The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

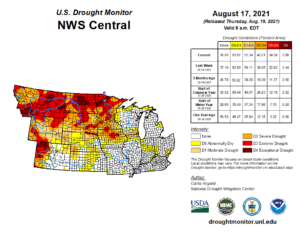

Drought Continues to Impact U.S. Crops

Wall Street Journal writer Kirk Maltais reported on Tuesday that, “Drought is blistering key U.S. cash crops, further elevating prices for staples including corn and wheat.

“The punishing dynamics of a torrid summer were evident this month on the Pro Farmer Crop Tour, an annual event in which farmers visit key growing areas across the grain belt to gather data on the coming harvest.”

The Journal article explained that, “Extreme heat is baking most of the U.S. North Dakota, South Dakota, Minnesota, Iowa and Nebraska all contain areas of extreme drought, according to data from the U.S. Drought Monitor. North Dakota and Minnesota, in particular, are experiencing near-record lows in soil moisture, according to data from the National Oceanic and Atmospheric Administration.

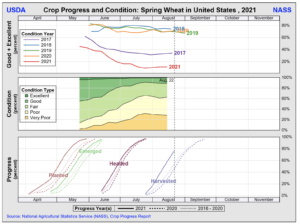

“As a result, many crops planted this spring are wilting. Some 63% of the U.S. spring wheat crop is in poor or very poor condition, versus 6% at this time last year, according to Agriculture Department data.”

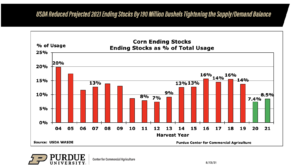

“The poor weather has caused the USDA to scale back its expectations for U.S. crop production in 2021—which, in turn, is causing domestic inventories to dwindle. In the USDA’s latest monthly supply and demand report, the agency pegged ending stocks for corn, wheat, and soybeans all at their lowest level since 2013.”

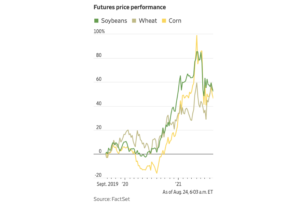

“For 2021, wheat prices are up 12%, and corn prices are up 11%,” the Journal article said.

Mr. Maltais pointed out that, “Farms elsewhere are getting scorched, too. Last month, the International Grains Council cut its forecast for global grain harvests in the 2021-22 season. The intergovernmental agency forecast world production at 2.295 billion metric tons, 6 million tons less than it was expecting in June.”

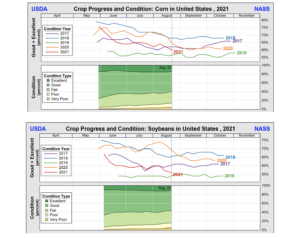

Reuters writer Naveen Thukral reported this week that, “The USDA rated 60% of the U.S. corn crop in good-to-excellent condition in its weekly crop progress report on Monday, down 2 percentage points from the previous week, while analysts surveyed by Reuters on average had expected only a 1-point decline.

“The agency rated 56% of soybeans as good-to-excellent, down from 57% the prior week and matching trade expectations for a 1-point drop.”

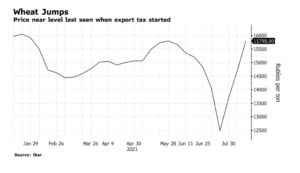

Meanwhile, Bloomberg writers Yuliya Fedorinova and Anna Andrianova reported on Monday that, “Russian domestic wheat prices jumped in August to levels typically not seen this time of year, raising concerns about food price inflation and possible government reaction.”

The Bloomberg article noted that, “Another area of concern is how big the new harvest will be. The U.S. Department of Agriculture said this month it expects Russian wheat production of 72.5 million tons, a 15% decline from its forecast in July. Russia’s Agriculture Ministry maintains its forecast of 81 million tons, even as some independent analysts see it lower.”

Also this week, Reuters News reported that, “A fall in the average quality of France’s soft wheat harvest this year will lead to an increase in flour prices linked to additional work for millers to sort good grains from poor ones, a senior member of French millers group ANMF said on Monday.

“However, there should be no impact on total volume of flour produced in France this year, said Erick Roos, chairman of ANMF’s process commission and director general of Moulins Soufflet, one of Europe’s biggest millers.

“Heavy summer rain in France, the European Union’s biggest grain producer, has slowed field work and led to low readings in some key milling criteria, although the harvest is still expected to rise well above last year’s poor crop in volume.”

More broadly, in its monthly Wheat Outlook report last week, USDA’s Economic Research Service (ERS) stated that, “Global wheat production is lowered this month by 15.5 million metric tons (MT) to 776.9 with Russia and Canada accounting for the bulk of this change. Global production in 2021/22 is still forecast record- large, but production for the top 8 exporters is collectively down 9.2 million MT from the previous year.”

The ERS report explained that, “The European Union, Argentina, and Ukraine are all projected to have larger production and exports, benefitting from reduced competition. This year, Australia is projected to have slightly smaller production from last year’s record, but this year’s crop is still forecast as its third largest ever. With global prices trending upwards and tight supplies in key competitors, Australia is expected to have strong exports to nearby Asian markets.”