President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

USDA Attache Update from Beijing Highlights Soy Variables, as Ida Related Export Delays Persist

Last week, a report from the USDA’s Foreign Agricultural Service (FAS) post in Beijing (“China: Oilseeds and Products Update“) stated that, “Soybean imports are forecast at 101 million metric tons (MMT) in marketing year (MY) 21/22, up 3 MMT from the previous year. The increase is based on growing soybean meal feed use, lower soybean production, and limited imports of rapeseed.

Soybean imports for MY20/21 are estimated at 98 MMT, a slight fall from the previous year that is mainly due to decreased pork and poultry profitability.

“Soybean production for MY21/22 is forecast 0.6 MMT lower than MY 20/21 as farmers switched soybean acreage to corn in response to high corn prices in MY20/21.”

Meanwhile, Reuters writers Hallie Gu and Shivani Singh reported earlier this week that, “China’s soybean imports fell in August from the same month a year ago, customs data showed on Tuesday, as low crushing margins and high international bean prices weighed on demand.

“China, the world’s top buyer of soybean, brought in 9.49 million tonnes of the oilseed in August, slightly down from 9.6 million a year ago, data from the General Administration of Customs showed.”

Note that on Wednesday, USDA’s Foreign Agricultural Service (FAS) indicated that, “Private exporters reported to the U.S. Department of Agriculture export sales of 106,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.”

And on Thursday, FAS stated that, “Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.”

Despite a noticeable uptick in US #soybean sales to China over recent weeks, cumulative 2021/22 commitments were still down y/y as at 12 Aug, reflecting softer Chinese demand amid heavy local supplies and a marked fall in hog sector margins. pic.twitter.com/emFlpvWNrK

— International Grains Council (@IGCgrains) September 1, 2021

Also, with respect to grain export logistical issues stemming from the damage caused by Hurricane Ida, Reuters writer Naveen Thukral reported on Wednesday that,

Asia’s grain and oilseed buyers are set to face shipping delays of at least one month after Hurricane Ida damaged key export terminals around the U.S. Gulf Coast, two traders and one miller said.

“The slowdown in supplies is likely to stoke food inflation fears for price-sensitive consumers in Asia, where many importers have already drawn down crop inventories after having been forced to curb purchases amid volatile crop prices and COVID-related supply disruptions this year.”

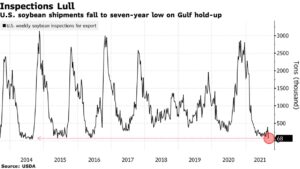

On Tuesday, Bloomberg writer Kim Chipman reported that, “A key measure of U.S. soybean shipments plunged to a seven-year low after Hurricane Ida blasted through the country’s busiest agriculture port, snarling trade just as harvesting is about to ramp up.

“Inspections of the crop for export, a critical step in the shipping process that is a proxy for how much is getting sent abroad, tumbled 96% last week to 68,000 metric tons. No activity was reported out of the storm-wrecked Gulf of Mexico, the major departure point for grain shipments loaded along the Mississippi River that snakes through Midwestern farming regions.”

The Bloomberg article noted that, “There also weren’t soybean cargoes moved out of the Pacific Northwest last week, inspections data show. That region could see an up-tick in activity if shipments from the Gulf remain jammed. U.S. Agriculture Secretary Tom Vilsack on Monday said he doesn’t expect significant export disruptions from the storm.”

"Port Damage from #Ida Not Likely to Cause Long-Term Export Reduction," https://t.co/Mm9btIkPoL (MP3- 1 minute). @USDA Radio.

— Farm Policy (@FarmPolicy) September 8, 2021

* Remarks from @SecVilsack and USDA Outlook Board Chairman Mark Jekanowski. pic.twitter.com/0IuxynoeaB

Also this week, Reuters writers Karl Plume and P.J. Huffstutter reported that, “Grain exports from U.S. Gulf Coast terminals in southern Louisiana remained severely limited on Tuesday, even after the U.S. Coast Guard reopened the lower Mississippi River to shipping traffic over the weekend.

“A large terminal near Baton Rouge owned by Louis Dreyfus Co has resumed loading export vessels. But lingering power outages kept most of about a dozen other terminals in the area shuttered, more than a week after Hurricane Ida roared through the busiest U.S. export outlet for grains.”

Storm damage to the main U.S. crop export hub has left Asian crop importers bracing for shipment delays. Not all ports were as badly damaged as this one in Port Fourchon, but extensive problems at key crop loading sites have been reported. (https://t.co/cqEsQEFSb0 ) pic.twitter.com/uI5bOwdpWm

— Gavin Maguire (@GavinJMaguire) September 8, 2021

For major Asian soybean importers, the timing of the outages at export terminals is particularly worrisome, as normally they import more than half of all their US soybeans between now and the end of the year. pic.twitter.com/Onn7Y54maq

— Gavin Maguire (@GavinJMaguire) September 8, 2021

The Reuters article added that, “Archer-Daniels-Midland Co, which operates four export elevators in Louisiana, and Bunge Ltd, which has an export terminal and a soy processing plant there, said on Tuesday their facilities remain without power. Terminals owned by Cargill Inc and CHS Inc sustained some damage and also are waiting for power to be restored.”

Associated Press writers Kevin McGill and Melinda Deslatte reported this week that, “Hundreds of thousands of homes and businesses in Louisiana, most of them outside New Orleans, still didn’t have power Tuesday and more than half the gas stations in two major cities were without fuel nine days after Hurricane Ida slammed into the state, splintering homes and toppling electric lines.”