As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Farmland Values Surge

In an update last week from the Federal Reserve Bank of Kansas City, “Farm Real Estate Values Rise Sharply,” Nathan Kauffman and Ty Kreitman stated that, “Farmland values surged in the third quarter according to Federal Reserve Surveys of Agricultural Credit Conditions.

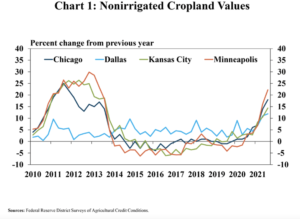

The value of nonirrigated cropland increased by 12% or more in all participating Districts.

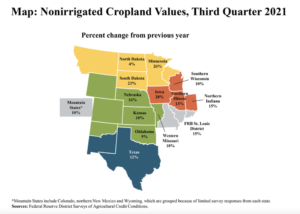

“The rapid increase was also consistent across most states, with annual increases of more than 20% in some areas. Supporting farm real estate markets, interest rates on farm loans remained at historic lows and strong farm finances drove further improvement in agricultural credit conditions.

“Despite persistent concerns about increases in input costs, agricultural lenders expected farm income and credit conditions to remain strong through the end of the year alongside elevated commodity prices. The accompanying surge in farmland values has bolstered farm balance sheets and provided additional support to the sector. Alongside prospects for further strength in commodity markets, the outlook for farm finances and agricultural land values through the end of 2021 remained strong.”

Kauffman and Kreitman noted that, “The value of nonirrigated cropland increased by an average of about 15% across all participating Districts. The gains from a year ago were the highest in any quarter since 2013 in all regions and have offset reductions in land values that may have occurred in recent years.

“The surge in farm real estate values was consistent across nearly all states. The value of nonirrigated cropland increased nearly 10% or more from a year ago in all states with available data except North Dakota. Values grew by over 20% in Iowa, Minnesota and South Dakota and between 9% and 20% in all other states except North Dakota.”

Last week’s update added that, “Agricultural credit conditions also continued to improve alongside strong farmland markets.”