Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

FAPRI: Higher Commodity Prices Contribute to a Sharp Increase in 2021 U.S. Net Farm Income

Earlier this week, the, the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri released its latest baseline update for U.S. farm income and government costs.

The baseline update stated that,

Higher commodity prices contribute to a sharp increase in U.S. net farm income in 2021. Under current policies, farm income could drop again in 2022, as government payments decline and production expenses continue to rise.

“This report utilizes commodity supply, demand and price projections from the FAPRI-MU baseline update released in early September 2021. Historical data are from USDA and include the revision to farm income accounts released by the Economic Research Service (ERS) on September 2, 2021.

“These baseline estimates reflect policies in place in late August 2021. It utilizes ERS estimates that farmers will receive about $18 billion in 2021 from pandemic-related programs such as the Coronavirus Food Assistance Program (CFAP), the Pandemic Assistance for Producers (PAP) initiative, and the Paycheck Protection Program (PPP). No further ad hoc assistance is assumed for 2022 and subsequent years, nor do these current-policy projections include any payments that might result from prospective legislation.”

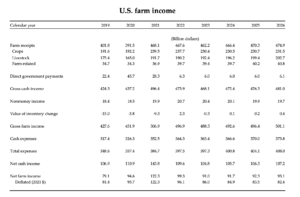

With this background in mind, FAPRI indicated that, “Projected 2021 net farm income reaches the highest level since 2013. Relative to 2020, a sharp increase in receipts from sales of crop and livestock products more than offsets the impact of higher production expenses and reduced government payments.

“At $122 billion, projected 2021 net farm income exceeds that reported by ERS by several billion dollars. FAPRI-MU and ERS estimates of 2021 livestock sector receipts, government payments and production expenses are similar, but FAPRI-MU estimates higher receipts for corn, soybeans and other crops.”

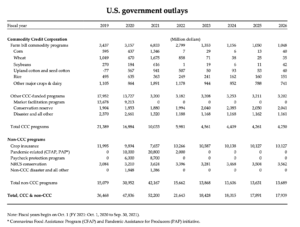

This week’s report pointed out that, “Total projected government spending on farm-related programs reaches a record $52 billion in fiscal year (FY) 2021. Spending on pandemic-related programs accounts for most of the outlays. Spending on 2018 farm bill commodity and crop insurance programs account for less than one-third of total expenditures on the selected programs in FY 2021.”

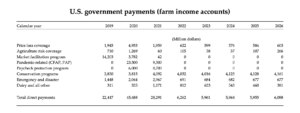

“Under current policies, government outlays drop to $22 billion in FY 2022, and government payments to farmers fall from $29 billion in calendar year 2021 to $6 billion in 2022. Conservation programs account for most 2022 government payments.”

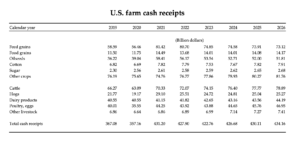

And with respect to cash receipts, FAPRI stated that, “Projected market prices for several crops peak in the 2021/22 marketing year. As a result, feed grain and oilseed market receipts decline after 2021, but remain well above the levels of 2020.”

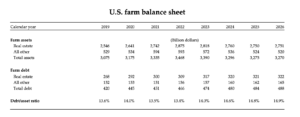

The baseline update also pointed out that, “Rising asset values and slower growth in debt reduce the sector’s debt-to-asset ratio in 2021 and 2022, temporarily reversing the trend of previous years.

“Lower projected farm income halts the rise in farm real estate values in 2023, and the debt-to-asset ratio again begins to increase.”