Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

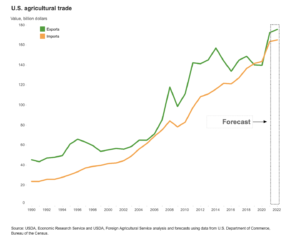

U.S. Agricultural Exports Forecast at Record in Fiscal Year 2022

On Tuesday, the USDA released its Outlook for U.S. Agricultural Trade, a quarterly report from the Department’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS). Today’s update includes highlights from the report, which was coordinated by Bart Kenner, Hui Jiang, and Dylan Russell.

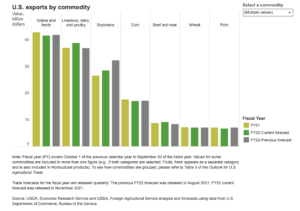

The Outlook stated that, “U.S. agricultural exports in fiscal year (FY) 2022 are projected at $175.5 billion, down $2.0 billion from the August forecast, but still a record if realized. This decrease is driven by reductions in oilseed and oilseed product exports that are partially offset by increases in livestock, poultry, dairy, cotton, and ethanol exports.

The projection for soybean exports is down $3.9 billion to $28.4 billion due to lower prices and softening Chinese demand.

The Outlook also noted that, “Livestock, poultry, and dairy exports are forecast to increase by $1.9 billion to $38.7 billion, with gains across all major commodities except pork.”

“Ethanol exports are forecast up $500 million to a record $2.9 billion on higher unit values. Grain and feed exports are revised down by $300 million to $41.5 billion, with corn, sorghum, and rice exports each down $100 million. The forecast for wheat exports is unchanged at $7.1 billion, as higher unit values are offset by lower volumes and greater competition.”

FAS-ERS pointed out that, “Agricultural exports to China are forecast at $36.0 billion, a decrease of $3.0 billion from the August projection—but still a record—largely due to lower soybean unit values.

China is expected to remain the largest U.S. agricultural market.

More narrowly, FAS-ERS pointed out that, “Corn exports are forecast at $17.0 billion, down $100 million from the August forecast, due to lower unit values despite larger volumes. U.S. corn is expected to be competitive until new crop supplies from South America come onto the market in early 2022.”

With respect to oilseeds, The Outlook stated that, “Soybean export value declines $3.9 billion from the August forecast to $28.4 billion; soybean meal is lowered $900 million to $4.9 billion. A larger 2021 soybean harvest and greater carryin stocks from last season have boosted supplies and lowered prices. Additionally, softening China demand and expectations of a large Brazilian harvest in early 2022 continue to provide strong headwinds for export volumes and unit values next year.”

Tuesday’s update also pointed out that, “The export forecast for Canada is up $200 million to $24.0 billion, largely driven by higher livestock prospects. The export forecast to Mexico is up $1.2 billion to $23.5 billion, as strong demand seen in the second half of FY 2021 is expected to continue, especially for livestock, poultry, dairy, and cotton.”

“Forecast exports to Japan are increased by $300 million to $13.6 billion, due to higher expected beef unit values.”

“Exports to the European Union (EU) are forecast at $11.0 billion, down $200 million from the previous projection, largely due to lower unit values of soybeans and soybean meal.”