A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Uncoupled Variables Scramble Agricultural Export Flows

Recent news articles have highlighted independent developments that are impacting agricultural export markets. Lingering damage from Hurricane Ida and drought in parts of South America are influencing grain export flows, while policy changes in Russia have caused shifts in the balance of its agricultural exports, particularly for wheat. Meanwhile, two cases of “atypical” mad cow disease were confirmed in Brazil on Saturday, although “no immediate market impact” has been noted, according to a report on Monday.

Ida, Drought, and Russian Trade Policy

Bloomberg writer Kevin Varley reported last week that, “American grain exporters are likely trying to figure out whether it’s worth waiting out shipping delays in the wake of Hurricane Ida or shipping grain using rail transport to lesser used elevators throughout the U.S., especially in the Pacific Northwest.

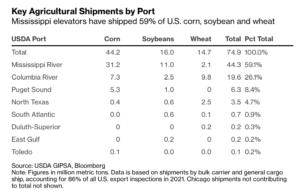

According to vessel data analyzed by Bloomberg News, no vessels have arrived at any of the USDA export inspection elevators in the lower Mississippi since August 30, putting focus on the Columbia River in the Pacific Northwest, the second largest port of departure for corn, soybean and wheat exports in the U.S.

The Bloomberg article explained that, “While 44.3 million tons of U.S. corn, soybean and wheat departed from the Mississippi River in the first eight months of 2021, just 19.6 million departed from the Columbia River, with the majority of it headed to Pacific nations.”

Mr. Varley added that, “Shutdowns of elevators in Louisiana persist, with CHS expecting it will take two to four weeks for power to be restored at its Myrtle Grove elevator and Cargill’s damaged Reserve elevator not providing an estimate of when shipments may restart.”

And DTN Ag Policy Editor Chris Clayton reported on Saturday that, “Some business will be moving to the Pacific Northwest. The ports in Texas also were not as affected by the storm, and there are options such as looking at ports along the East Coast for grain movement as well. ‘The industry is pretty efficient at optimizing capacity and mitigating some of those impacts,’ [John Griffith, senior vice president of global grain marketing at CHS] said.

“Still, the Mississippi River ports are responsible for roughly 300,000 metric tons of grain exports per day. So, every missed day is a missed opportunity.”

Also last week, Reuters writers Karl Plume and P.J. Huffstutter reported that, “Much of Louisiana Gulf Coast grain exporting capacity remained shuttered on Friday, as flooding and power outages from Hurricane Ida continue to cripple exports from the busiest U.S. grain shipping port, a state official said.”

The Reuters article pointed out that, “Crop exporters are anxious for shipping to resume as autumn harvests and the country’s peak grain export season loom at a time of strong demand from China. Crop export volumes are due to increase up to five-fold from now to mid-October.

‘About 50% of the grain export capacity in the lower Mississippi River is not operational,’ said Mike Strain, commissioner of the Louisiana Department of Agriculture.

Meanwhile, New York Times writer Daniel Politi reported in Sunday’s paper that, “The Paraná’s reduced flow, at its lowest level since the 1940s, has upended delicate ecosystems in the vast area that straddles Brazil, Argentina and Paraguay and left scores of communities scrambling for fresh water.

“In a region that depends heavily on rivers to generate power and to transport the agricultural commodities that are a pillar of national economies, the retreat of the continent’s second-largest river has also hurt business, increasing the costs of energy production and shipping.”

Mr. Politi indicated that, “The shallow Paraná River raised the cost of exporting agricultural products from Argentina by $315 million over all between March and August, according to an estimate by the Rosario Board of Trade. More than 80 percent of the country’s agricultural exports, including almost all of its soybeans, the country’s top cash crop, take the river to the Atlantic Ocean.”

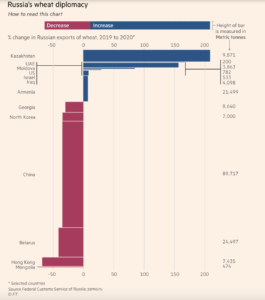

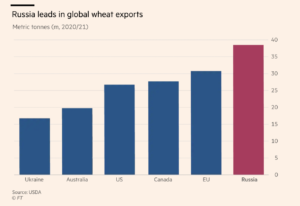

In a closer look at how policy has impacted agricultural trade, Financial Times writer Nastassia Astrasheuskaya reported last week that, “Wheat, and especially grain, have become valuable sources of foreign capital in a sanctions-hit economy. Now Russia is slowly making its way across Eurasia, Africa, and Latin America as an agricultural export powerhouse as it looks to reduce its reliance on oil, identify new markets and extend its global diplomatic reach.

Some even anticipate Russian grain becoming the Kremlin’s new oil — a commodity through which to keep some countries dependent on its resources — or to at least open doors to others.

The FT article stated that, “After successful lobbying for new markets, particularly in Asia, China and Vietnam have become big customers. Russia has tripled its 2020 beef exports, and doubled those of pork, both in tonnes and dollar revenue year on year. Half of the beef went to China, after it opened its market to Russian cattle producers last year. Vietnam, which started importing Russian pork in late 2019, is now the second-largest importer of meat from the country in the world.”

“Agricultural output in the country has grown by almost 50 per cent since 1991. Exports have more than trebled in that time to over $30bn last year, having jumped by a fifth in money terms over 2019. Of all the agricultural exports it is grain that is the main source of foreign exchange, with Egypt and Turkey being the biggest single buyers,” the FT article said.

“Atypical” Mad Cow Disease in Brazil

Reuters writer Nayara Figueiredo reported last week that, “Brazil has suspended beef exports to China after confirming two cases of ‘atypical’ mad cow disease in two separate domestic meat plants, the agriculture ministry said in a statement on Saturday.

“The suspension, which is part of an animal health pact agreed between China and Brazil and is designed to allow Beijing time to take stock of the problem, begins immediately, the ministry said.”

Nonetheless, Reuters writers Dominique Patton and Nayara Figueiredo reported on Monday that, “Chinese beef importers said on Monday the suspension of exports by top supplier Brazil due to two cases of mad cow disease has had no immediate market impact, with some still making purchases in anticipation of a quick resumption of trade.

“Brazil said on Saturday it had confirmed two cases of ‘atypical’ mad cow disease in different states, and was suspending beef exports to China as part of a prior agreement on the issue with its top buyer.

“Despite Brazil’s dominant 40% share of China’s beef imports, prices had not moved by Monday and some importers were still looking for deals.”