A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

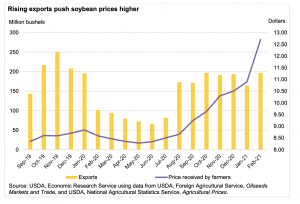

U.S. Soybean Exports to China Swell in March, as Brazil Suspends Corn, Soy Import Duties

Reuters writers Shivani Singh and Dominique Patton reported this week that, “China’s March soybean imports from Brazil plunged as rain delayed some shipments from the world’s top exporter, but U.S. bean imports rocketed more than fourfold as delayed cargoes arrived, hitting the highest monthly total since December 2016.

“The world’s biggest buyer of soybeans imported 315,334 tonnes from Brazil in March, down 85% from 2.1 million tonnes a year earlier, data from the General Administration of Custom showed on Tuesday. The Brazilian imports were the lowest since January 2017, according to Reuters records of customs data.

“More than offsetting that slide, China imported 7.18 million tonnes of soybeans from the United States in March, up 320% from 1.71 million tonnes in the previous year.”

China's soybean imports from U.S. surge in March, Brazilian imports slide https://t.co/3zca5DxEWd pic.twitter.com/324vyzZkBv

— Gavin Maguire (@GavinJMaguire) April 20, 2021

In separate news regarding the Brazilian market, Reuters writer Nayara Figueiredo reported this week that, “Brazil has suspended import duties on soy, corn, soybean meal and soybean oil until the end of the year, the Agriculture Ministry said on Monday, as the country seeks to slow inflation fanned by rising global commodities prices.

“The Chamber of Foreign Commerce (Camex) had already authorized the suspension of the import tax on corn until March 31 of this year and soybean until January 15. The latest measure is likely to benefit U.S. grains producers, experts say, as Brazilian buyers had earlier focused on Mercosur producers who are already exempt from tariffs.”

And Reuters writer Ana Mano pointed out this week that,

Brazil’s decision to temporarily suspend grain import tariffs is likely to benefit the United States and Ukraine, whose producers could sell products like corn for use as feed in Brazil, the leader of a Brazilian meat lobby told Reuters on Tuesday.

“As the price of corn rises, [meat association] ABPA said the meat industry is looking for feed alternatives, including wheat,” the Reuters article said.

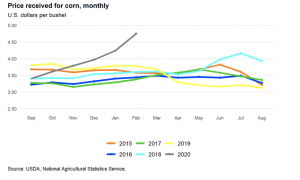

More broadly, Reuters News reported this week that, “Global commodity prices are expected to stay firm around current levels in 2021 after recovering in the first quarter buoyed by strong economic growth, the World Bank said on Tuesday.”

The Reuters article explained that, “Agricultural markets have rallied on strong Chinese demand and production issues in South America, even though most global food commodity markets remain adequately supplied by historical standards, the World Bank said.

“Benchmark Chicago corn and soybeans are trading close to multi-year highs, with prices lifted by food security worries and adverse weather in Brazil.

“Food inflation in Latin America, the Middle East and Africa averaged nearly 9% in January-February 2021, and there is risk of higher price inflation if the recent spikes in world food prices ‘transmit into domestic markets,’ it added.”