Reuters' Doyinsola Oladipo and David Shepardson reported late Thursday that "U.S. dock workers and port operators reached a tentative deal that will immediately end a crippling three-day strike that has…

Fertilizer Prices: Another Week, Another Record- but Corn-Soybean Ratio Still Seen as Relatively Strong

Late last week, Bloomberg writer Elizabeth Elkin reported that, “A gauge of North American fertilizer prices touched a new record high, driving up costs for farmers who are already experiencing tight margins and threatening to make food even more expensive.

“The Green Markets North American Fertilizer Price Index rose 3% to $1,048 per short ton on Friday, rocketing past an October peak for the index that began in January 2002.”

The Bloomberg article stated that, “Top fertilizer producers Nutrien Ltd. and Mosaic Co. expect prices to keep climbing, according to executive comments during earnings calls this week.

Fertilizer normally accounts for about 35% of a corn farmer’s operating costs. That number could jump to 45% in 2022, according to Bloomberg’s Green Markets.

And Reuters writer Rod Nickel reported last week that, “A shortage of nitrogen fertilizer due to soaring natural gas prices is threatening to reduce global crop yields next year, CF Industries, a major producer of the crop nutrient, said on Thursday.”

The Reuters article indicated that, “‘Who’s going to get the scarce tons that are out there? … There’s going to be a lot of unmet demand that’s going to be pent up,’ CF Chief Executive Tony Will told analysts on a conference call. ‘And so we do think yield is going to be, on a global basis, off next year. Not because of demand destruction, just because there’s not enough tons available.'”

#Illinois Production Cost Report (Bi-weekly), Nov. 4th @USDA_AMS pic.twitter.com/hdoUVxOqtq

— Farm Policy (@FarmPolicy) November 4, 2021

Also last week, the AMIS Market Monitor pointed out that, “Soaring fertilizer prices, in part driven by a strong run-up in natural-gas prices, are poised to add more uncertainty to global food markets well into the 2022/23 season. With international prices of most food crops (with the exception of rice) already at multi-year highs and their exportable supplies barely adequate to meet demand, any weather or input induced shortfall in 2022 could have worrying implications for global food security.”

Fertilizer prices have increased sharply over the past 12 months, putting further upward pressure on food prices. Find out more in this month's AMIS Market Monitor: https://t.co/kPrGK62eSc pic.twitter.com/KkMZ9Rutd7

— AMIS (@AMISoutlook) November 4, 2021

With respect to acreage decisions, Reuters writer Pavel Polityuk reported last week that, “Soaring global gas prices and a subsequent rise in domestic prices has increased the net cost of Ukrainian corn, restraining the pace of the 2021 harvest and forcing farmers to reduce next year’s area under corn, analysts and traders said on Friday.”

The Reuters article noted that, “‘The corn sowing area is expected to decrease by 10% to 15% next year, also because of higher prices for nitrogen fertilisers,’ one foreign trader said, adding that the cost of growing 1 hectare of corn will increase by $200-$300.”

In the U.S., DeLoss Jahnke reported last week at FarmWeekNow Online that, “Purdue University has not yet asked farmers about acreage expectations, but they plan to do so in the coming months as part of its regular survey for the Ag Economy Barometer. ‘We have the higher input costs, which are hitting corn harder, but we’ve also seen more strength in corn prices recently,’ said Michael Langemeier, associate director for Purdue University’s Center for Commercial Agriculture.

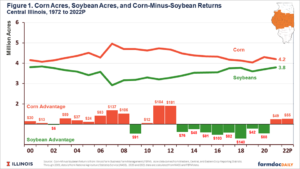

“‘Corn’s hanging right in there. The corn-soybean ratio is still relatively strong. A lot of people are saying that we’re going to see a lot more soybean acres. I say, ‘Hold it here; if that ratio next spring is similar to what we’re seeing now, corn is going to be very competitive, and we’re not going to see that big of a reduction in corn acres with the current price ratio.””

I am definitively on board with this reasoning https://t.co/ieZhCvDkwM

— Scott Irwin (@ScottIrwinUI) November 4, 2021

On Friday, in an early release of selected tables prepared for the upcoming USDA Agricultural Projections to 2031 report, USDA projected a reduction in corn acres for the 2022/23 crop year, and in increase in soybean and wheat acres.