The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

WASDE Reveals Record Wheat Trade, as China Wheat Imports Soared Over the Past Year

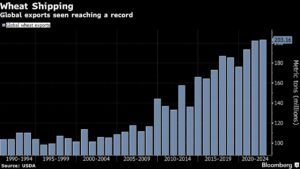

Bloomberg writer Megan Durisin reported this week that, “Global wheat exports will reach an all-time high as Russia, the European Union, India and Ukraine are all shipping out more than expected.

“That’s according to the U.S. Department of Agriculture’s monthly crop report out Tuesday, which showed that exports will reach 203.2 million metric tons.”

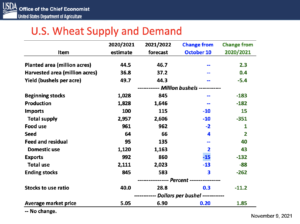

The Bloomberg article stated that, “The U.S. is falling in the wheat export ranks, though: It’s sales will be surpassed not only by the EU and Russia, but also Ukraine and Australia. That’s largely due to high domestic prices for varieties like spring wheat, the USDA says.”

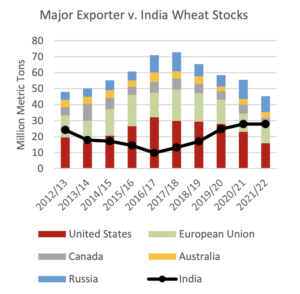

More narrowly, in its Grain: Worlds Market and Trade report this week, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Wheat prices have risen sharply over the past several months, reflecting strong consumption growth despite relatively flat global production. Production was down sharply from last year among several of the major suppliers, including Canada, the United States, Kazakhstan, and Russia. While somewhat offset by larger crops in the European Union, Ukraine, and Argentina, strong global demand is a major factor leading to tighter global stocks. Import demand is surging as dry weather in the Middle East spurs additional imports, especially for Iran and Turkey. Tendering from the Middle East and North Africa has been robust especially over the past month despite global wheat prices significantly higher than last year.”

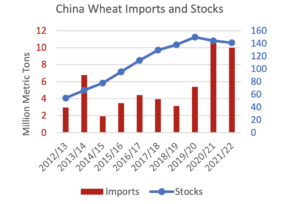

FAS explained that, “About one-half of global stocks are held by China and generally have not played a significant role in the global market. But over the past year, high feed demand prompted China to offload some of the multi-year-old government-held stocks into the domestic market via auctions. Wheat stocks in China declined in 2020/21 for the first time in over a decade.

Meanwhile, China import demand for milling-quality wheat soared, propelling it to become the second-largest importer.

“Imports are forecast at high levels again in 2021/22, with China forecast as the fourth-largest importer.”

The FAS report added that, “The major exporters’ stocks are set to decline in 2021/22, representing tighter supplies available to the global market. Owing to drought-affected production, U.S. and Canada stocks are expected to draw down to the lowest level since 2007/08, despite lower exports from both countries.

“While Ukraine stocks remain steady, Russia stocks are set to decline with its smaller crop and strong exports to the Middle East. EU and Australia stocks are also expected to decline due to exceptionally high exports.”