The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

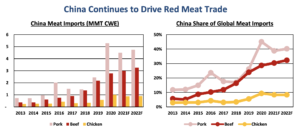

FAS: “China Continues to Drive Red Meat Trade”

In its Livestock and Poultry: World Markets and Trade report this week, the USDA’s Foreign Agricultural Service (FAS) indicated that, “China pork production is expected to contract in 2022 as the hog sector adjusts to rapidly changing market conditions. Hog prices have fallen dramatically since the beginning of 2021 and have remained persistently low despite recent national holidays that usually mark an uptick in pork consumption. Market participants that could have easily made money for much of 2020 at exceptionally high prices may find it more difficult going forward, especially as input prices remain high. These dynamics will likely cause pork production to decline and imports to rise in 2022, particularly in the second half of the year.

China pork imports are expected to reach nearly 4.8 million tons, up nearly 6 percent year-over-year, after falling in 2021 on rising pork production and depressed prices.

“However, they will remain below the 2020 record when disease-induced pork supply shortfalls were most acute.”

The FAS update also noted that, “Meanwhile, China beef imports and its share of global trade are expected to grow for the eighth consecutive year in 2022. Beef gained ground as China struggled with tight pork supplies over the past several years. Evolving consumer preferences and an improving foodservice environment will give beef a larger place in the Chinese diet than in the past while muted growth in domestic production will support imports.”

This week’s report update added that, “China chicken meat imports are forecast to grow 3 percent in 2022 on increased consumer demand and the expectation that imported product will be competitively priced. However, China’s share of global trade for chicken meat remains small compared to that of other meats. Global trade in chicken meat will instead be driven by broad recovery from pandemic-related disruptions as improving economic conditions are expected to lead many key players to reenter the global market.”

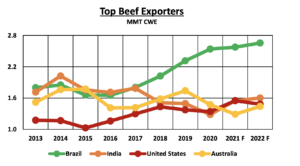

Regarding U.S. beef production, FAS explained that, “Production for 2022 is forecast down 3 percent as tighter cattle supplies weigh on slaughter. Tightening U.S. beef supplies are expected to constrain exports, which are forecast 4 percent lower year-over-year. Meanwhile, production recovery in Australia is expected to increase competition in key Asian markets. However, U.S. exports are expected to remain elevated by historical standards, achieving the second-highest total on record.”

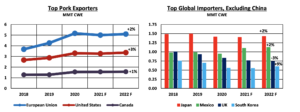

And with respect to U.S. pork production, FAS pointed out that, “U.S. production is forecast marginally lower in 2022 as lower pig inventories and producers’ intentions to farrow fewer sows in the latter part of 2021 keep supplies tight going forward.

“Nevertheless, U.S. exports are expected to rise 3 percent on improving demand in most major markets.

Higher imports in China will support U.S. trade both directly and indirectly as major competitors shift product out of other East Asian markets such as Japan and South Korea.

“Additionally, pent-up consumer demand and improvement in the value of the peso will support shipments to Mexico.”