As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

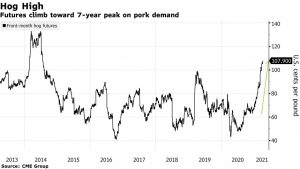

U.S. Hog Prices Climb- Imports to the Philippines Rise, as Chinese Demand Expected to Moderate

Last week, Reuters News reported that, “Philippine President Rodrigo Duterte on Wednesday reduced pork import tariffs as the government seeks to address a domestic shortage by ramping up purchases from abroad.

“The Southeast Asian country, the world’s seventh-biggest pork importer before local demand fell due to the pandemic, plans to import roughly 400,000 tonnes of pork this year, more than double the 162,000 tonnes planned earlier.

The pork shortfall, due to African Swine Fever [ASF] outbreaks, has pushed local meat prices higher, causing inflation to shoot up and stay above the central bank’s full-year target band of 2% to 4% in the first quarter.

And Bloomberg writer Michael Hirtzer reported on Wednesday that, “Lean hogs, one of this year’s best-performing commodities, are fetching the highest U.S. prices since 2014 as pork-pricing changes in the Philippines lift demand prospects.”

Compare the performance of selected #commodities, year-to-date (percent change), https://t.co/Uzf2OAPYcY @WSJ

— Farm Policy (@FarmPolicy) April 10, 2021

* #hogs, #corn, #soybeans, #cotton, #cattle, #wheat. pic.twitter.com/tfs8no1BaB

Mr. Hirtzer explained that, “The Philippines is one of the fastest-growing markets for U.S. pork, while China has become the world’s biggest importer since the outbreak of swine disease in 2018. Demand for the meat is rising as businesses reopen in the U.S., a turnabout from last year’s diminished demand when restaurants closed in the early days of the pandemic.”

“Lean hog futures climbed as much as 2.3% to 108 cents a pound, the highest since July 2014. Year-to-date gains of more than 50% has hogs outperforming other big gainers, including gasoline and copper futures,” the Bloomberg article said.

In other developments regarding ASF, Reuters News reported last week that, “China reported an outbreak of African swine fever in Xinjiang region, the agriculture ministry said on Monday.”

And a separate Reuters article reported recently that, “Taiwan has begun testing hog herds and putting in place movement controls near where a dead pig infected with African swine fever washed ashore over the weekend, the government said on Tuesday, as it works to ensure the island remains free of the disease.

“Taiwan has been on guard against the infection reaching them after the deadly virus ravaged farms in neighbouring China during 2018 and 2019, and is once again affecting the world’s most populous country.”

More broadly with respect to pork production, the USDA’s Foreign Agricultural Service (FAS) indicated on Friday (“Livestock and Poultry: World Markets and Trade“) that, “Global production is forecast 5 percent higher in 2021 to 101.5 million tons as China and Vietnam recover from the impacts of African swine fever (ASF). Additionally, improving economic conditions and continued export opportunities will support output growth among most major producers.

While China production is expected to still be 25 percent below pre-ASF levels, it is nevertheless forecast up 11 percent year-over-year.

“According to official government statistics, hog inventories grew rapidly in 2020; however, low productivity and continued disease challenges are expected to constrain production this year. High feed prices are also likely to put pressure on China carcass weights and limit output growth. Vietnam production is forecast up 5 percent year-over-year. With ASF mostly under control, high prices have incentivized investment and led to recovery in the breeding herd. Meanwhile, Philippines production is expected to decline 10 percent as ASF continues to constrain output.

FAS added that, “China imports are forecast 8 percent lower year-over-year due to recovering production but are still expected to be elevated by historical standards. On the other hand, the Philippines is expected to see imports more than double amid a domestic pork supply shortfall and changes to its tariff rate quota system. Additionally, a rebound in foodservice business, which is a major user of imported product, will drive South Korea imports 16 percent higher year-over-year.”

“U.S. exports are forecast at 3.3 million tons in 2021, marginally lower year-over-year. China demand is expected to moderate from the record levels of last year and will offset higher expected exports to Mexico, Japan, South Korea, and the Philippines,” FAS said.