Farm Progress' Joshua Baethge reported at the end of last week that "it’s hard to find anyone optimistic about passing a new farm bill this year. While the two political…

House Ag Subcommittee Reviews Farm Safety Net Issues

On Wednesday, the House Ag Subcommittee on General Farm Commodities and Risk Management discussed the Farm Bill, crop insurance, and ad hoc disaster programs in a meeting titled, “A Hearing to Review the Efficacy of the Farm Safety Net.” Witnesses at Wednesday’s hearing included Illinois farmer Jeff Kirwan, as well as farmdoc’s Gary Schnitkey.

We had a very informative hearing on farm safety net programs today. Here's what @RepCheri had to say at the opening of the hearing. pic.twitter.com/DoSfDQGHJq

— House Agriculture Committee (@HouseAgDems) June 23, 2021

Subcommittee Ranking Member Austin Scott (R., Ga.) noted in his opening remarks that, “This committee should take on a larger role in crafting policy, so tomorrow’s disasters leave less of an impact on our producers and create less risk for our food supply chain.

“Without a doubt, it is difficult to find a silver bullet to remedy all of the problems facing our agriculture industry.”

Rep. Scott added that, “As we review the effectiveness of the safety net and begin to consider future changes, our primary objective must be to do no harm to the existing programs and make sure any enhancements are to the benefit of all of production agriculture, not just certain regions of the country or specific causes of loss.”

And Full Ag Committee Ranking Member Glenn ‘GT’ Thompson (R., Pa.) indicated on Wednesday that, “Whether it be a natural disaster that can wipe out a crop at a moment’s notice, a foreign government that interferes with a market, or a pandemic that disrupts the entire supply chain—producers are in a constant battle to remain viable. That is why a strong safety net is a critical piece of rebuilding a robust rural economy.”

Rep. Thompson outlined his guiding principles for disaster programs during the hearing, which include:

- The program must complement rather than compete with crop insurance;

- The program should be easy to implement, and;

- The program should be reliable and respond quickly to disaster events.

With respect to perspective from witnesses at Wednesday’s meeting, in prepared remarks, Illinois farmer Jeff Kirwan explained that, “Crop insurance is the cornerstone of my operation.

Our ability to market our grain, manage risk, and financially survive depends on crop insurance. Hundreds of thousands of dollars invested in a growing crop can be wiped out in one weather event.

“And there are broader impacts on the ag economy. Considering what farmers spend on ag inputs, machinery, equipment, and crop protection, we must succeed for the entire industry. That is why crop insurance is so critical.”

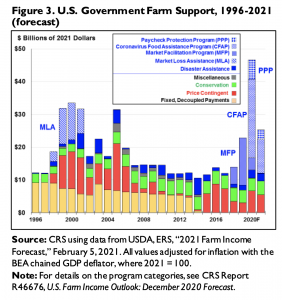

Mr. Kirwan added that, “On top of crop insurance, looking at the recent past, whether it was CFAP, WHIP+, or Market Facilitation Program payments, the timely emergency assistance that you and USDA provided allowed farmers like me to meet each of these challenges, pay our bills and continue producing.

“Through it all, the farm safety net— ARC-PLC — also played a role in keeping farmers afloat. But in the absence of ad hoc disaster assistance, there’s no question those programs – and the timing of payments – were simply not designed to address extraordinary economic and weather-related disasters. There needs to be a review of these programs, and farm organizations must be a part of that conversation.”

At today's @HouseAgDems hearing on the #Farm Safety Net, Subcommittee on General Farm Commodities and Risk Management Chair @RepCheri discussed farmdoc decision tools with University of Illinois Professor Gary Schnitkey pic.twitter.com/QJyu2k3JX6

— Farm Policy (@FarmPolicy) June 23, 2021

And farmdoc’s Gary Schnitkey pointed out that, “One hopes that the worst of the trade disputes and COVID control measures are behind us. Still, the justification for MFP and CFAP programs may have exposed weaknesses in the existing commodity title programs.”

.@RepDavidRouzer discussed ad hoc disaster programs that have been put in place to assist farmers at today's @HouseAgDems hearing- farmdoc's Gary Schnitkey pointed out that policy certainty, as well as the timeliness of program clarity were important elements in these programs. pic.twitter.com/zaY2mYEP9R

— Farm Policy (@FarmPolicy) June 24, 2021

Dr. Schnitkey noted that, “Many commodities have had higher prices since late summer 2020, and income looks good in 2021. This more robust outlook differs from what many– me included — would have expected last year at this time, illustrating how situations can change abruptly in agriculture.

.@RepCheri, the @HouseAgDems Subcommittee Chair on General Farm Commodities and Risk Management, asked farmdoc's Gary Schnitkey about the #agricultural impacts of ongoing #drought at today's hearing on the #Farm Safety Net. pic.twitter.com/B8FhPGDhji

— Farm Policy (@FarmPolicy) June 23, 2021

“The committee’s evaluation of the efficacy of the programs is timely as the safety net will come into play in the future.”