A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

A Profitable Harvest, But Farmers Leery of Rising Production Costs and Parts Shortage

Des Moines Register writer Donnelle Eller reported this week that, “After last year’s destructive derecho, which flattened corn and stripped soybean across the state, better-than-expected yields and strong prices are making this harvest a profitable one for Iowa farmers lucky enough to have gotten the much-needed rain. And it’s helping to offset concerns about rising production costs and possible supply shortages for next year’s growing season.”

The Register article explained that,

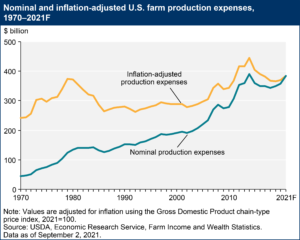

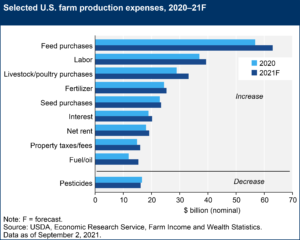

In addition to concerns about whether the drought will linger into next season, farmers are watching rising prices for land, seed and fertilizer, as well as and other expenses. U.S. production costs are estimated to be 7% higher this year and next year’s could match the national record set in 2014, some experts and farmers say.

And with respect to machinery parts, the Register article noted that, “Chris Edgington, who farms in northern Iowa, was waiting for a shaft he needed to repair a combine. His dealer was looking across the nation.

“‘There’s definitely a shortage of parts,’ said Edgington, who raises corn and soybeans near St. Ansgar in Mitchell County.

“Edgington, president of the National Corn Growers Association’s board, points to hundreds of Case IH tractors sitting outside a Nebraska plant, waiting for parts before they can be shipped to dealers.”

Ms. Eller added that, “Even with fertilizer, land, seed and other costs rising, next year should be profitable as well, [Chad Hart, an Iowa State University agriculture economist] said. Corn prices for next year’s crop are sitting around $5.20 a bushel, based on futures prices, and Hart estimates production costs will be around $4.40.

“Still, farmers are concerned about the rapidly growing cost of one of their biggest expenses: Land.

“Ryan Kay, a farmland broker at Hertz Farm Management, expects farmland rents next year will climb 10 to 20%. Farmland sales, with values driving rent prices, already have set new records this year.”

Closing in on #fertilizer price records:

— Josh Linville (@JLinvilleFert) October 12, 2021

NOLA #urea all-time high - $835

Current urea - $710

NOLA #UAN all-time high - $556

Current UAN - $500 - $535

NOLA #DAP all-time high - $1,100

Current DAP - $695

Midwest #NH3 all-time high - $1,150

Current Midwest NH3 - $900 - $1,000

Also this week, Reuters writers P.j. Huffstutter and Mark Weinraub reported that, “Manufacturing meltdowns are hitting the U.S. heartland, as the semiconductor shortages that have plagued equipment makers for months expand into other components.

Supply chain woes now pose a threat to the U.S. food supply and farmers’ ability to get crops out of fields.

“Farmers say they are scrambling to find workarounds when their machinery breaks, tracking down local welders and mechanics. Growers looking to buy tractors and combines online are asking for close-up photos of the machine’s tires, because replacements are expensive and difficult to find, said Greg Peterson, founder of the Machinery Pete website which hosts farm equipment auctions.”

Meanwhile, Des Moines Register writer Tyler Jett reported on Thursday that, “The United Auto Workers has called a strike of Deere & Co. for the first time in 35 years.

“After negotiating with the Moline, Illinois-based agricultural and construction equipment manufacturer for two months, the union announced just after midnight that its 10,100 members in Iowa, Illinois and Kansas would go on strike and begin picketing outside of Deere’s plants. “

Adding to the supply chain issues for farm equipment and components... https://t.co/rqbM2OqyY4

— PJ Huffstutter (@pjhuffstutter) October 13, 2021

More broadly on the issue of production costs and fertilizer prices, Bloomberg writer Megan Durisin reported this week that, “Surging fertilizer prices have European farmers questioning whether to curb their planting plans.

“Crops of winter wheat and barley are being sown just as numerous nitrogen fertilizer plants in Europe shut as prices jump for their key feedstock, natural gas. Those fields will require fertilizer when they thaw next year to boost yields and quality. Consequently, soaring nutrient prices risk curtailing output, highlighting how the spike in global energy costs is adding to food inflation.

“‘We have a lot of question marks about not only the price, but if there will be enough supply of nitrogen fertilizer for next spring,’ said Philippe Heusele, general secretary of French wheat growers’ group AGPB. ‘The question is should we plant 100% of what was foreseen before the winter or not.'”