As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Global Wheat Supplies Contract, Impacting Exports, and Food Prices

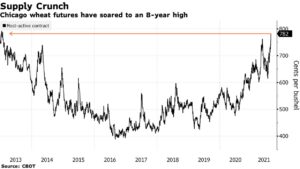

Late last week, Bloomberg writers Megan Durisin, Kim Chipman, and Khadija Kothia reported that, “Crop losses in two of the world’s biggest wheat exporters and quality concerns in a third have pushed prices to multiyear highs, adding to worries about food price inflation for millions of the world’s most vulnerable.

“Drought and heat continued to fry Canada’s wheat in July, months after a brutal winter hit the Russian crop. Those losses will only be partially offset by gains elsewhere for a crop planted on more land globally than any other, and used for basic foods like breads, pasta, and breakfast cereal.

“Wheat futures surged this week as the U.S. Department of Agriculture slashed its forecast for Canadian and Russian production, pulling down global stockpiles and trade. A smaller U.S. crop is also adding to the pressure.”

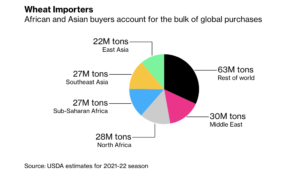

The Bloomberg article explained that, “The impact will be felt by households and governments alike, especially in poorer nations reliant on imports. And in the U.S. and elsewhere, higher bread costs would be another pressure point for a food supply chain already grappling with labor shortages and logistical snarls.”

“As the basis of everything from French baguettes to Middle Eastern flat-breads to Asian noodles, wheat prices have a more direct bearing on consumers than crops like corn and soybeans, which are mostly fed to animals,” the Bloomberg writers said.

And USDA’s Foreign Agricultural Service stated in this month’s Grain: World Markets and Trade report last week that,

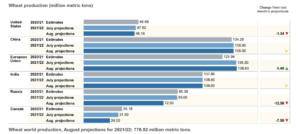

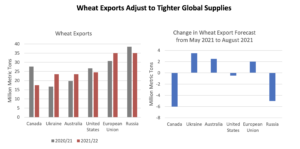

Since the release of USDA’s first 2021/22 forecast in May, the outlook for global wheat supplies has fallen by nearly 2 percent.

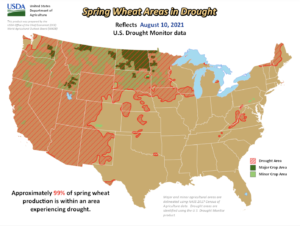

“Production is estimated down, based on ice crusting in Russia and drought affecting North American spring wheat crops.

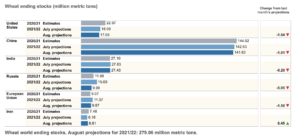

“Meanwhile, global consumption is nearly unchanged since May as food, seed, and industrial use remains robust while feed use is now modestly lower. As a result, global stocks are cut more than 5 percent from the initial forecast to the lowest level in 5 years. Stocks held by the major global exporters are forecast to decline, reflecting tightness in supplies available to the global market. Price-sensitive importers are expected to respond to the reduced supplies by tightening inventories, lowering global trade by nearly 3.5 million tons from the initial forecast. Sharp declines for some top exporters are only partially offset by gains for other exporters.”

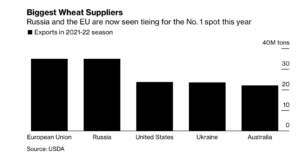

FAS added that, “The most significant year-to-year export decline is for Canada, where carryin stocks are at the lowest in decades and production is being decimated by a widespread drought across the Prairie Provinces. Canada’s exports will be down by more than a third, its lowest since 2011/12. Global durum supplies are expected to be particularly thin this year, with not only Canadian exports plummeting but U.S. durum exports also dropping to the lowest since 1964/65. Reduced Russia winter wheat production is only partly offset by larger spring wheat production and sizable carryin in response to export constraints at the end of 2020/21. As Russia continues to tax exports, it will likely lose market share to both the European Union and Ukraine, both of which have much larger crops. Ukraine exports are forecast at a record, with Australia at near-record.”

In other export related news, Reuters writer Hugh Bronstein reported last week that,

A once-a-century drought has lowered the water level of Argentina’s main grains transport river, reducing farm exports and boosting logistics costs in a trend that meteorologists said will likely continue into next year.

“The South American grains powerhouse is the world’s No. 3 corn supplier and No. 1 exporter of soymeal livestock feed, used to fatten hogs and poultry from Europe to Southeast Asia. Farm exports are Argentina’s main source of hard currency needed to bolster central bank reserves sapped by a three-year recession.

Southern Brazil, source of the Parana River, has been hit by severe dryness for three years. This has reduced water levels in the Argentine ports hub of Rosario, Santa Fe province, where about 80% of the country’s agricultural exports are loaded.”

The Reuters article added that, “Ships sailing from Rosario are loading 18% to 25% less cargo than normal due to the shallow water, said Guillermo Wade, manager of Argentina’s Chamber of Port and Maritime Activities.”

A separate Reuters News article from Friday reported that, “Argentina’s government said on Friday it would seek to redirect a loan from the Inter-American Development Bank for $300 million to contain the effects of a devastating drought on the Paraná River, a key waterway for trade and power generation and a source of drinking water.”