A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

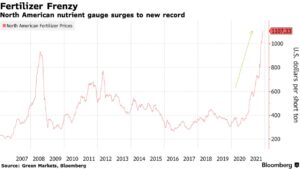

Fertilizer: Risk of “Spring Scramble” for Supplies

Last week, Reuters writer Rod Nickel reported that, “A global shortage of nitrogen fertilizer is driving prices to record levels, prompting North America’s farmers to delay purchases and raising the risk of a spring scramble to apply the crop nutrient before planting season.

“Farmers apply nitrogen to boost yields of corn, canola and wheat, and higher fertilizer costs could translate into higher meat and bread prices.

“World food prices hit a 10-year high in October, according to the United Nations food agency, led by increases in cereal crops like wheat and vegetable oils.”

Mr. Nickel explained that, “In the United States, nitrogen fertilizer supplies are adequate for applications before winter, said Daren Coppock, CEO at U.S.-based Agricultural Retailers Association. Applying fertilizer before winter reduces farmers’ spring workload.

But with prices so high, some farmers are delaying purchases, risking a scramble for supplies during their busiest time of year, Coppock said.

The Reuters article pointed out that, “Delaying fertilizer purchases until spring runs the risk of further supply chain congestion as farmers rush to apply fertilizer and plant seed during a tight window.

“‘There’s going to be a lot of people who wait and see,’ Coppock said. ‘(But) if everybody’s scrambling in the spring to get enough, somebody’s corn isn’t going to get covered.'”

Also last week, Financial Times columnist John Dizard noted that, “Natural gas accounts for about 80 per cent of the variable costs of essential nitrogen fertiliser components such as ammonia. The ammonia price in Europe roughly tripled between January and March. Expensive fertiliser pressures food supplies.”

Mr. Dizard stated that, “Of course fertiliser prices have surged in the past, only to decline again as producers increased capacity and farmers cut back on their fertiliser use. Spikes similar to what we are seeing now came in early 2008, peaking a few months before the global financial crisis.

“The difference this time, particularly in Europe, is that climate policy means there is no finance available for natural gas production expansion. Farmers can skimp on potash and phosphate applications for a season or two, but yields will decline quickly without nitrogen fertilisers.”

Meanwhile, Bloomberg writers Pratik Parija and Vrishti Beniwal reported this week that,

Indian farmers squeezed by a massive shortage of fertilizers are turning to the black market and paying exorbitant prices for supplies.

“The shortfall has led to a thriving market where subsidized crop nutrients are sold illegally at prices much higher than levels set by the government. Shady agents have been busy fielding requests from farmers who call them in desperate need.”

The Bloomberg article noted that, “With a key planting season underway for India’s millions households that depend on agriculture for a living, farmers say they don’t have much of a choice.

“We either have to cut the use of fertilizers and risk lower production, or pay sky-high prices on the black market, said Dilip Patidar, a wheat and onion grower in the state of Madhya Pradesh.”