As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Outlook for Ag Economy in 2021 Remains Strong

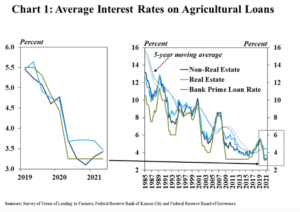

In an update late last week from the Federal Reserve Bank of Kansas City (“Interest Rates for Operating Loans Rise Slightly From All-Time Lows“), Nathan Kauffman and Ty Kreitman pointed out that, “Interest rates on agricultural loans made by commercial banks increased slightly for some types of lending, but remained historically low through the first half of 2021.

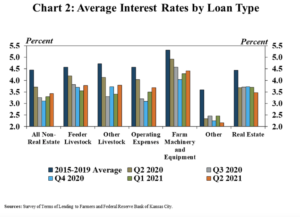

The average rate on non-real estate loans was about 30 basis points higher than the all-time low reached at the end of 2020 and the uptick was largely consistent across loan types. In contrast, average rates on farm real estate loans continued to decline and marked another historic low.

“Rates also remained comparatively low at the largest commercial banks and those lenders offered a sizeable discount for the lowest risk loans, while smaller lenders continued to provide similar accommodation regardless of riskiness.”

The Kansas City Fed update noted that, “Profitability in the sector also continued to be supported by strong prices for most major commodities. The slight decline in financing costs for farm real estate may also provide ongoing support to farmland values.

With the exception of some persistent headwinds for the cattle industry and producers impacted by drought, the outlook for the agricultural economy in 2021 remained strong through the second quarter.

More narrowly, Kauffman and Ty Kreitman explained that, “The slight uptick in interest rates for non-real estate loans was consistent across nearly all types of non-real estate lending, but rates also remained well below historic averages. Rates on operating loans increased 60 basis points from the record low reached at the end of 2020.”

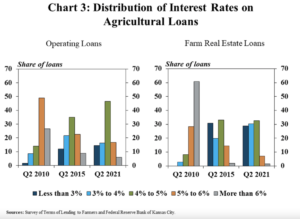

Last week’s update added that, “The distribution of rates on operating and real estate loans was similar to five years ago, but starkly different than 10 years ago. About 15% of operating loans had rates less than 3% in the second quarter, compared with 12% of loans the same time in 2015 and 2% of loans in 2010.

“Almost a third of farm real estate loans had an interest rate less than 3% in the second quarter of 2021, compared with a similar share in 2015 and none in 2010.”