A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

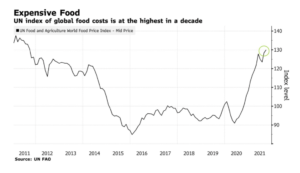

Global Food Prices Highest Since 2011, as Energy Costs Rise and Supply Chain Challenges Persist

Bloomberg writer Megan Durisin reported on Thursday that, “The jump in global food prices to a decade high risks leading to even more expensive grocery bills, and the energy crisis is threatening to make things even worse.

“Harvest setbacks, strong demand and supply chain disruptions have sent a United Nations index of food costs up by a third over the past year. The latest leg up last month came as prices for almost all types of foodstuffs gained, adding to inflationary headaches for consumers and central banks.”

The Bloomberg article explained that, “Soaring energy bills are now adding to the problem, escalating costs of producing fertilizers and transporting goods around the world, and making the run-up more reminiscent of the price spikes seen during food crises in 2008 and 2011. The energy rally could also prompt more crops to be diverted from food to making biofuels, the UN warned.”

Reuters News reported on Thursday that, “FAO’s food price index, which tracks international prices of the most globally traded food commodities, averaged 130.0 points last month, the highest reading since September 2011, according to the agency’s data.”

In a more narrow look at global wheat supply and demand issues, the AMIS Market Monitor stated on Thursday that, “Poor weather conditions hit wheat crops particularly hard this season in several key producing countries, such as Canada (minus 38 percent below last season’s output), the Russian Federation (minus 13 percent); and the United States (minus 7 percent). Not surprisingly, therefore, global wheat inventories could fall below opening levels in the 2021/22 marketing season. With most of the drawdowns concentrated in major exporting countries, the wheat stocks-to-disappearance ratio could fall to the lowest level in over two decades, which is a worrying sign of supply tightness in world markets, raising the possibility of even further gains in wheat prices this season.”

The Market Monitor added that, “The current supply tightness in global wheat markets must also be assessed in light of important and fast changing developments in energy markets and supply chain logistics. Easing COVID-19 restrictions are likely to sustain economic recovery, boosting prices of oil, gas, and, as a result, fertilizer. In addition, port congestions, such as those witnessed recently in China and the US, are also a concern, contributing to supply chain disruptions, which – along with elevated freight rates – might add more volatility to wheat prices and increase import costs, which would be a particular burden for the poorest countries in the world.”

Prices for most fertilizers continued their upward trend mainly driven by high #energy and #shipping costs and supply constraints. https://t.co/h1cy1iqFpa @AMISoutlook pic.twitter.com/kej5th6enc

— Farm Policy (@FarmPolicy) October 7, 2021

Meanwhile, Wall Street Journal writer Jesse Newman reported on Thursday that,

Escalating costs and supply-chain challenges are squeezing major U.S. food companies, boosting food costs and hampering the flow of staples to grocery-store shelves.

“Makers of french fries, ketchup and potato chips are struggling to staff processing lines and move goods across highways and ports, executives said, while costs for products as diverse as packaging and cooking oil rise. Companies including Conagra Brands Inc., PepsiCo Inc. and Lamb Weston Holdings Inc. are raising prices to keep up, they said, while striving to keep products in stores.

“Supply-chain problems are growing for U.S. food makers at a time consumers are spending heavily on food, in supermarkets and restaurants. Consumer spending at grocery stores was 4% higher in August than in the same month a year earlier, according to U.S. Census Bureau data. Restaurant sales have climbed this year as Covid-19 restrictions ease, though concerns over the Delta variant have eroded some of the rebound in recent weeks.”

Ms. Newman pointed out that, “Other food companies are contending with similar problems. PepsiCo Inc. said earlier this week that it faces higher costs for aluminum cans, plastic bottles, labor and trucking, though the company boosted its profit expectations for the year because of rising sales of Mountain Dew, Doritos and other snacks. General Mills Inc. said last month that the Cheerios and Betty Crocker parent is dealing with hundreds of operational disruptions—such as more-expensive ingredients and a shortage of truck drivers—that are pushing up costs for supermarket customers.”