President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Chinese Livestock Producers Look to Corn as Domestic Prices Fall, While U.S. Corn Exports Hit Record Volume

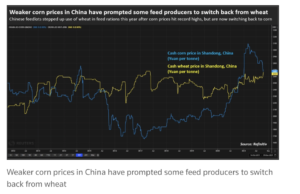

Reuters writers Hallie Gu and Gavin Maguire reported late last week that, “For the first time in a year, corn prices in China’s key Shandong hub this week have fallen to the same levels as wheat, leading some feed producers to switch back to using more of the yellow grain, traders and analysts said.

“Corn prices in key animal-feeding hubs such as Shandong province had been trading at a rare sustained premium to wheat for most of the past year. That’s because corn production hiccups and a drawdown in stocks last year led to a slide in supply that pushed domestic prices to record highs.

“Costly corn in turn spurred industrial corn users to look for alternatives, with some feed lots switching to using record volumes of feed-grade wheat.”

The Reuters article noted that,

However, with local corn prices now weakening as the 2021 harvest rolls on, wheat’s price advantage relative to corn has now all but disappeared.

“Corn prices in Shandong province, a livestock hub in northern China, were at 2,600 yuan per tonne as of Thursday , down 15% from their record highs in March, and below wheat prices in the same area,” the Reuters article said.

Here's a chart of corn and wheat prices in Shandong, China. There was record feed use of wheat in 2021 as a result of the wide price spread. But now that corn is back at par or discount to wheat, a swing back to corn feeding is underway. pic.twitter.com/2QiM7n5RVh

— Gavin Maguire (@GavinJMaguire) October 15, 2021

Also last week, a separate Reuters News article reported that, “China has lowered estimates of 2021/22 corn output as rains hit the new crop in parts of the northern region, the agriculture ministry said on Tuesday.

“China’s 2021/22 corn output was seen at 271 million tonnes, down 850,000 tonnes from its previous monthly crop report forecast, the Ministry of Agriculture and Rural Affairs said.”

“Heavy rains have delayed the corn harvest in the region, and damaged quality of the new crop,” the Reuters article said.

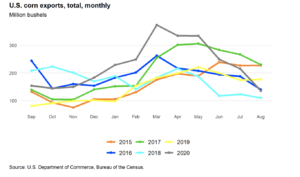

Meanwhile, with respect to U.S. corn exports, the USDA’s Economic Research Service (ERS) indicated last week in its monthly Feed Outlook report that, “Corn exports in 2020/21 totaled 2,753 million bushels according to the U.S. Census Bureau, with data for the entire marketing year being reported.

This number marks a new record for U.S. corn exports, beating the previous mark of 2,437 million bushels set in 2017/18.

“U.S. exports benefited from strong feed demand from China, coupled with production issues in other major exporting countries—notably Brazil and Ukraine.”

The ERS report noted that, “Export shipments did pare back in the final quarter of the marketing year, mainly due to high prices and the anticipation of additional corn supplies coming to market during the Northern Hemisphere’s fall harvest.

“Likewise, Hurricane Ida made landfall in Louisiana on August 30, during the transition between the 2 marketing years. The storm affected the operations of many key grain export terminals located on the Mississippi River. Export capacity continues to come back online but isn’t expected to dramatically impact the outlook for 2021/22 corn exports, since the peak export period for corn is typically later in the season.

Upcoming Marketing Year U.S. Corn Export Commitments #China vs. All Destinations

— Farm Policy (@FarmPolicy) October 13, 2021

--- @PUCommercialAg webinar: October #Corn & #Soybean Outlook Update, https://t.co/iZM3szpVcH pic.twitter.com/1zmYrYGO0r

“Corn exports for 2021/22 are projected at 2,500 million bushels, a 25-million-bushel increase from September, but lower than the 2020/21 record total.”