China, the world’s largest soybean importer, has ramped up orders for Brazilian cargoes of the oilseed after meeting an initial shipment volume from the US as part of a trade…

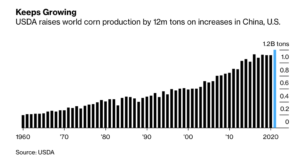

China Corn Production at Record Level, as U.S. Expecting Second Largest Corn Harvest Ever

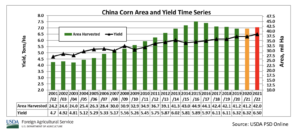

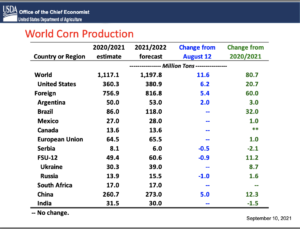

In its monthly World Agricultural Production report on Friday, USDA’s Foreign Agricultural Service (FAS) indicated that, “USDA estimates China marketing year (MY) 2021/22 corn production at a record 273.0 million metric tons (mmt), up 5.0 mmt or 2 percent from last month, up 5 percent from last year, and 5 percent above the 5-year average of 260.3 mmt. Yield is estimated at a record 6.5 metric tons per hectare, up 2 percent from last month, 3 percent from last year, and 5 percent above the 5-year average. Harvested area is estimated at 42.0 million hectares (mha), no change from last month, but up approximately 0.7 mha or 2 percent from last year. In recent years there has been marginal increases or stable corn area in the major production provinces of Heilongjiang, Jilin, Shandong, Henan, Inner Mongolia, and Hebei. This has been primarily attributed to changes in agricultural policy.”

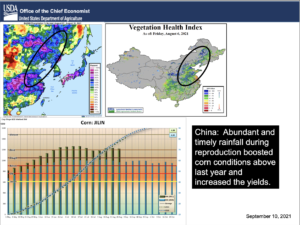

FAS stated that, “The major factors shaping USDA’s forecast are the favorable growing season conditions and government policies encouraging increased corn production. The MY 2021/22 season has been characterized by favorable growing conditions across the major corn belt, the northeast, and north- central plains. In particular, the Northeast provinces of Heilongjiang, Jilin, Liaoning, and Inner Mongolia, where close to half of the nation’s corn and soybeans are produced, experienced beneficial weather for a major part of the growing season. The conditions facilitated rapid planting and crop establishment, boosting corn yield expectations.”

Friday’s report explained that, “In addition to the favorable seasonal conditions, farmers were also encouraged by government policies to reduce the area left fallow and to increase rotation of grain crops. Additionally, the government provision of targeted incentives and subsidies to corn processors and ethanol program initiatives have increased corn area. Previously, government policy aimed to reduce corn area. The policies are expected, in the short run, to contribute to the increase in corn production. Approximately 75 percent of China’s corn is used for feed.”

With respect to China corn imports, Friday’s World Agricultural Supply and Demand Estimates (WASDE) report stated that, “Despite a forecast increase in corn production, imports are unchanged for 2021/22 as the gap between China’s domestic and international corn prices is expected to persist, particularly in the feed deficit South.”

Meanwhile, Reuters writer Mark Weinraub reported late last week that, “The U.S. government lifted its forecast for the country’s corn harvest by 1.7% on Friday after farmers devoted more acres to the grain than previously reported.”

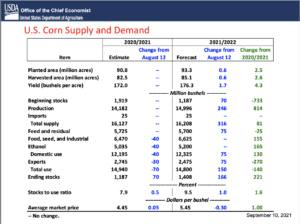

“U.S. corn production will reach 14.996 billion bushels, which would be the second biggest harvest ever,” the Reuters article said.

And Bloomberg writers Michael Hirtzer and Kim Chipman reported on Friday that, “While the WASDE supply increases were more than analysts expected, they aren’t a surprise. Bearish sentiments have prevailed after prices peaked at near-decade highs in May. Rains in August helped crops, and exports were hurt after Hurricane Ida damaged port infrastructure near New Orleans, just as the American harvest begins.”

“Corn prices are down about 20% from a peak in May. Futures on Friday briefly touched $4.975 a bushel, the lowest since January for the most-active contract,” the Bloomberg article said.

Friday’s WASDE report also stated that, “[Corn] exports for 2021/22 are up 75 million bushels to 2.5 billion. With supply rising more than use, ending stocks are increased 166 million bushels to 1.4 billion. The season-average corn price received by producers is lowered 30 cents to $5.45 per bushel.”