As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed- Strong Outlook for Farm Sector, as Business Groups Seek Restart of U.S.-China Talks

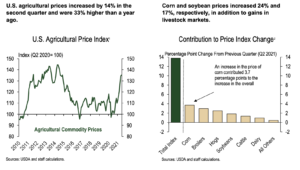

An update yesterday from the Federal Reserve Bank of Kansas City (“kcFED Ag Bulletin“) stated that, “Agricultural commodity prices surged in the second quarter amid further increases in economic activity and robust global demand.

Broad increases in the prices of most major agricultural commodities boosted the index of U.S. agricultural prices 14% from the previous quarter and continued to support a strong outlook in the U.S. farm sector.

“Though increases in the costs of some inputs weighed on profit margins, the financial condition of farm borrowers also continued to improve. Despite severe drought in the West and upper Midwest, U.S. agricultural production was expected to be slightly above trend in 2021 as growing conditions have remained favorable in the lower Midwest.”

Meanwhile, Reuters columnist Karen Braun indicated today that, “China’s apparent lack of interest in the upcoming U.S. soybean harvest has put bullish traders on edge and U.S. export prospects in question.

“The world’s top soybean buyer has been relatively inactive in the U.S. market for the last several months, a stark contrast with a year ago when China’s buying was rampant.

Chad Hart provides an overview of what agricultural markets are doing ahead of August and September USDA reports.

— Farm Policy (@FarmPolicy) August 5, 2021

* #Soybean Exports.

* Full video here: https://t.co/wERBm5YHKY @AgDecisionMaker, @ISUANR pic.twitter.com/s88ya9dVdE

“Last year was an anomaly, though. New-crop U.S. soybean sales in June and July 2020 set records and were more than double average volumes for those months. China and unknown destinations accounted for a particularly high share.”

Ms. Braun explained that, “Through July 29, U.S. soybean export sales for the 2021-22 year starting on Sept. 1 totaled 10.6 million tonnes (390 million bushels), and three-fourths were to China or unknown. That is 29% off the year-ago total but 13% above the five-year average.

“The previous five years were marred by the U.S.-China trade war and demand problems in China due to hog disease, so shifting that average back by two years would put current sales 2% below normal.”

Here's a look at the top destinations for #agricultural exports from Jan-June: China, Mexico, Canada, Japan & South Korea. pic.twitter.com/WY13GxoCym

— Senate Ag Committee Republicans (@SenateAgGOP) August 5, 2021

Ms. Braun added that, “USDA’s latest prediction is for China’s soy imports in 2021-22 to rise 4% on the year to a new high. But industry participants have their doubts given slow Chinese soymeal demand and a huge profitability decline in the hog sector. Additionally, other feed ingredients like wheat and rice are displacing some soymeal use.

“If U.S. soybean exports falter, that could make the U.S. supply situation significantly more comfortable by mid-2022. Predicted U.S. carryout for 2020-21 represents less than 12 days of typical soybean use in China.”

(Note that on Friday morning, USDA’s Foreign Agricultural Service did announce export sales of 131,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year).

Reflecting signs of a softening of global import demand over recent months, the Council’s outlook for world trade in #soybeans in 2020/21 (Oct/Sep) is trimmed m/m, with full-season volumes expected to post a marginal y/y fall. pic.twitter.com/a5AifeN5b5

— International Grains Council (@IGCgrains) July 29, 2021

More broadly on the U.S., China trade relationship, New York Times writers Paul Mozur and David McCabe reported today that, “A group of the most influential American business groups is urging the Biden administration to restart trade talks with China and cut tariffs on Chinese-made goods that had remained in place after the start of the bruising trade war between the two countries.

“The groups, which represented interests as diverse as potato farmers, microchip companies and the pharmaceutical industry, said in a letter dated Thursday that the Biden administration should take ‘swift action’ to address ‘burdensome’ tariffs. They also called on the White House to work with the Chinese government to ensure that it carries out commitments made in its trade truce with the Trump administration, sealed in early 2020.

“The letter, addressed to the Treasury Department and the United States trade representative, comes as the relationship between the world’s two largest economies remains fractious. A high-profile visit to China last month by Wendy R. Sherman, the deputy secretary of state, began with acerbic opening remarks from the Chinese side and ended with little sign of progress. The two have squabbled over human rights, cyberattacks and China’s military operations in the South China Sea.”

And Wall Street Journal writer Bob Davis reported today that, “Nearly three dozen of the nation’s most influential business groups—representing retailers, chip makers, farmers and others—are calling on the Biden administration to restart negotiations with China and cut tariffs on imports, saying they are a drag on the U.S. economy.”

“The trade groups include some of Washington’s most influential big business associations, including the U.S. Chamber of Commerce, the Business Roundtable, the National Retail Federation, the American Farm Bureau Federation and the Semiconductor Industry Association,” the Journal article said.