A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Ida Slows Soybean Export Pace, as China Looks to Brazil for Soy

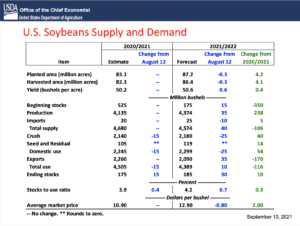

Earlier this week, the USDA’s Economic Research Service noted in its monthly Oil Crops Outlook report that, “Hurricane Ida’s emergence in the Gulf of Mexico slowed the pace of exports near the end of August which is expected to continue into early September.

This natural disaster indicates U.S. soybean exports will get off to a slower pace in the new marketing year.

“Even so, 2021/22 U.S. soybean export projections increased by 35 million bushels to 2.09 billion bushels due to larger crop supplies.”

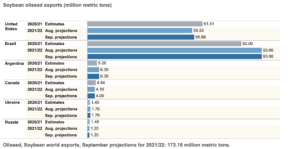

Also this week, Reuters writers Karl Plume and Ana Mano reported that, “Chinese importers bought four to six bulk cargoes of Brazilian soybeans early this week for shipment in October and November, an unusual purchase during the peak export period for rival supplier the United States, two traders with knowledge of the deals said on Wednesday.

“The deals were inked as export terminals along the U.S. Gulf Coast in Louisiana, the country’s busiest crop shipping outlet, have struggled to recover from damage, flooding and power outages caused by Hurricane Ida on Aug. 29.

The pivot to costly Brazilian soybeans underscored concerns among global importers that U.S. shipping delays could linger well into the peak season for exports from the United States.

Plume and Mano explained that, “Soybean exporters said the purchases by the world’s top importer were likely triggered by concerns that U.S. Gulf terminal capacity would remain constrained into next month.”

“The U.S. Department of Agriculture on Wednesday announced U.S. soybean export sales cancellations totaling 328,000 tonnes to China and undisclosed buyers,” the Reuters article said.

And Reuters columnist Karen Braun indicated on Thursday that, “U.S. soybean shipments over the next year are already seen below last year’s high. Though with reduced loading capacity and a possible record harvest on deck in Brazil, U.S. exporters could end up with the short straw, alleviating the historically tight supply situation.”

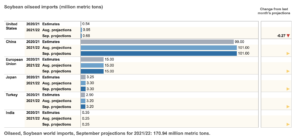

Ms. Braun stated that, “Concerns over China’s soybean demand have lurked in the market for some time now, especially with low profits for hog producers and what had been terrible soy crush margins. China’s agriculture ministry on Friday cut feed consumption for corn over low hog prices, substantiating some of those concerns.

“But projected 2021-22 soybean imports were unchanged from last month at 102 million tonnes, up 3.4% on the year.

“Crush margins in China are around four-month highs though still not great, but the U.S. cancellation and purchase of very pricy Brazilian beans likely signals a need.”

Meanwhile, Dow Jones writer Kirk Maltais reported on Thursday that, [In this week’s USDA export sales report], sales of U.S. wheat and soybeans fell on the high end of trader expectations…U.S. soybeans totaled 1.26 million tons for the week.”

China bought net 34.7 million bushels of U.S. #soybeans in the week ending Sept 9, while unknown destinations bought another 6 million. #oatt

— Arlan Suderman (@ArlanFF101) September 16, 2021

In its weekly Grain Transportation Report on Thursday, USDA’s Agricultural Marketing Service (AMS) noted that, “For the week ending September 9, total inspections of grain (corn, wheat, and soybeans) for export from all major U.S. export regions totaled .824 million metric tons (mmt). Total grain inspections were up 2 percent from the previous week, down 75 percent from the same time last year, and down 66 percent from the 3-year average.Total inspections were the lowest since early January 2019.”

AMS added that, “As the U.S. Gulf continued to recover from Hurricane Ida, there were no inspections of grain in the Mississippi Gulf. Pacific Northwest (PNW) inspections increased 30 percent from the previous week.

During the last 4 weeks, total inspections were 57 percent below the same time last year and 51 percent below the 3-year average.

Also on Thursday, USDA’s Foreign Agricultural Service (FAS) stated that, “Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.”

Yes, they cancelled this exact amount yesterday...

— Karen Braun (@kannbwx) September 16, 2021

And on Friday, FAS announced that, “Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.”

Meanwhile, Reuters writers Julie Ingwersen and Karl Plume reported this week that, “Barge freight costs for moving grains in the Midwestern United States spiked on Thursday due to ongoing logistical problems more than two weeks after Hurricane Ida, while CHS Inc said the timeline to reopen its terminal remains uncertain.

“CHS Inc, a farmer cooperative and grain trader, said it expected its Myrtle Grove, Louisiana, grain export terminal to be operational by the height of the U.S. corn and soy harvest but could not be more specific.”

The Reuters article stated that, “Adding urgency, crops are maturing earlier than normal in key states such as Minnesota, Iowa and Illinois. In Minnesota, the No. 4 corn producer, the corn harvest was 3% complete by Sept. 12, and 34% of the crop was mature, compared to the state’s five-year average of 20%, according to the U.S. Department of Agriculture.”