A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

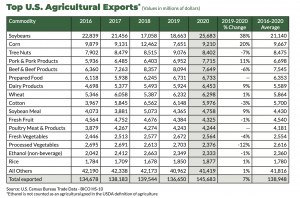

2020 U.S. Ag Exports Second Highest on Record, Led by Soybeans, Corn and Pork to China

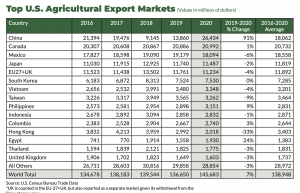

This week, the USDA’s Foreign Agricultural Service (FAS) released its 2020 U.S. Agricultural Export Yearbook, a statistical summary of U.S. agricultural commodity exports. Today’s update includes highlights from the report, with a focus on soybeans, corn and pork.

The Yearbook stated that,

Total U.S. agricultural exports in 2020 were nearly $146 billion, up almost 7 percent from 2019, and the second highest level on record (after Calendar Year 2014). The primary factor for this surge in exports was increased shipments of soybeans, corn, and pork to China.

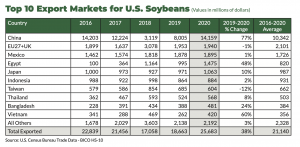

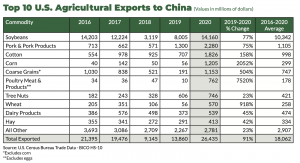

“Soybeans continued to be the United States’ No.1 agricultural export, increasing 38 percent to a record $25.7 billion in 2020 and accounting for nearly 18 percent of total U.S. agricultural exports. In 2020, soybean shipments to China accounted for 55 percent of total soybean exports, returning to levels prior to China’s imposition of Section 232 and 301 retaliatory tariffs, when China accounted for at least 50 percent of total bean export value since 2009.”

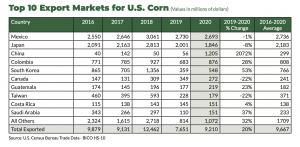

FAS stated that, “Corn exports to the world rose 20 percent to $9.2 billion, led primarily by a $1.1 billion increase in sales to China. Increased competitiveness due to production shortages in Argentina and Ukraine contributed to this sharp increase. Mexico and Japan continued to be the top two markets for U.S. exports, while high domestic prices in China led to the largest value of U.S. exports to China since 2013.

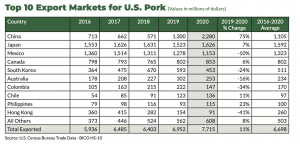

“Pork exports was the other major contributor in 2020, rising by 11 percent. This rise was led by a 75- percent increase in exports to China and a 7-percent increase to Japan, the No. 2 market. Exports to China were buoyed by increased demand for imports following significant reduction of the Chinese herd due to African swine fever (ASF).”

More narrowly with respect soybeans, the Yearbook noted that, “U.S. soybean exports are forecast at record levels for the marketing year ending in August (2020-2021). Soybean shipments are back on trend this MY with large sales being shipped out in late 2020 and early 2021.”

Regarding corn, FAS indicated that, “U.S. corn exports to China are expected to be stronger. At the end of January 2021, sales to China for delivery in 2021 stood at a record 11.6 million tons. China’s demand for competitively priced feedstuff should remain strong as its swine sector continues to rebound from ASF. High corn prices in China, which were nearly double those of U.S. corn at the end of January, are also expected to stimulate demand for imports.”

While discussing pork exports, FAS pointed out that, “China became the largest market for U.S. pork in 2020, generating an additional $1 billion in exports over the previous year, due to decreased Chinese production resulting from ASF.”

The Yearbook also noted that China, Canada, Mexico, Japan, the EU, and South Korea were the top six export markets for agricultural goods in 2020.

FAS added that, “China’s strong demand for U.S. agricultural products is expected to continue. China recovered from COVID-19 more quickly than most of the world and is increasing purchases of U.S. agricultural products, including corn, soybeans, and other animal feeds needed to replenish its growing swine heard.

“Continued economic growth and an expanding middle-class also bodes well for increased exports of poultry, fruits and vegetables, and other higher-valued consumer- oriented goods.”