Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

From Retail Grocer to Commodity Production Inputs, Supply-Chain Knots Persist

Bloomberg writers Brendan Case, Leslie Patton, and Kim Chipman reported this week that, “In Denver, public-school children are facing shortages of milk. In Chicago, a local market is running short of canned goods and boxed items.

“But there’s plenty of food. There just isn’t always enough processing and transportation capacity to meet rising demand as the economy revs up.

More than a year and a half after the coronavirus pandemic upended daily life, the supply of basic goods at U.S. grocery stores and restaurants is once again falling victim to intermittent shortages and delays

The Bloomberg article stated that, “‘I never imagined that we’d be here in October 2021 talking about supply-chain problems, but it’s a reality,’ said Vivek Sankaran, chief executive officer of Albertsons Cos., who echoed the laments of other retailers. ‘Any given day, you’re going to have something missing in our stores, and it’s across categories.'”

“The shortages aren’t as acute as they were earlier in the pandemic,” the Bloomberg article said, but added: “Many food suppliers are planning for these hiccups and shortages to last.”

U.S. farmers are pre-buying seeds and chemicals they need earlier than normal, in a bid to secure supplies for next spring amid sector-wide supply-chain problems, Bayer told Reuters, & estimates seed prices on average will go up about 5% for 2022.

— PJ Huffstutter (@pjhuffstutter) October 19, 2021

https://t.co/gX2CH4BMpG

Opposite retail, on the commodity production side of the food supply chain, Reuters writers P.j. Huffstutter and Zuzanna Szymanska reported this week that, “U.S. farmers are pre-buying seeds and chemicals they need earlier than normal, in a bid to secure supplies for next spring amid sector-wide supply-chain problems, a top executive at German agricultural and pharmaceuticals firm Bayer AG said on Tuesday.

“Bayer also estimates its average seed prices will go up about 5% for 2022, Liam Condon, president of Bayer’s agricultural unit, told Reuters on Tuesday.”

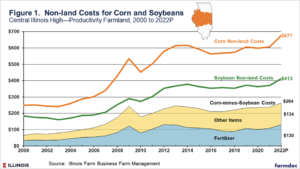

“U.S. farmers have been gearing up for a spike in how much it will cost them to produce their corn and soybean crops next year, amid rising prices of fertilizer, chemicals and seeds due to labor issues, snarled exports and surging demand,” the Reuters article said.

Huffstutter and Szymanska noted that, “Asked if rising production costs may push farmers to plant fewer acres of corn – which is a cornerstone of Bayer’s performance and tends to be a more expensive crop to produce – and more soybeans, Condon said it was too early to know whether producers might make any such shifts.”

University of Illinois agricultural economist Gary Schnitkey indicated this week that, “Uncertainty about nitrogen fertilizer prices moving into spring will make it difficult to determine whether corn or soybeans is more projected to be profitable for 2022. Given the higher relative costs for corn, corn prices will need to be relatively higher than soybean prices for corn to have the same profitability as in recent years.”

Meanwhile, Bloomberg writers Megan Durisin and Andy Hoffman reported this week that, “Agri-commodities trading giant Archer-Daniels-Midland Co. says high grain prices have yet to impact demand, according to the finance chief of its trading division.

Jerome Daven, the chief financial officer of ADM’s Global Trade unit in Switzerland, said his firm isn’t seeing signs of demand destruction despite rising grain prices.

The Bloomberg article noted that, “Daven’s comments were echoed by Marco Orioli, the vice president of grain marketing in Europe, Middle East and Africa for CHS Europe, and Andreas Rickmers, the chief operating officer of Ameropa AG, who also told [delegates at the GrainCom conference in Geneva] they see no signs of slowing demand.”