Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Federal Reserve Ag Credit Surveys- 2021 Second Quarter Farmland Values Climb

Last week, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the second quarter of 2021.

Federal Reserve Bank of Chicago

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in the AgLetter that, “At 14 percent, the year-over-year increase in the value of District farmland for the second quarter of 2021 was the largest recorded since 2013’s third quarter. All five District states exhibited double-digit year-over-year gains in their agricultural land values.”

The AgLetter stated that, “Of particular relevance to the District were the June corn, soybean, and hog prices, which were up 90 percent, 74 percent, and 100 percent from a year ago, respectively.”

“Agricultural land values have been spurred higher by a surge in farm revenues and an influx of government payments. Moreover, historically low interest rates have had a positive effect on such values,” the report said.

Explore what’s new with Seventh District #agricultural land values and credit conditions in our latest #AgLetter. https://t.co/9NP1NwU4pH pic.twitter.com/nt2eShQugs

— ChicagoFed (@ChicagoFed) August 13, 2021

Mr. Oppedahl added that, “With 9 percent of survey respondents noting demand for non-real-estate farm loans above the level of a year ago and 46 percent noting demand below that of a year ago, the index of loan demand was 63 for the second quarter of 2021; this was the lowest reading since the fourth quarter of 1986.”

The Chicago Fed indicated that, “At 2.8 percent of the District loan portfolio, the share of farm loans with ‘major’ or ‘severe’ repayment problems (as measured in the second quarter of every year) was last lower in 2014— this result was a big turnaround from a year ago.”

Nonetheless, the AgLetter explained that, “While District agricultural bankers seemed optimistic about the farm sector over the short term, some cautioned about its longer-term prospects, given the uncertainties surrounding the course of the pandemic and government responses, as well as trade flows and input costs.”

Federal Reserve Bank of Kansas City

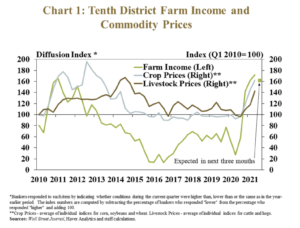

“The outlook for profit opportunities in 2021 remained strong for most agricultural producers as commodity prices remained well above recent years. Conditions in the cattle industry remained somewhat weaker, however, and drought continued to hinder conditions for farmers and ranchers in some areas of the District. Nearly all banks reported that production expenses for both crop and livestock producers increased and cash rental rates in the District also increased, which could pressure margins going forward.

Despite potential headwinds, bankers indicated they expected improvement in farm income and credit conditions to continue in the months ahead.

Thursday’s update stated that, “Alongside multiyear highs in farm commodity prices, about 80% of bankers surveyed in June reported that farm income was higher than the previous year.”

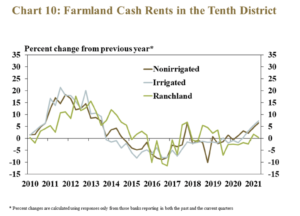

The Ag Credit Survey also indicated that, “Cash rents on all types of land also increased, but at a slightly slower pace than farmland values. Cash rents on nonirrigated and irrigated cropland rose about 7% from last year, while rents for ranchland increased slightly less than 1%.”

The Survey added that, “Increases in nonirrigated farmland values outpaced increases in cash rents in most states and bankers expected a similar trend in coming months. The annual percent change in the value of nonirrigated land was slightly higher than the change in cash rents in nearly all states.”

Federal Reserve Bank of Minneapolis

In an article last week, “Farm finances held up into summer, despite drought concerns,” Joe Mahon pointed out that, “Solid commodity prices and persistent government aid benefited agricultural producers even as severe drought had a negative impact in many areas, according to a recent Federal Reserve Bank of Minneapolis survey. ‘Overall condition of ag economy [is] good,’ said a Minnesota banker. ‘Concerned for livestock producers with heat and dryness. Input costs/feed costs going up. Crop farmers in good shape.'”

Mr. Mahon explained that, “The rate of repayment on agricultural loans increased, reflecting continued improvement in farm finances, while renewals decreased somewhat.”

With respect to land values and cash rents, the Minneapolis Fed stated that, “After halting their half-decade slide and rebounding since late last year, land values and cash rents surged in the second quarter. Ninth District nonirrigated cropland values increased by 16 percent on average from the second quarter of 2020….The district average cash rent for nonirrigated land jumped by more than 9 percent from a year ago. Rents for irrigated land and ranchland each increased about 6 percent. Changes in land values and rents were generally consistent across district states.”