Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China Sees Record Pork Imports in March, as Swine Fever Continues to Limit German Pork Exports

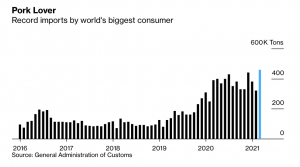

Bloomberg News reported on Monday that, “China’s pork imports jumped to an all-time high in March on supply concerns following a resurgence of African swine fever in the world’s biggest consumer and producer.

“Inbound shipments increased 16% from a year earlier to 460,000 tons, boosting overall meat imports to a record as well, according to customs data Sunday. Purchases in the first quarter advanced 22% to 1.16 million tons, data showed.”

The Bloomberg article added that, “Imports, driven partly by state purchases, will remain strong in May as traders anticipate a rebound in domestic pork prices, which have been falling recently partly as a result of a selloff by hog farms, said Lin Guofa, senior analyst with Bric Agriculture Group.”

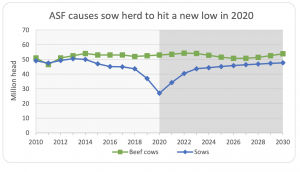

Meanwhile, the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri indicated on Monday in its 2021 International Livestock Outlook that, “Due to the ASF outbreak in China that was first discovered in fall 2018, the sow herd fell 38% between 2018 and 2020.

“This large dip in the sow herd caused the total swine herd to contract 21% over the same period. The decreased supply and high prices of pork in China had a positive impact on the beef sector.

We expect that the sow herd will begin to rebuild in 2021 and will surpass 2018 levels by 2023, however, the herd is not expected to exceed pre-2014 levels.

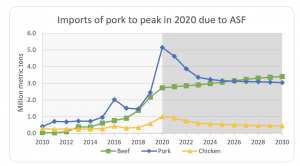

The FAPRI report also stated that, “Given the shortage of pork on the Chinese market and the high domestic prices, imports of pork rose 350% between 2018 and 2020. However, this major increase in pork imports was not enough to offset China’s loss in production, and the country accounts for nearly 50% of the world’s pork production. Consequently, imports of beef and chicken rose substantially, too. As China recovers from ASF, we expect imports of pork and chicken to fall but remain well above historical levels. Beef imports are expected to continue growing as consumers respond to higher incomes.”

And FAPRI also noted that, “While ASF did cause per-capita consumption of pork to fall between 2018 and 2020 mainly due to record high prices, pork still remains a staple in the Chinese diet. We expect pork production to grow steadily as China recovers from ASF. Chicken per-capita consumption is expected to remain high during the first part of the ASF recovery years and then slowly decline. Conversely, beef per-capita consumption is expected to remain above historical levels as consumers continue to demand more beef in their diets.”

(Note: The FAPRI report indicated that, “This report was prepared the week of January 18, 2021 using the latest data available at that time.”)

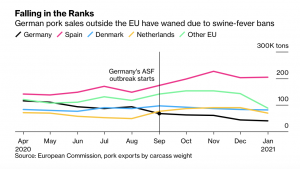

In other news regarding ASF, Bloomberg writer Megan Durisin reported this week that, “Germany’s deadly pig-disease outbreak has topped 1,000 cases, delaying its return as a major meat exporter as the battle to stamp out the virus persists.

“The rising count risks keeping exports subdued from the European Union’s top pork producer, benefiting other sellers in the bloc and the Americas. Meat buyers like Vietnam and Singapore have eased initial prohibitions on German supply, but a ban in top importer China is limiting the upside. Beijing is unlikely to lift it before mid-year at minimum, according to a Rabobank report from March.”