China, the world’s largest soybean importer, has ramped up orders for Brazilian cargoes of the oilseed after meeting an initial shipment volume from the US as part of a trade…

China’s Import Demand for Corn in Focus, as Brazil’s First Corn Planting Underway

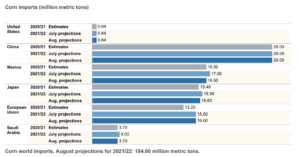

Alfred Cang reported this week at Bloomberg that, “China’s record corn-buying spree — a cornerstone of its trade deal with the U.S. — may be running out of steam, with risks growing that imports by the top buyer will fall short of U.S. official estimates.

“The domestic harvest season is looming and China is expecting a bumper crop after farmers sharply boosted corn planting this year. This is already starting to weigh on Chinese corn prices, narrowing the gap with overseas prices and hurting the attractiveness of imports, according to traders and analysts.

“China’s corn purchases in 2021-22 will probably miss the U.S. Department of Agriculture’s prediction of 26 million tons, said Darin Friedrichs, senior Asia commodity analyst at StoneX Group Inc. That forecast ‘is pretty aggressive and I don’t think we’ll see it.'”

The Bloomberg article added that, “China has imported about 23 million tons in the 2020-21 marketing year, close to USDA’s forecast of 26 million tons. The department kept its official forecasts unchanged for 2021-22, while the USDA Foreign Agricultural Service said imports would likely be 20 million tons.”

In other news highlighting crop supply variables, Reuters writer Roberto Samora reported this week that, “The area planted with Brazil’s first corn crop in the center south is expected to grow just 0.6% in the 2021/2022 cycle as growers will prefer to plant soybeans, according to agribusiness consultancy AgRural on Monday.

Despite the 2021 #safrinha failure and strong #corn prices, #Brazil’s farmers are not exactly keen to increase their 1st corn crop area, which is already being planted in the South. More: https://t.co/jJ7iNWYev7 (Eng) and https://t.co/FOqASIIPVR (Port, more complete analysis). pic.twitter.com/zDS2bAhUyF

— Daniele Siqueira (@siqueiradaniele) August 31, 2021

“The area to be planted with Brazil’s first corn, which competes with soybeans in the Southern Hemisphere’s spring and summer, is estimated at 2.973 million hectares (7.3 million acres) this season, AgRural said.”

The Reuters article noted that, “Fear of crop failure due to weather issues is also a factor, AgRural said.”

Mr. Samora pointed out that, “AgRural sees Brazil’s first corn crop growing by 2.7 million tonnes to 21.5 million tonnes in the center south during the 2021/2022 cycle, which is starting now. Brazilian farmers have already planted 5.3% of their first corn area for the current season, less than 8% at this time in 2020, according to AgRural data.”

Good rains seen over the last 10 days in southern #Brazil gave the soil moisture a boost and favored the 1st #corn crop planting progress in Rio Grande do Sul. According to @AgRural, 5% of the area had been planted in south-central Brazil by Aug 26: https://t.co/6sRANLrMWu. pic.twitter.com/72mTX6z5UA

— Daniele Siqueira (@siqueiradaniele) August 30, 2021

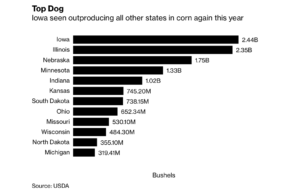

And with respect to U.S. crop prospects, Bloomberg writers Kim Chipman and Michael Hirtzer reported this week that, “In a make-or-break year for the U.S. corn and soybean crops, Iowa may hold the deciding vote.”

“The way Iowa tilts for corn and soybean output could go a long way in determining whether the crop rally earlier this year revs up again or fully sputters out. The futures of those key U.S. crops reached near-decade highs on tight global supplies and record-breaking Chinese demand for grains to feed hog herds,” the Bloomberg article said.

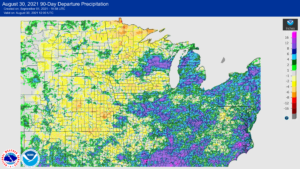

Chipman and Hirtzer noted that, “Wild weather variations across the Midwest this year will weigh heavily on the outcome, with Iowa in a pivotal spot: The current line dividing the drought danger zone from more ‘normal’ weather cuts right through the Hawkeye State.”

“Traders are awaiting a supply-and-demand report from the USDA on Sept. 10. Kristi Van Ahn-Kjeseth of Minnesota brokerage Van Ahn & Co. sees Iowa as the deciding factor,” the article said.