Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Farm Debt Declines, Loan Performance Improves- Kansas City Fed

Last week, Nathan Kauffman and Ty Kreitman, of the Federal Reserve Bank of Kansas City, penned an update titled, “Farm Debt Declines Further and Credit Stress Eases,” which noted that, “Agricultural debt at commercial banks continued to decline in the first quarter of 2021 and farm loan performance improved.”

The Kansas City Fed pointed out that,

The outlook for agriculture remained strong heading into the summer months. Robust demand for key farm commodities continued to support strong prices and optimism across the sector.

“Increases in production costs and persistent drought in many regions lingered as concerns, however; and profitability for cattle producers remained narrow. Overall, strength in aggregate conditions and lasting support of government aid and lending programs have continued to limit increases in farm debt and ease agricultural credit stress.”

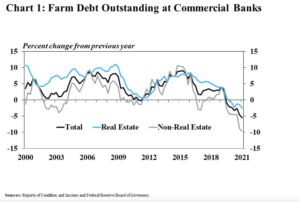

More narrowly, Kaufmann and Kreitman explained that, “Farm debt at commercial banks continued to shrink in the first quarter. Non-real estate farm debt decreased by 10% from a year ago as strong profits in large segments of the agricultural sector limited producers’ needs for operating loans. Similarly, farm real estate debt declined by 3% from a year ago despite ongoing increases in the valuations of farm real estate.”

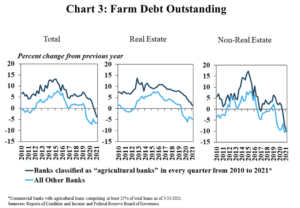

Last week’s update stated that, “Among lenders that have remained highly concentrated in agriculture, the pullback in farm debt in recent quarters has been less pronounced. For banks that retained their classification as an agricultural bank through the first quarter of 2021, farm debt was about 3% less than a year ago. In contrast, farm debt decreased by nearly 7% at other banks not classified as an agricultural bank in the first quarter (Chart 3, left). Moreover, farm real estate debt increased slightly at banks retaining their agricultural classification while real estate lending at other banks declined by 5% (Chart 3, middle). Non-real estate farm loan balances dropped by about 10% at all commercial banks, regardless of their classification as agricultural or non-agricultural (Chart 3, right).”

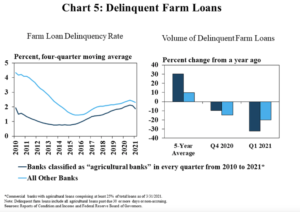

The Kansas City Fed added that, “Alongside reduced levels of farm debt in aggregate, the volume of delinquent loans declined substantially in the first quarter. The volume of delinquent farm loans was about 25% less than a year ago at commercial banks and the rate of delinquencies also edged lower.

“Delinquent loan volumes decreased more substantially at banks most concentrated in agriculture and the rate of delinquency among those lenders also remained slightly less than at other banks.”