The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

Federal Reserve Ag Credit Surveys- 2021 Third Quarter Farmland Values Soar

On Monday, the Federal Reserve Banks of Chicago and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the third quarter of 2021.

Federal Reserve Bank of Chicago

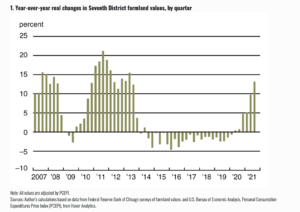

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in the AgLetter that, “Assisted by low interest rates, government support, and higher than normal farm incomes, the District saw a year-over-year gain of 18 percent in its agricultural land values in the third quarter of 2021.

This was the largest year-over-year increase in the District’s farmland values in nine and a half years.

“Iowa led the way with a year-over-year jump in farmland values of 28 percent; other District states also saw double-digit year-over-year growth in farmland values.”

The AgLetter stated that, “After being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), District farmland values were still up 13 percent in the third quarter of 2021 relative to a year ago. In nominal terms, the District’s agricultural land values in the third quarter of 2021 were 6 percent higher than in the second quarter.”

Mr. Oppedahl added that, “Although drought threatened a substantial portion of the Midwest over the summer, District-wide corn and soybean yields in 2021 rebounded strongly from 2020 and looked to set new highs, according to U.S. Department of Agriculture (USDA) data.”

And the Chicago Fed indicated that, “Agricultural credit conditions for the District showed improvement yet again in the third quarter of 2021. For the July through September period of 2021, repayment rates on non-real-estate farm loans were higher than a year earlier.”

Federal Reserve Bank of Kansas City

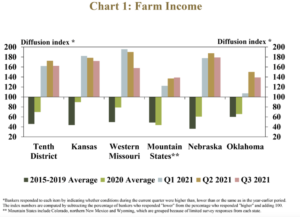

Nathan Kauffman and Ty Kreitman, writing in Monday’s Ag Credit Survey from the Kansas City Fed, noted that, “Agricultural credit conditions in the Tenth District remained strong in the third quarter and farm real estate values increased sharply. Farm income and loan repayment rates continued to increase at a steady pace and contributed to multi-year lows in problem loans and asset liquidation. While conditions have improved substantially from recent years throughout the region, the pace of increase in farm income and loan repayment rates was slower in areas most significantly impacted by drought.

Alongside a strong agricultural economy and historically low interest rates, the value of all types of farmland was about 15% higher than a year ago.

Monday’s update stated that, “Most lenders have remained optimistic about the outlook for agriculture in the District but have expressed concerns about rising input costs. Despite rising costs, however, elevated commodity prices have continued to support farm finances, particularly for crop producers. Though many risks remain, the agricultural sector will be well positioned heading into 2022 alongside the persistent strength in commodity prices and double-digit gains in land values.”

Kauffman and Kreitman noted that, “A strong agricultural economy continued to support increases in farm income and spending through the third quarter. More than half of banks in the District reported income was higher than a year ago for the fourth consecutive quarter.”

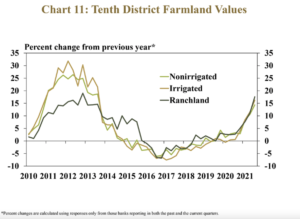

The Ag Credit Survey indicated that, “With support from a strong farm economy and historically low interest rates, farmland values in the region increased sharply.

Nonirrigated cropland values were about 15% higher than a year ago, the largest increase since 2013.

“Irrigated cropland and ranchland values increased slightly more than 15%, which was also the largest increase since 2013.”

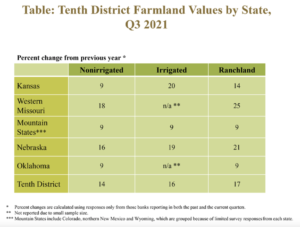

The Survey added that, “The strength in farm real estate values was consistent across all states in the District. Nonirrigated cropland increased more than 15% in western Missouri and Nebraska and slightly less than 10% in all other states.

“The appreciation of Ranchland was also most pronounced in western Missouri and Nebraska, while irrigated land values increased at the fastest pace in Kansas and Nebraska.”