Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China Demand Could Create “Mini Super-Cycle,” U.S. Corn, Soybean Exports Remain Robust, as Shipping Costs Increase

Last week, Bloomberg writer Andy Hoffman reported that, “Agricultural commodities are poised for a ‘mini supercycle’ as China’s rampant demand keeps supplies tight, according to the head of a key Cargill Inc. trading unit that’s seeing its best results in a decade.

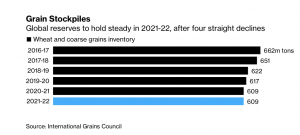

“China’s crop-buying spree and dwindling stockpiles recently sent prices to multiyear highs, while also whipping up volatility that traders crave. A surprise smaller-than-expected U.S. planting report should help drive corn and soy prices even higher, said Alex Sanfeliu, who runs Cargill’s World Trading Group. The International Grains Council also sees supplies remaining tight.

‘This opens the door for high prices, high volatility and a friendly outlook to be with us for longer,’ Sanfeliu said in an interview from Geneva, where the global trade group is based. ‘Maybe this starts a mini supercycle.’

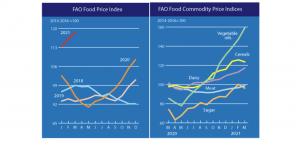

Meanwhile, Reuters News reported last week that, “World food prices rose for a 10th consecutive month in March, hitting their highest level since June 2014, led by jumps in vegetable oils, meat and dairy indices, the United Nations food agency said on Thursday.

“The Food and Agriculture Organization’s food price index, which measures monthly changes for a basket of cereals, oilseeds, dairy products, meat and sugar, averaged 118.5 points last month versus a slightly revised 116.1 in February.”

“FAO’s cereal price index fell 1.7% month on month in March, ending eight months of consecutive gains, but still 26.5% higher than the same period last month,” the Reuters article said.

And Bloomberg writers Agnieszka de Sousa and Megan Durisin reported on Thursday that, “Food prices are in the longest rally in more than a decade amid China’s crop-buying spree and tightening supplies of many staple products, threatening faster inflation. That’s particularly pronounced in some of the poorest countries dependent on imports, which have limited social safety nets and purchasing power and are struggling with the Covid-19 pandemic.”

(Note: A recent farmdoc daily article explored issues associated with food price inflation in greater detail).

Meanwhile, the USDA’s Agricultural Marketing Service (AMS) pointed out in its weekly Grain Transportation report on Thursday that, “At 18.8 mmt, first-quarter 2021 corn inspections were up 55 percent from the 5-year average and up 95 percent from year to year.

“About 90 percent of first-quarter 2021 total corn shipments were destined to Asia and Latin America. First-quarter U.S. Gulf corn inspections increased 97 percent, and PNW corn inspections jumped 194 percent.

Rising demand for grain from China and other Asian countries have boosted U.S. corn exports.

With respect to soybeans, the AMS report stated that, “At 15.4 mmt, total first-quarter soybean inspections were up 25 percent from the 5- year average and up 55 percent from year to year. First-quarter soybean inspections in the U.S. Gulf jumped 52 percent and jumped 89 percent in PNW. At 7.6 mmt, soybeans inspected for export to China were up 143 percent.”

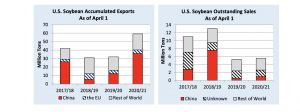

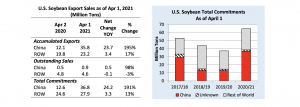

In a closer look at U.S. soybean exports, the USDA’s Foreign Agricultural Service (FAS) stated on Friday (“Oilseeds: World Markets and Trade“) that, “As of April 1, 2021, cumulative global U.S. soybean shipments reached 59.0 million tons, with China accounting for 60 percent (35.8 million tons). Exports to China have nearly tripled from the same period in 2019/20. Outstanding sales to all destinations are 5.6 million tons, up 6 percent from last year. These are led by outstanding sales to China of just over 900,000 tons, which are almost doubled from last year.

“Due to growth in sales and exports to China, total export sales commitments reached a record 64.7 million tons, up nearly 75 percent (27.4 million tons) from last year.”

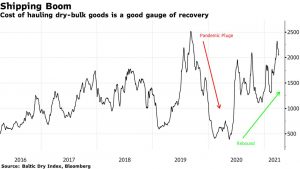

And earlier this month, Bloomberg writers Isis Almeida, Rachel Graham, and Annie Lee reported that, “Rising demand for everything from soybeans to steel has sent the cost of hauling dry goods soaring more than 50% this year.”

The Bloomberg article noted that, “Freight costs started to recover as top commodities buyer China emerged from the pandemic faster than other countries. Rebounding manufacturing in the Asian nation and huge imports of American crops to feed an expanding hog herd gave dry-bulk rates a first leg up.

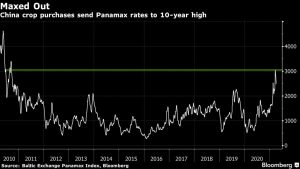

“The nation’s imports are so big that they helped send the cost of hauling in Panamax ships — those meeting the size limits for the Panama Canal — to the highest level in more than a decade.”

On Sunday, Bloomberg writer Henry Ren reported that, “Stubbornly high shipping expenses for businesses are getting sealed into contracts for the next 12 months, forcing companies to pass the extra costs on to consumers.

“The price for a container of goods from China to the U.S. West Coast and European ports has hovered near record highs for several months, and conditions are ripe for more increases even though spot rates usually soften this time of year. What’s more, new contracts being signed by some of the biggest U.S. importers indicate the spike won’t be a short-term blip.”