A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Ballooning Fertilizer Prices and Production Cost Considerations Gain Scrutiny

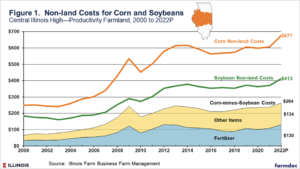

Bloomberg writers Kim Chipman and Elizabeth Elkin reported late last week that, “Skyrocketing fertilizer prices could lead U.S. corn profits to drop by about a quarter next year, potentially motivating farmers to shift millions of acres into less cost-intensive soybeans.

“That’s according to Terry Roggensack, agriculture specialist and co-owner of the Hightower Report. He predicts corn returns on an operating-cost basis for producers in the U.S., the world’s biggest producer, could plummet to roughly $430 an acre. That compares with about $600 this year. The yellow grain uses more fertilizer than other crops like soybeans and wheat.”

The Bloomberg article indicated that, “Farmers could find it more attractive to plant soybeans, with operating-cost returns for the oilseed pinned at $500 an acre, according to Roggensack.”

Also last week, Bryan Doherty reported at Successful Farming Online that, “Skyrocketing fertilizer prices and expectations for increased soybean acreage in the year ahead could create a significant change in the price ratio of corn to soybeans.”

The article added that, “Now we see fertilizer prices skyrocketing, and a bigger concern could be availability. ”

More broadly with respect to fertilizer prices, Bloomberg writers Randy Thanthong-Knight and Jasmine Ng reported on Friday that, “Rice, the staple food for half of humanity, is set to become more expensive because of a blistering rally in fertilizer prices.”

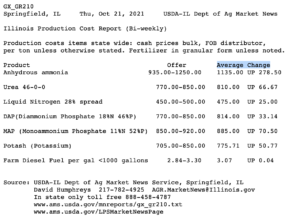

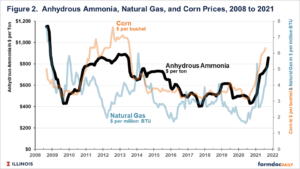

The Bloomberg article explained that, “Global fertilizers costs have rocketed to records on a perfect storm of events — from extreme weather and plant shutdowns to government sanctions. The energy crises in Europe and China are exacerbating the impact as coal and natural gas are important feedstocks. The cost increase comes at a worrying time, with international food prices at a decade high.

“China is also stepping up scrutiny on its fertilizer industry, including imposing new hurdles for exporters in a bid to protect domestic supplies.”

Other costs are also on the rise, including diesel fuel (see below) and propane.

Average price of diesel now $3.57/gal, the highest its been since Thanksgiving Day 2014. Not only are commodity prices driving up the price of goods, but rising diesel prices are a second hit.

— Patrick De Haan (@GasBuddyGuy) October 21, 2021

Des Moines Register writer Donnelle Eller reported on Saturday that, “Propane prices in Iowa averaged $2.03 per gallon last week, 84% higher than the same time a year earlier, Energy Information Administration data show.

“Prices could climb to around $3 per gallon this winter, said Jay Christie, past president of the Iowa Propane Gas Association board of directors.”

Meanwhile, Alan Bjerga, a spokesman for the National Milk Producers Federation, was quoted in a FoxBusiness News article last week as saying:

‘If you are a dairy farmer anywhere in the country you are seeing increases in everything you need to produce milk.’

Nonetheless, in the context of net returns, the price of some agricultural commodities are robust.

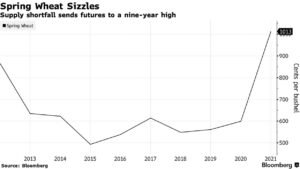

Bloomberg writers Kim Chipman and Megan Durisin reported last week that, “Spring wheat surged to $10 a bushel for the first time since 2012 as hot and dry crop conditions from North America’s prairies to Russia’s Urals leaves the world short on grain used to make everything from croissants to pizza crusts.

“Prices climbed for the sixth straight week, the longest run of gains in more than two years, as a global appetite grows for wheat of all types. The U.S. expects overall grain stockpiles to end the season at a five-year low. The scarcity is boosting demand for hard red winter wheat, which was more abundant this year than other varieties. Those futures soared to a seven-year high.”

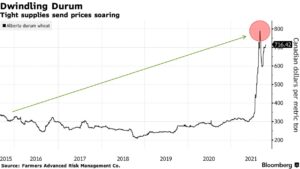

Also last week, Bloomberg writers Jen Skerritt and Kim Chipman reported that, “Durum prices in the western Canadian province of Alberta have risen more than 60% since August and are currently trading near the highest since at least 2015, according to data from Farmers Advanced Risk Management Co. in Winnipeg.”

The Bloomberg article stated that, “In North Dakota, the U.S. Midwest state that grows about 80% of the nation’s crop, prices at grain elevators have nearly doubled since June, [Jim Meyer, president of St. Louis-based Italgrani USA, North America’s largest semolina and durum flour miller] said.”