As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: U.S. Farm Economy Strong in First Half of the Year

In an update from the Federal Reserve Bank of Kansas City earlier this month (“Financing of Ag Production Loans Eases Further”), Nathan Kauffman and Ty Kreitman stated that, “Farm debt at commercial banks continued to ease in the second quarter. Agricultural loans balances decreased by 5% from the previous year due to a relatively large decline in production loans. Although farm lending increased at some banks, loan balances dropped by more than 10% from a year ago at a relatively large number of banks. Declines were most substantial among lenders with both the smallest and largest farm loan portfolios and among agricultural banks with high concentrations of farm loans.

The U.S. agricultural economy remained strong through the first half of the year and farm income was projected to reach an eight-year high in 2021.

“The quick recovery in farm finances from weakness in recent years has contributed to reduced levels of debt at commercial banks and is likely to continue supporting improvements in agricultural loan performance. In addition to stronger farm income and credit conditions, interest rates have remained at historic lows, providing ongoing support to farmland markets.”

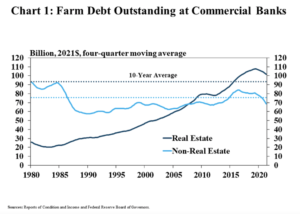

Kaufmann and Kreitman explained that, “Farm loan balances at commercial banks continued to decline through the first half of the year according to recent Call Report data. Total farm debt decreased toward the historic average on a rolling four quarter basis in real dollar terms and the stabilization has mostly been driven by a pullback in production loans.”

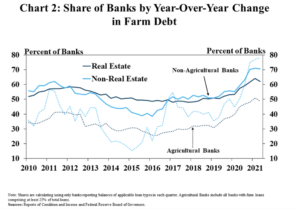

The Kansas City Fed indicated that, “Farm debt declined at a large number of banks, but decreases in real estate debt were less prevalent than declines in non-real estate debt. Production loans were less than a year ago at about 70% of non-agricultural banks and nearly 80% of agricultural banks in the second quarter.

“In contrast, farm real estate debt was less than a year ago at about 60% of non-agricultural banks and only about 50% of agricultural banks.”

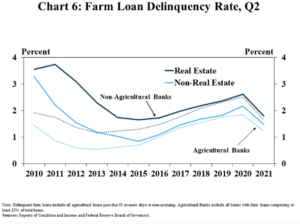

Kaufmann and Kreitman add that, “Alongside reduced agricultural debt and stronger farm finances, loan performance also continued to improve. Delinquency rates on both real estate and non-real estate farm loans were about 80 and 70 basis points less than a year ago, respectively.

“Similar to recent years, delinquency rates remained slightly lower at agricultural banks than other lenders.”