A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Ida Aftermath Stymies Grain Exports as Trade Routes Altered, China Eyes Brazil Soy

Reuters writers Karl Plume and PJ Huffstutter reported this week that, “Grain shippers on the U.S. Gulf Coast reported more damage from Hurricane Ida to their terminals on Wednesday as Cargill Inc confirmed damage to a second facility, while power outages across southern Louisiana kept all others shuttered.

“Global grains trader Cargill Inc said its Westwego, Louisiana, terminal was damaged by Ida, days after confirming more extensive damage at its only other Louisiana grain export facility, located in Reserve.

Ida, which roared ashore on Sunday, has disrupted grain and soybean shipments from the Gulf Coast, which accounts for about 60% of U.S. exports, at a time when global supplies are tight and demand is strong from China.

The Reuters article explained that, “Cargill is still assessing the extent of the damage and does not yet know how soon its grain loading and shipping operations at the busiest U.S. grains port may resume, Cargill spokeswoman April Nelson said.

“Rival exporter CHS Inc is diverting its export shipments scheduled through the next month through its Pacific Northwest terminal as the hurricane knocked out a transmission line that powers its lone Gulf Coast facility, the company said.

“Other shippers, including Bunge Ltd and Archer-Daniels-Midland Co, are still assessing damage to their locations, although all are still without power, the companies said.”

On Wednesday, Bloomberg writers Fabiana Batista, Michael Hirtzer, and Kim Chipman reported that, “Hurricane Ida’s lingering impacts to the busiest U.S. agricultural port is showing early signs of altering crop-trading routes.

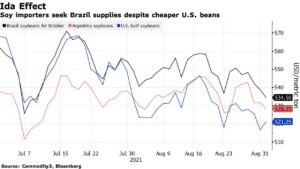

“China soybean importers began shifting orders to agricultural powerhouse Brazil for a shipment in October — during the U.S. harvest when American supplies are the biggest — after Ida damaged a key export terminal and left others without power.

“‘Buyers haven’t had many options to get soybeans after Ida,’ said Eduardo Vanin, an analyst at brokerage Agrinvest Commodities, who’s aware of one confirmed cargo of Brazil’s costlier oilseeds. Vanin’s firm is getting more offers for Brazilian soybeans and while not sufficient to attract sellers yet, he said in an interview that they may rise if U.S. port issues linger.”

The Bloomberg article noted that,

The shutdown of port facilities that are key to getting American exports overseas are forcing big buyers such as China to look elsewhere and adding to supply-chain snarls that have disrupted shipments for goods ranging from crops to computer chips.

Batista, Hirtzer, and Chipman added that, “Meanwhile, Brazil is in its off-season with limited volumes of soybeans available and farmers who have been reluctant to sell at current prices, Vanin said. South American beans have traded at 35 cents to 40 cents per bushel higher than U.S. prices, Vanin said.”

With respect to this market dynamic, Ana Mano reported at Reuters on Wednesday that, “Brazilian soybean farmers are keeping their crops instead of selling them because they expect prices to rise further as global supplies tighten, according to brokers, buyers and sellers in the world’s largest producer and exporter of the oilseed.”

“In southern states like Rio Grande do Sul and Paraná, farmers still have a combined 12.4 million tonnes of soybeans from the 2021 crop to sell, according to early August estimates from agribusiness consultancy Safras&Mercado. That represented about half of Brazil’s nearly 25 million tonnes left from the 2021 cycle,” the Reuters article said.

Ms. Mano pointed out that, “Iuri Gomes, from Paraná-based brokerage firm Origem, said soy inventories in Southern Brazil are larger than forecast. He said local soy crushers are willing to pay more than the export markets for soy, with higher domestic premiums seen as the only way to entice farmers to accept bids.

“That could limit the amount of soy Brazil has to export to China, its top buyer by far. Earlier this month, the Brazilian government cut its soy export forecast to 83.4 million tonnes in 2021.”

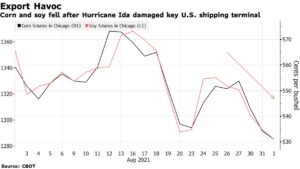

Dow Jones writer Paulo Trevisani reported on Wednesday that, “Grain futures extended losses as markets zeroed in on trade disruptions caused by Tropical Storm Ida.”

“Concerns about Gulf exporting facilities are expected to continue to weigh on grain futures,” the Dow Jones article said.

Mr. Trevisani indicated that, “The Gulf exporting infrastructure could take quite some time to be back, according to early estimates.”

Also on Wednesday, Reuters writer Julie Ingwersen reported that, “Corn futures fell for a third day on fears that the problems could back up U.S. grain exports as the fall harvest approaches.”

And Bloomberg writers Megan Durisin and Kim Chipman reported on Wednesday that, “Soybeans declined for a fifth day and corn prices fell to a seven-week low as U.S. exports face obstacles after a storm tore through the nation’s busiest agricultural port.”

The Bloomberg article stated that, “The storm damage is ‘substantial‘ and in some cases might take months to repair, according to Commonwealth Bank of Australia strategist Tobin Gorey. Given that the U.S. is the world’s top corn supplier, investor focus is now turning to whether companies can find temporary solutions to the stalled operations.

“Demand is looking bearish as well. China’s record corn-buying spree may be running out of steam as domestic production is set to climb and local prices weaken, making imports less attractive. There are risks that purchases by the Asian nation will fall short of U.S. official estimates for the 2021-22 season.”

But still, the USDA’s Foreign Agricultural Service (FAS) indicated on Thursday that, “Private exporters reported to the U.S. Department of Agriculture export sales of 126,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.”

And on Friday, FAS stated that, “Private exporters reported to the U.S. Department of Agriculture export sales of 130,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.”

Meanwhile, Reuters writer Julie Ingwersen reported on Thursday that, “U.S. soybean futures firmed on Thursday on bargain buying after a six-session slide and better-than-expected weekly export sales data, analysts said.

“Corn and wheat futures also edged higher, consolidating after recent declines.”

“All three markets stabilized after falling this week on fears that damage at the U.S. Gulf from Hurricane Ida would stall grain exports as the U.S. harvest draws near,” the Reuters article said.