Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

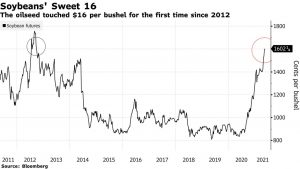

Soybean Futures Hit $16, While Inflation Concerns Persist and Shipping Costs Rise

Bloomberg writer Breanna T Bradham reported this week that, “Soybean futures touched $16 on Tuesday for the first time since 2012 as concerns mount over a supply crunch.

“Surging Chinese demand and bad weather in key global-growing areas are stoking fears of grain shortages. China’s expanding hog herds need soybean meal, so the Asian nation has been buying massive amounts of the oilseed off global markets.”

AGRICULTURE MARKET: Most-active soybean futures contract hits $16 per bushel for the first time since 2012. Reminder the all-time high was set that year at $17.89 a bushel | #soybeans #OATT

— Javier Blas (@JavierBlas) May 11, 2021

The Bloomberg article explained that,

The economic recovery from the pandemic is driving demand for agricultural goods generally, draining stockpiles and fueling food-inflation concerns.

Also this week, Reuters News reported that, “U.S. agricultural commodities trader ADM said on Monday it planned to build a soy-crushing facility and refinery in North Dakota to meet increasing demand for food and renewable fuel.

“Companies are counting on rising demand for food as restaurants and the travel sector emerge from the COVID-19 pandemic, and for feedstocks to produce biofuels, including renewable diesel.

“A renewable diesel boom could also have a profound impact on the agricultural sector by increasing demand for oilseeds such as soybeans and canola.”

The Reuters article added that, “ADM also plans to invest about $25 million to expand refining and storage capacity at its crush and refining facility in Quincy, Illinois. The expanded capacity is expected to be online by the first quarter of 2022.”

Beans in the (even higher) teens... now the costliest since 2012 at $16+ a bushel pic.twitter.com/ItWIImmxmr

— Stuart Wallace (@StuartLWallace) May 11, 2021

Meanwhile, in a look at corn supply and demand variables, Reuters columnist Karen Braun pointed out on Wednesday that, “The anticipated shortfalls in Brazil [corn production] increase the chances for U.S. exporters to gain even more business on top of their banner season or potentially for the upcoming one. As far as Wednesday’s report is concerned, the impact on projected U.S. exports will depend on the Brazilian crop estimate.”

4. So, the first number I am going to check in the May WASDE at 11am tomorrow is what they do with Brazilian corn production. Will USDA forecast it at less than 100 MMT?

— Scott Irwin (@ScottIrwinUI) May 11, 2021

Ms. Braun added that, “But China is the other factor for U.S. exports due to some recent cancellations for the 2020-21 year. Within the last week, China cancelled a total of 420,000 tonnes of old-crop corn, slightly less than 2% of its total standing commitments at the end of last month.

“That volume alone could very easily be replaced by Brazil’s losses, though it is unknown how many more U.S. cargoes China might push to 2021-22, which starts on Sept. 1. Brazil does not export significant amounts of corn to China, so extra U.S. business would likely be from other buyers.

“Within the last three trading days, USDA has confirmed a total of 3.06 million tonnes of U.S. corn sold to China for shipment in 2021-22, the country’s first new-crop purchases. It is unclear if overall Chinese corn demand is still as strong as market watchers thought or if the timing is simply pushed forward.”

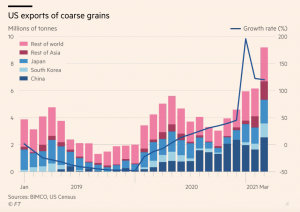

Also this week, Harry Dempsey and Neil Hume reported in The Financial Times that, “Rates for ships carrying commodities that fuel global industries and keep the world fed have soared, raising hopes of a turnround in fortunes for the embattled dry bulk shipping sector.

“Roaring Chinese demand for iron ore, a key steel ingredient, a return to strength for manufacturing in the rest of the world and under-investment in new vessels in recent years have powered a sharp increase in prices for dry bulk carriers, which transport unpackaged raw materials in large holds.”

The FT writers explained that, “A host of other factors have contributed to squeezing the shipping market, from record high US coarse grain exports to the trade dispute between China and Australia, which has tied up vessels with coal and other materials outside the ports of the world’s biggest commodity importer.”

The Financial Times article indicated that, “But the industry is divided on whether the rally will solidify into a longer lasting trend. Soaring prices for a broad set of commodity markets has prompted talk of a supercycle — a prolonged period of high prices — as large economies fire on all cylinders. That has set off speculation as to whether there will be a trickle-down effect for dry bulk shipping.”