Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China Pork Imports Expected to Drop, as U.S. Pork Prices Fall- Feed Grain Demand Potentially Impacted

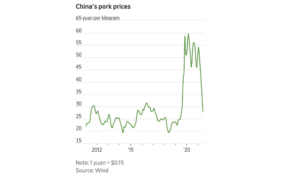

Late last week, Wall Street Journal writer Jacky Wong reported that, “Prices of everything seem to be going up this year. Pork prices in China are doing the opposite as a different sort of health crisis eases. That’s tough news for the global pork industry, but a welcome respite for pork buyers everywhere.

“Prices of pork in China have halved since January: a big change after about two years of surging prices due to an African swine fever outbreak, which saw the country’s pig population fall more than 40%. There was a renewed flare-up in early 2021 but that has since subsided. Minor outbreaks still happen from time to time, but the overall situation has improved markedly compared with 2019.

“This year’s reversal seems like a classic case of ‘the cure for high prices is high prices’: Production and imports in the past year have both increased to capture outsize profits. China’s pig herd grew 23.5% year on year in May, according to the government. Imports in 2020 doubled from a year earlier. The outbreak earlier this year also caused some farmers to cull their herds earlier, bringing forward pork supply.”

The Journal article added that,

All this may have some ripple effect on global prices. Imports will likely slow as importers are unlikely to make money in the current market. Pan Chenjun, a senior analyst at Rabobank, expects China’s pork imports to drop 10% to 30% from 2020 levels. China made up about half of global pork imports in 2020.

Earlier this week, Reuters writer Dominique Patton reported that, “China’s state planner said on Monday that central and local governments will start buying pork for state reserves to support prices, even after prices rebounded sharply from a two-year low last week.

“The move comes after live hog prices in the world’s top pork producer plunged 65% from January to early June as outbreaks of disease triggered panic selling, and as a glut of large pigs were sent to slaughter.

“Falling prices eroded profits for farmers and raised concerns that many would stop farming, triggering shortages later on.”

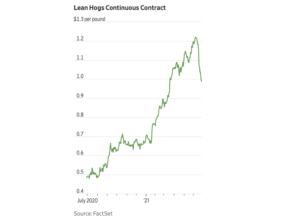

Meanwhile, Wall Street Journal writer Kirk Maltais reported on Tuesday that, “Prices for hogs in the U.S. are tumbling in the wake of China’s announcement that the country’s herds have recovered from the African swine fever.

“Through last week, the most-active hog futures contract trading on the Chicago Mercantile Exchange has fallen nearly 17%, bringing the price down to 99 cents a pound—the first time it has fallen under a dollar since March. Futures have posted a slight rebound to start this week, rising 0.8% Tuesday to nearly $1.04 a pound.”

With respect to feed grain demand, the Journal article pointed out that,

Some analysts expect demand for U.S. grains such as corn and soybeans to weaken as hog producers use less feed.

“‘The news that pork prices are plunging in China foretells a fall in [grains] demand,’ said Scott Irwin, head of agricultural marketing department at the University of Illinois.”

Also this week, Dow Jones News reported that, “Export inspections of U.S. grains were down across the board, the USDA said Monday.”

“However, China was the top destination for U.S. corn this week, with 335,052 tons of corn being inspected for delivery there,” the article said.