President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Wheat Prices Climb, as Elevated Fertilizer Prices Persist

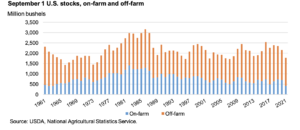

In its October Wheat Outlook report, the USDA’s Economic Research Service (ERS) pointed out that, “USDA’s National Agricultural Statistics Service (NASS) published its Grain Stocks report on September 30, which indicated that wheat stocks as of September 1 this year were the lowest for that date since 2007. Stocks this year are especially tight based on a smaller crop, as indicated in the NASS Small Grains Annual Summary report, published concurrently with the stocks report.”

The Outlook report stated that, “It is also noteworthy that on-farm stocks are estimated at the lowest level since 1963.”

“Notably, the season-average farm price for 2021/22 is now projected at $6.70, which would be up 33 percent from last year and the highest since 2013/14,” ERS said.

The September price for all #wheat, at $7.75 per bushel, is 62 cents higher than August and $3.02 higher than September 2020.

— Farm Policy (@FarmPolicy) October 29, 2021

- Monthly Agricultural Prices, https://t.co/212D2srff5 @usda_nass pic.twitter.com/PQNAbSK7o7

More broadly, ERS indicated that, “Global ending stocks are projected to be down 6.0 million MT to 277.2 million in 2021/22. This is the lowest since 2016/17 and is largely driven by a 3.2 million MT decrease to major exporters’ ending stocks. Major exporters’ 2021/22 ending stocks are expected to be 33-percent lower than 2016/17 at 50 million MT.”

On Friday, Bloomberg writer Megan Durisin reported that, “Wheat, one of the world’s vital staples, is getting increasingly pricey.

“Wheat is harvested on more land than any other, and its geographic spread typically blunts the risk of bad weather in any one region. But a brew of droughts, freeze and heavy rain hit crops this year from Canada to the Black Sea.

“Stockpiles have dropped across the biggest exporters, making it increasingly expensive for buyers to stock up.

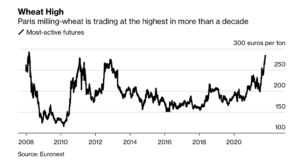

Benchmark wheat futures in Chicago are nearing their highest since 2013 and the milling-wheat contract in Paris is approaching a record.

The Bloomberg article pointed out that, “Increased supply on the way in the Southern Hemisphere could help ease the pain, with Australia due for a bumper crop. Argentina’s harvest also just kicked off and, even with expensive freight, its supply will compete against European grain into North African markets, said Andree Defois at French consultant Strategie Grains.”

And Financial Times writers Emiko Terazono and Chelsea Bruce-Lockhart reported on Friday that, “Wheat futures prices are up 20 per cent from the start of the year as Russia, North America and Argentina were affected by drought, while European producers were hit by rain. The last time wheat prices soared to current levels was in the aftermath of the 2012 drought in the US.”

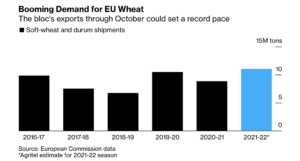

With respect to demand, a separate Bloomberg article last week by Megan Durisin reported that, “Countries around the world are loading up on European wheat at the fastest pace ever after poor harvests in other major exporters.

“The European Union’s exports may top 11 million tons by the end of this month, according to Nathan Cordier, an analyst at consultant Agritel. That would be 25% more than a year earlier and the most for that time of the season in EU data going back two decades.”

Ms. Durisin stated that, “European wheat is filling the gap left by tighter supplies elsewhere and as export taxes slow sales from wheat giant Russia.”

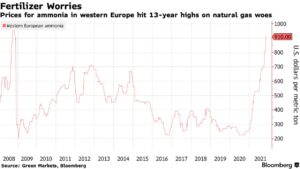

Meanwhile, Reuters News reported on Friday that, “Farmers in France have stepped up fertiliser purchases this month amid fears of shortages as they wrestle with mounting costs that could affect next year’s harvests, the French unit of fertiliser group Yara said.

Soaring gas prices have unsettled nitrogen fertiliser markets that rely on gas as an input, leading manufacturers including Yara to reduce output and causing fertiliser prices to treble.

“That has raised the prospect of some farmers planting fewer fertiliser-intensive crops such as corn or spreading less of the nutrient, adding uncertainty to grain markets that have reached multi-year highs in 2021 on supply concerns.”

As the repercussions of higher input costs continue to reverberate for producers, Javier Blas, the Chief Energy Correspondent at Bloomberg News, recently tweeted about nitrogen fertilizer prices in the U.S. corn belt, and ammonia prices (see below).

FERTILIZER SHORTAGE: Pretty shocking price increases for ammonia in key US export locations over the last week: New Orleans (NOLA) spot price jumped 70% over seven days to a record high of $1,030 per tonne. US Tampa spot ammonia went up 25%. And prices surged too overseas pic.twitter.com/nea2k1Rqxu

— Javier Blas (@JavierBlas) October 30, 2021