Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Kansas City Fed: Reduced Demand for Farm Loans in First Quarter

In an update earlier this month from the Federal Reserve Bank of Kansas City (“Farm Lending Remains Muted in Early 2021“), Nathan Kauffman and Ty Kreitman stated that, “Farm loan demand remained muted at commercial banks in the first quarter of 2021. A reduction in the volume of operating loans led to an overall decline in total non-real estate lending. Financing activity also declined more notably at banks with relatively large farm loan portfolios, while lending was more stable among small and mid-size lenders.

“Factors specific to the pandemic in 2020 likely contributed to the reduced lending activity as the year progressed. Substantial government aid through various programs in 2020 provided financial support, which may have mitigated some producers’ financing needs toward the end of the year. In addition, the Small Business Administration’s Paycheck Protection Program accounted for a sizable share of loans reported, and likely displaced a portion of typical financing needs for some borrowers.

Despite some ongoing challenges for cattle producers, financial conditions in agriculture remained favorable alongside strength in other major agricultural commodity markets. The outlook for the sector in 2021 remained significantly improved from recent years, but rising input costs could also weigh on profit margins in the months ahead.

The Kansas City Fed update noted that, “Reduced demand for loans to finance operating expenses drove the overall decline in non-real estate financing. Operating loans decreased by about $12 billion from a year ago, which represented nearly all of the drop in non-real estate farm lending. Large commercial banks also accounted for most of the decline from a year earlier. Loan volumes fell by nearly 14% at large banks, compared with a decrease of less than 1% at banks with smaller portfolios.”

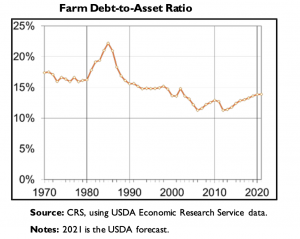

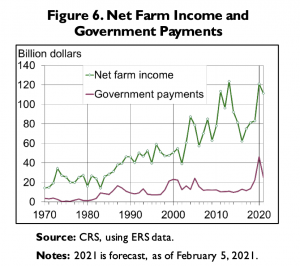

Meanwhile, in a Congressional Research Service (CRS) report last week (“Agricultural Credit: Institutions and Issues“), Jim Monke indicated that, “The farm sector’s balance sheet has remained strong in recent years. Inflation-adjusted debt levels and debt-to-asset ratios (debts divided by assets) are below peak s tress levels during the 1980s. The delinquency rates on FSA direct and guaranteed loans have remained fairly steady in recent years through the trade disruption and the COVID-19 pandemic. About 30% of all U.S.farms have farm debt.

“Since 2018, more of net farm income has come from the government in the form of trade aid payments and COVID- 19 assistance.”

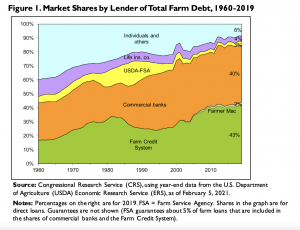

Mr. Monke explained that, “Figure 1 [below] shows that, based on USDA data for 2019, FCS [the Farm Credit System] and commercial banks provide most of the farm credit (43% and 40%, respectively) followed by individuals and others (8%) and by life insurance companies (4%). FSA provides about 3% of farm debt through direct loans. FSA also guarantees about another 5% of the market through loans that are made by commercial banks and FCS.”

The CRS report indicated that, “As a whole, farm assets have remained strong and grown steadily since the end of the 1980s, though inflation-adjusted growth has slowed since 2014. At the end of 2020, farm sector assets totaled $3.1 trillion, according to USDA, which was 4% below their 2014 peak in inflation-adjusted terms. Real estate accounted for about 82% of total farm assets in 2020; machinery and vehicles were the next-largest category, at about 9% of the total.14 USDA forecasts that farm assets will increase by 1.8% in 2021.

“Farm debt reached a historic high of $432 billion at the end of 2020. About 30% of U.S. farms have farm debt. USDA forecasts that debt will increase by 2.2% in 2021. In inflation-adjusted terms, this forecast debt is approaching, but remains below, the peak level of farm debt in the 1980s.”