The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

Fertilizer Exports from China Face Curbs, as Crop Acreage Levels Garners Attention

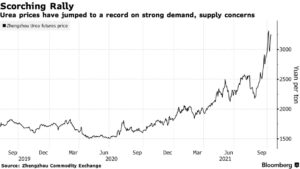

Bloomberg News reported this week that, “Chinese authorities are imposing new hurdles for fertilizer exporters amid growing concerns over surging power prices and food production, a move that could worsen a global price shock and food inflation.

“Some Chinese fertilizer cargoes ready to be shipped are being held up by local authorities for additional checks or to obtain new export certificates, according to people familiar with the matter. The supplies will either end up being sold on the domestic market or face delays in being exported, said the people, who asked not to be named as they are not authorized to speak on the matter.

“The increased scrutiny comes as global fertilizers costs have soared to new records, spurred by energy crises in Europe and China as coal and natural gas are important feedstocks. The cost increase comes at a particularly worrying time, with global food prices hitting a 10-year high.”

Coal prices are going parabolic in China, with futures climbing 110% since Sep 1 to almost 2,000 yuan per tonne today (~$300). Coal for prompt delivery in the physical market is trading much higher. To put it in context, Newcastle and Richards Bay coal trades ~$230 per tonne pic.twitter.com/hrotNxlv1f

— Javier Blas (@JavierBlas) October 19, 2021

The Bloomberg article added that, “China’s move to curb fertilizer exports will be felt around the world as it is a key supplier of urea, sulphate and phosphate, accounting for about 30% of global trade. The biggest buyers of China’s fertilizers include India, Pakistan and countries in Southeast Asia.”

Meanwhile, Reuters News reported this week that,

Farmers need more space to grow crops to meet mounting demand for food and renewable fuel at a time of slowing growth in yields, consultancy AgResource said on Tuesday.

“A renewable fuel push under U.S. President Joe Biden’s climate agenda is set to trigger a boom in soyoil use, reinforcing a worldwide picture of rising consumption of staple crops driven by China, Dan Basse, president of consultancy AgResource Co, told the GrainCom conference in Geneva.

“At the same time, combined global yields of major grain crops appear to have levelled out in the past five years, he said.”

The Reuters article noted that, “For renewable diesel, U.S. production capacity is set to double in the coming year as over 1 billion gallons in capacity comes onstream, he said.

“With U.S. states barring companies from using imported feedstocks for such fuel, that could in theory create the need for an additional 40 million acres (16.2 million hectares) of soybean plantings in the United States, Basse said.”

“AgResource estimates Chinese imports of feed grains reached nearly 54 million tonnes in 2020 – or about one in every four tonnes of feed grain traded worldwide – and will rise to a new record of almost 57 million tonnes in 2021, Basse said.”

More broadly with respect to oilseeds, a news release today stated that, “Reportlinker.com announces the release of the report ‘Global Vegetable Oils Industry‘ – Applications of vegetable oils expand continuously, providing a major boost for the market. Several vegetable oils are currently in high demand in developing country markets, for both food and non-food applications. In these markets, an increasing population base and growing living standards constitute the chief reasons behind growth. Another major market growth promoting factor is the increasing demand for certain types of vegetable oils from the rapidly growing biofuel industry. Vegetable oils find use in the production of bioethanol, used further in the production of biofuels. Vegetable oils also constitute a major feedstock for the production of bio-lubricants. Increasing regulatory scrutiny on recyclability and disposal of lubricants derived from petrochemicals has been one of the important factors driving demand for bio-lubricants and thereby for vegetable oils. Supportive policies of governments for instance, the RED (Renewable Energy Directive) and CAP (European Union Common Agricultural Policy) among others have also been offering immense support to market growth. The policies have been leading to increased application of the oils in different industries including animal feed, biofuel, food and cosmetics.

“Amid the COVID-19 crisis, the global market for Vegetable Oils estimated at 199.1 Million Metric Tons in the year 2020, is projected to reach a revised size of 258.4 Million Metric Tons by 2026, growing at a CAGR of 4.4% over the analysis period. Palm, one of the segments analyzed in the report, is projected to grow at a 5.2% CAGR to reach 101.8 Million Metric Tons by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Soybean segment is readjusted to a revised 4.5% CAGR for the next 7-year period. This segment currently accounts for a 29.6% share of the global Vegetable Oils market.”

The news release added that, “The Vegetable Oils market in the U.S. is estimated at 17.5 Million Metric Tons in the year 2021. The country currently accounts for a 8.28% share in the global market. China, the world`s second largest economy, is forecast to reach an estimated market size of 55.1 Million Metric Tons in the year 2026 trailing a CAGR of 5.3% through the analysis period.”