The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

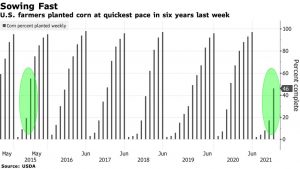

Corn Planting Rate Fastest Since 2015

Bloomberg writers Kim Chipman and Dominic Carey reported on Monday that, “U.S. corn farmers are planting at the fastest pace since 2015, a move that could finally bring some relief to a market that’s battling tight supplies.

“Sowing of America’s most widely grown crop is 46% complete, the U.S. Department of Agriculture said Monday. That marks an increase of 29 percentage points versus last week, the biggest such advance in six years.

All eyes in the food world are currently on America’s corn belt.

“Bumper U.S. supplies might be the only the factor that can help prices ease off a recent surge to an eight-year high. Growers in top rival Brazil are battling drought, while China is snapping up huge purchases of the grain. High corn prices increase costs to feed livestock herds, which translates to meat inflation for consumers.”

Although carryover stocks in the key exporters of #maize (#corn) are predicted to rebound from a multi-year low in 21/22, the aggregate volume will remain well below the prior five-year average. pic.twitter.com/W0UH5XZm7Q

— International Grains Council (@IGCgrains) May 3, 2021

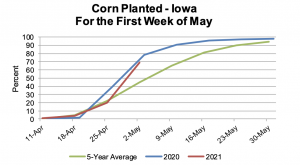

The Upper Midwest Regional Field Office of USDA’s National Agricultural Statistics Service (NASS) stated yesterday that, “Iowa farmers were able to plant almost half of the State’s expected corn crop during the week ending May 2 for a total of 69% planted, 9 days ahead of the 5-year average. With the week’s warmer temperatures, there were scattered reports of corn emerged. Iowa farmers planted over one-third of the expected soybean crop during the week ending May 2 for a total of 43% planted, 12 days ahead of normal.”

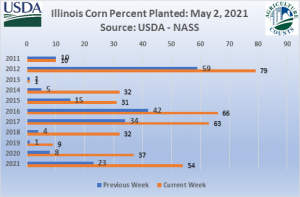

A separate NASS report yesterday from the Heartland Regional Field Office covering Illinois crop progress, pointed out that, “Corn planted reached 54 percent, compared to the 5-year average of 49 percent. Corn emerged reached 14 percent, compared to the 5-year average of 13 percent.”

And the Nebraska Crop Progress and Condition report yesterday from the NASS Northern Plains Region stated that, “Corn planted was 42%, behind 55% last year, but ahead of 36% for the five-year average. Emerged was 2%, behind 8% last year, and near 5% average.”

Grain prices have rallied to multi-year highs following the Covid-19 panic of spring 2020. What’s driving the rebound in prices? Presented by @CMEGroup pic.twitter.com/X3ovtnJScK

— Bloomberg Quicktake (@Quicktake) May 3, 2021

And Tuesday’s Agricultural Weather Highlights, from the USDA’s Office of the Chief Economist, pointed out that, “During the week ending May 2, nearly one-half (49%) of the intended corn acreage was planted in Iowa, along with 42% in Minnesota and 36% in Nebraska.”

Meanwhile, Reuters writer Tom Polansek reported on Monday that, “Chicago Mercantile Exchange lean hog futures soared to contract highs on Monday on tightening U.S. supplies and rising cash prices.

“Prices have been rallying as consumer demand is rising due to easing pandemic-induced restrictions on dining and travel, analysts said. Hog supplies are tight after some farmers euthanized hogs or performed abortions on pregnant sows last year as slaughterhouses closed during COVID-19 outbreaks among workers.

“CME most-active June lean hogs ended up 2.925 cents at 112.650 cents per pound, and futures set new life-of-contract highs. The market remained strong after finishing up by the daily, exchange-imposed 3-cent limit on Friday.”