Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China’s Hog Herd Expands, But Sow Numbers Fall in July- U.S. Corn Exports at Record Levels

Earlier this week, Reuters writers Min Zhang, Shivani Singh and Dominique Patton reported that, “China’s sow herd declined for the first time in nearly two years, contracting 0.5% in July from the previous month, state media said, after a plunge in hog prices pushed many farmers to get rid of unproductive sows.

“In year-on-year terms, however, it was still up 25%, according to National Development and Reform Commission spokesman Meng Wei.

“Prices have plummeted in recent months amid an abundance of supply due to efforts by the world’s biggest pork producer to rapidly rebuild its breeding herd following a devastating epidemic of African swine fever during 2018 and 2019.”

The Reuters article noted that, “China had 45.6 million sows as of end-June, some 2% more than the end of 2017, the last year before the African swine fever epidemic. The ministry said this month it was aiming for a herd of 43 million by 2025.

“Overall, China’s pig herd increased 0.8% in July from the prior month and was 31% larger than a year earlier, the country’s state planning agency said in a separate media briefing.”

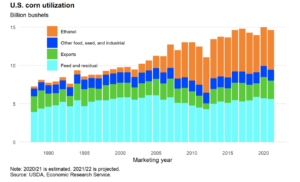

As China rebuilds its hog herd, American corn imports have grown and contributed to the expansion.

Top 10 U.S. export markets for #corn, by volume https://t.co/V85OpkE44w @USDA_ERS

— Farm Policy (@FarmPolicy) August 6, 2021

* #China pic.twitter.com/lBLEjQpmXC

Dow Jones writer Paulo Trevisani reported on Tuesday that, “Export inspections for U.S. corn have risen from the previous week, with China getting the largest share.

“In its latest grain-export inspections report, the U.S. Department of Agriculture said corn inspections totaled 754,929 metric tons for the week ended Aug. 12, up from a revised 744,934 metric tons in the previous week.”

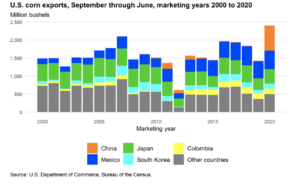

“China was the destination of 274,898 tons of U.S. corn last week, followed by Japan, with 194,508 tons, and Mexico, with 180,638 tons,” the Dow Jones article said.

More broadly regarding U.S. corn exports, in its monthly Feed Outlook report this week, USDA’s Economic Research Service (ERS) indicated that,

U.S. corn exports estimates for 2020/21 are reduced, but still would be a record at 2,775 million bushels.

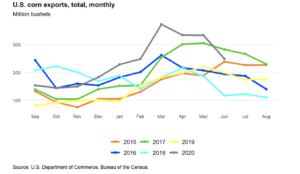

“Through June, the U.S. Bureau of the Census has reported 2,402 million bushels have been exported this marketing year—nearly matching the previous marketing year record of 2,437 million bushels set in 2017/18. June shipments were lower than the previous few months, although still relatively large. Additionally, export inspections data through the first week of August show a continued reduction in the pace, as limited available supplies and higher prices ration back foreign shipments.”

The ERS report added that, “The record pace of exports in 2020/21 is the result of a substantial increase in shipments to China, as well as maintaining shipments to other traditional export markets, despite increased prices and competition. Tight global supplies and limited production from other major exporters that developed over the course of 2020/21—including Ukraine and Brazil—have resulted in strong demand for U.S. corn in the global market.”

The Outlook report noted that, “Corn exports for 2021/22 are projected at 2,400 million bushels, a 100-million-bushel reduction from July. Tighter supplies and higher prices in the U.S. market, along with increased competition from other major exporting-countries, are expected to result in the annual decline in exports—although, the current projection is still large by historical standards.”

In other news on the U.S., China trade relationship, Politico’s Weekly Trade update on Monday stated that,

Groups representing America’s largest companies are getting antsy over the Biden administration’s extended review of trade policy toward China.

“Groups like the U.S.-China Business Council, the Chamber of Commerce and the Business Roundtable welcomed the president’s pledge during the campaign to reset trade policy toward China after four years of trade-policy-by-tweet from then-President Donald Trump.

“But now, eight months into his presidency, the companies want action. And they’re beginning to wonder whether the lack of it on tariffs and trade restrictions indicates that Biden’s brand of being tough on China might not be that much different from Trump’s.”