Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Amid China’s Record Grain Buying, Port Delays Arise- While U.S. Corn Exports Reach New High for 2020/21

Bloomberg News reported on Friday that, “China’s embarked on a record corn-buying spree this year and some vessels have been delayed for as long as a month outside southern ports because of congestion, incurring hefty demurrage fees.

“At least two ships laden with U.S. corn had been waiting for weeks before eventually moving to berth on Thursday, according to Bloomberg vessel-tracking data. The Priscilla carrying 71,400 tons was anchored off Zhanjiang port in Guangdong province since May 11 and the Krini, with 75,100 tons, was waiting since May 16 near Huangpu port in the same province.”

The Bloomberg article noted that, “China’s grain purchases have surged this year as hog herds recover from a devastating outbreak of African swine fever. Corn imports quadrupled in the first four months from a year earlier, while sorghum arrivals jumped five times in April from a year ago. Barley shipments are up too. The delays may add to rising raw material costs that the government is struggling to control.”

#Corn Imports, June #WASDE (@USDA_ERS). pic.twitter.com/9SA8pMH8mc

— Farm Policy (@FarmPolicy) June 12, 2021

The Bloomberg article pointed out that, “Feed mills are not the only buyers. The government has been shipping in corn from Ukraine and the U.S. to replenish state reserves depleted after years of sales. China is set to import a record 26 million tons of corn this marketing year and the same next year, according to the U.S. Department of Agriculture.”

And on Thursday, in its monthly Grain: World Markets and Trade report, USDA’s Foreign Agricultural Service (FAS) indicated that, “The global corn market is supplied primarily by four countries – Argentina, Brazil, Ukraine, and the United States. Combined, these countries account for nearly 90 percent of global exports. This month, U.S. exports are forecast higher to reflect continued strong foreign demand and limited supplies in Ukraine and Brazil.

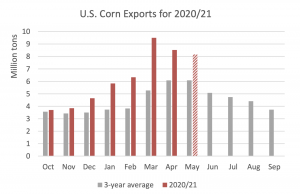

“U.S. corn exports are forecast up 3.0 million tons to 73.0 million for 2020/21 (Oct-Sep).

If realized, the volume would be the largest in history. The previous record was 63.7 million tons in 2017/18.

“For the first half of the current trade year, the export pace was well ahead of previous levels with large volumes to China and many other destinations. The pace of U.S. corn inspections for exports is still brisk according to export inspections data for May, totaling nearly 8.2 million tons, of which roughly 40 percent is destined to China.”

FAS explained that, “For Ukraine, its exports to China have more than doubled from a year ago despite smaller available supplies. This has left countries in North Africa, Middle East, and Asia to look to the United States for corn. For Brazil, exports are lowered this month reflecting persistent dry conditions in several states where the second-crop corn is produced. The second-crop corn, particularly in the Center-West, is primarily destined for overseas markets, while the first-crop corn is used in the domestic market.”

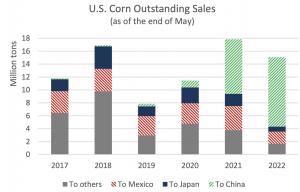

FAS noted that, “U.S. corn exports are expected to be robust for the remainder of the year with large sales on the books. Unfavorable crop prospects in Brazil could be supportive of U.S. exports into early 2021/22 (Oct-Sep). However, with the current forecast of larger exports for Argentina, Brazil, and Ukraine, U.S. exports are projected to decline for 2021/22. Still, this would be the third-largest exports on record.”

The Grain report also pointed out that, “China import demand for coarse grains is not limited to corn and sorghum. This month, barley imports are forecast higher, reflecting trade to date. For the first 7 months in 2020/21 (Oct-Sep), imports totaled 7.0 million tons, well above previous years’ levels.”

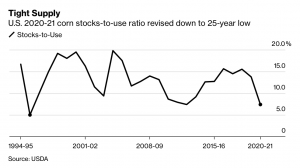

In a closer look at domestic crop variables, Bloomberg writers Elizabeth Elkin, Megan Durisin, and Breanna T Bradham reported on Thursday that, “Corn stockpiles in the U.S., the world’s biggest shipper, keep on shrinking at a time when agricultural markets are steeped in worries over strained supplies and food inflation.

“The weather’s too dry for crops to thrive. Americans are embarking on summer travels, which burns up corn-based fuel that’s mixed into gasoline. China is scouring the world market for grains to feed its expanding hog herd.

“That’s pulling corn supplies to their tightest since 2013, according to the Agriculture Department’s monthly report on global agricultural supply and demand released Thursday.”

The Bloomberg writers stated that, “This year’s weather patterns are especially tricky because while some areas are suffering from parched farmland, too much rain in other regions is also a problem for some farmers, adding to market volatility.”