to do business with the U.S.

The Bloomberg writers also pointed to the Iowa State Agricultural Policy Review article, and explained that, “A new analysis from Iowa State University shows that the Asian country’s reported pig losses last year were larger than the official figures indicated. Scott Irwin, an agriculture economist at University of Illinois, said the report’s findings should translate into ‘large demand for both corn and soybean meal as the herd recovers for real into 2022.’

#corn shipments for the week ending March 11 were revised up to a record high 89.54 million bushels in today's USDA inspection report. #oatt pic.twitter.com/5qfvBCARjo

— Arlan Suderman (@ArlanFF101) March 22, 2021

“As far as U.S.-China trade relations, there’s speculation that the most recent flurry of corn purchases could portend well for upcoming negotiations.”